With much consternation, capital markets participants are watching US treasury bond yields go up while Jerome Powell and the Fed continue to lower the Fed Funds Rate in an effort to spur another round of easy money.

The Fed Funds rate is a short-term interest rate used for interbank borrowing. US treasury bonds are medium-long term securities that represent the sovereign debt of the US government, so the yield on those bonds represents the US government’s cost of borrowing. While there is no law that binds the two, lower rates from the Fed generally translate into lower treasury yields.

Explanations for the divergence have been proffered, talking heads have opined, and conclusions abound with regard to the meaning behind the movement. Given the mixed signals, difficult questions related to the financial health of the US Treasury are being asked. Is the government’s profligate spending finally catching up with it? Isn’t more easy money from the Fed a reckless, inflationary gamble? Is the global reserve currency status a curse rather than a blessing?

Regardless of what happens with US bond yields, these are important considerations for an American public ravaged by inflation due to government overspending and continual monetary molestation by the Federal Reserve.

$2 Trillion Deficits

The US is on track to run a $2 trillion deficit this fiscal year, which began in October. This will add to the existing national debt of $36 trillion, or 135 percent of GDP. Notwithstanding the goofy Department of Government Efficiency, all signs point to continued large deficits during the Trump administration. The recent action in US bond yields does not help this situation.

By August of this year, futures markets had fully priced in a 25-50 basis point Fed rate cut in September, and were expecting additional 25 basis point cuts in November and December. This expectation for the Fed Funds Rate initially carried over into treasury yields. At the beginning of August—as markets priced in 75-100bps of Fed rate cuts by year-end—10-year treasury yields reacted accordingly, dropping from 4.30 percent in late July (they had been 4.70 percent in April) to 3.65 percent in the middle of September.

As of mid-November, that entire move had been erased, with yields back above 4.40 percent, roughly where they were prior to markets pricing in this year’s Fed rate cuts. At roughly $1 trillion annually, interest on the US debt carries an effective interest rate (interest expense divided by debt balance) of 3 percent. However, by mid-November, bond yields across the curve ranged from 4.25 percent to 4.75 percent, meaning interest expense is only going higher as old cheap bonds mature and are refinanced with new, more expensive bonds.

Easy Money, Inflation, and Asset Bubbles

In late 2020, the global inventory of bonds with negative yields reached an astounding $18.4 trillion. Let that sink in. $18.4 trillion worth of bonds where the lenders—rather than earning interest—were actually paying borrowers for the privilege of lending them money.

The direct cause of this unfathomable distortion was central banks—the Federal Reserve foremost among them—playing fast and loose with monetary policy. Forcing interest rates down, creating money by the trillions, and fostering a reckless inflationary environment—centered on the capital markets and asset prices—has produced market signals that are unmistakably irrational.

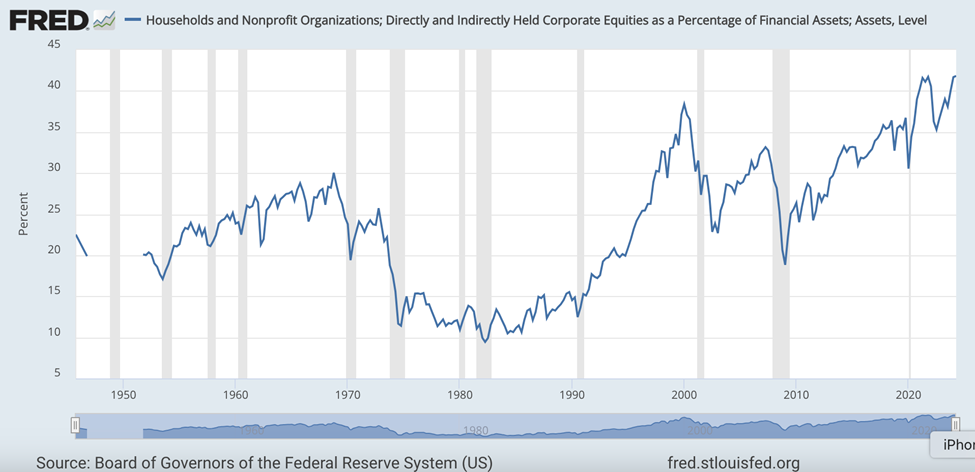

Faced with a much higher cost of living in light of excessive government spending and money creation by the Fed, average Americans have resorted to gambling in those same capital markets. American households and nonprofits now have nearly 42 percent of their financial assets in stocks, while the stocks themselves are at all-time highs.

Into the teeth of this raging asset bubble comes the Fed with further rate cuts, the stand-alone effects of which are reflationary. And, all else equal, more inflation means higher yields on government bonds. It’s increasingly unlikely that investors will accept a yield that whittles down to zero after adjusting for inflation.

Reserve Currency Status

Sober and rational market observer Jim Grant recently analogized the US dollar’s reserve currency status as follows:

[Reserve currency status] is like an affluent parent with a somewhat underachieving child saying [to that child], “Here’s $20 million dollars, go out and drink yourself to death.” That, in a way, is the reserve currency privilege.

Mr. Grant puts it well. There is no doubt that the US dollar’s reserve currency status has been abused, and that abuse was inevitable. Endless and expensive wars, combined with runaway spending for political programs, have effectively bankrupted the US Treasury. Honestly-underwritten, no investor would lend to a private entity with such a disdain for financial discipline and no sense of urgency to reverse course.

Like the Pound Sterling before it, unhinged profligacy over an extended period of time is likely a precursor to the dollar’s loss of status and there are already compelling signs that global markets wish to decouple from the dollar, including a notable decline in foreign holdings of US treasuries relative to domestic holdings, the latter category including treasuries held by the Federal Reserve. This indicates that prospective foreign buyers of US sovereign debt are already wary of Uncle Sam’s rapidly-declining credit quality.

Undoubtedly, the specter of the US losing reserve currency status should move treasury yields much more than a few dozen basis points, but bond markets often move at a glacial pace. While slow, such movements are just as unavoidable.

Something That Can’t Last Forever

Fair is foul, and the US reserve currency status is likely to be seen in hindsight as a curse rather than a blessing. The Fed’s ability to print money stems partially from the hubris of long-past geopolitical successes. Those successes, combined with a level of economic dominance, fostered an appetite from foreign markets for all things dollar-denominated. Increasingly, that no longer appears to be the case, but the domestic tendency to print and spend has not abated in the least.

Those who continue to invest in US government bonds—despite the deranged fiscal recklessness of Congress and the improvisational monetary policy of the Fed—must do so with regard for the creditworthiness of the borrower and the soundness of its currency. As treasury yields go up, dependent markets—including stocks and housing—are likely to be impacted as well. Investors of all stripes would, therefore, do well to remember how currency regimes decline and asset bubbles pop—gradually, then all at once.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter