Administrative Note:

We will not publish a daily market commentary tomorrow or Wednesday.

Everyone at RIA Advisors would like to extend our sincere blessings to you and your families and our wishes for a very Merry Christmas.

_________________

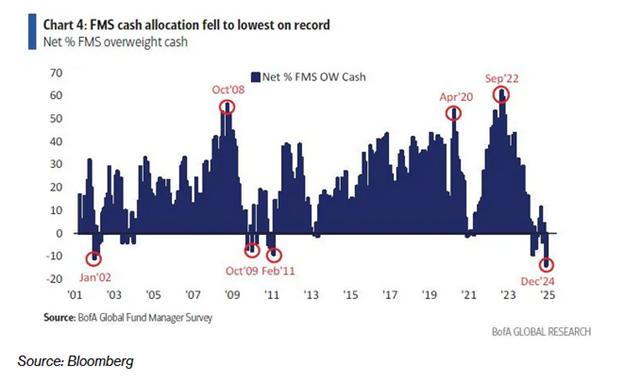

According to Bank of America, institutional fund managers are sitting on record low cash allocations as they increase their equity holdings. Bank of America believes this is a contrarian indicator warning that a decline could be nearing. Moreover, they report that 36% of the fund managers they evaluate are overweight stocks.

Per a Bloomberg article on Bank of America’s findings:

Since 2011, every time the BofA sell signal was triggered, the MSCI All-Country World Index handed investors losses of 2.4% in the following month.

While the data and positioning of the investors may seem scary, a 2-3% decline, as noted above, is not a big deal. Furthermore, timing such a decline is challenging. Who’s to say investors reducing cash allocations to pile into stocks can’t continue for six more months or longer?

What To Watch Today

Earnings

- No notable earnings releases today

Economy

Market Trading Update

Last week, we noted the ongoing market churn that could last into this week's Fed meeting. To wit:

"That certainly seemed the case this past week, with the market trading being fairly sloppy. Attempts to push the market higher were repeatedly met with sellers, and we saw a rotation from over-owned to under-owned assets. Notably, that selling pressure arrived as expected, and while such could persist until early next week, we should be getting close to the end of the distribution and rebalancing process. The good news is that the recent consolidation paves the way for 'Santa Claus to visit Broad and Wall."

That process continued as expected this past week but became violent on Wednesday following the Federal Reserve meeting. While the Fed cut rates as expected, the market shock came from the lift in its outlook for interest rates in 2025 by a half percentage point. The market is assuming that the Fed is giving up on the idea that inflation will return to the 2% target next year, an idea that they had confidence in as recently as September. That more hawkish outlook undermined the view that elevated valuations were justified by easier monetary conditions, which now seems to be reversing. We suspect that this view is rather short-sighted, and given the economic dynamics both abroad and in the U.S., slower economic growth will lead to a "dovish" pivot by the Fed in the first half of 2025.

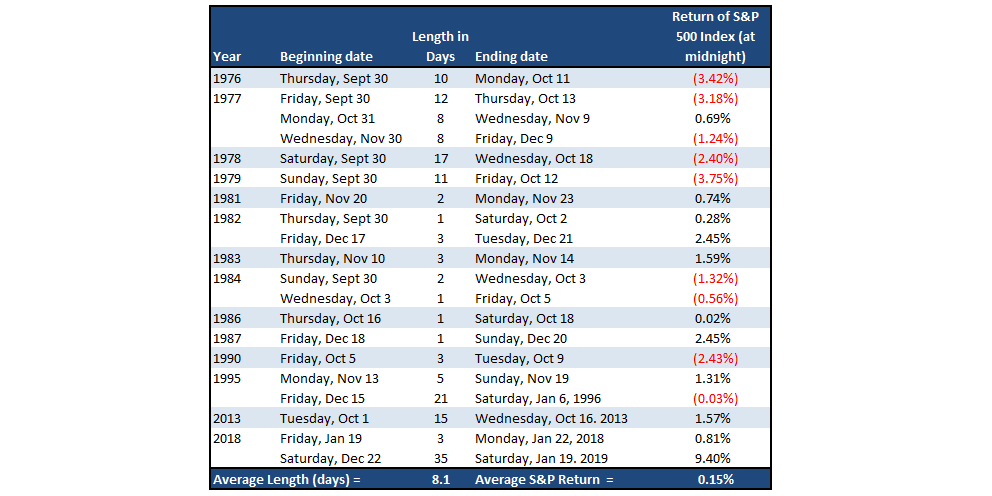

On Friday, the markets were hit again by concerns about a Government shutdown. As we discussed in October 2023, shutdowns are NOT a threat to the market in the long term. To wit:

"What is critical to understand about Government shutdowns is that mandatory spending (social security, welfare, interest on the debt) continues as needed. Shutdowns are primarily about discretionary spending. Such is why it mainly involves Government employment and the shuttering of national parks and monuments. According to Goldman Sachs, the shutdown would have only impacted about 2% of Federal spending overall. Notice that the vast majority of Government spending is directly a function of the social welfare system and interest on the debt."

Please note that during a Government shutdown, all MANDATORY spending continues. In other words, the government WILL NOT default on its debt, and social security payments will continue, despite rhetoric to the contrary.

Furthermore, market reactions to government shutdowns have become increasingly muted. The reason is that the markets have learned that funding typically arrives at the 11th hour via a ‘continuing resolution’ to provide temporary funding through the next political event, such as midterm elections, inauguration, etc. While these short-term spending bills eventually translate into longer-term spending bills, the real problem is that continuing resolutions increase spending by 8% annually.

However, as shown, government shutdowns, if they occur, can temporarily impact markets, but the event tends to be mild and short-lived.

Technically speaking, the market did register a short-term MACD sell signal last week, which warned investors that some "event" could exert downward pressure on stocks. That event was two-fold this week as the Fed and "Government Shutdown" drama ensued. However, those were just the catalysts that brought sellers to the market. As of Friday, with relative strength oversold, the setup for a reflexive rally into year-end has become a much higher-probability event. However, that sell signal is deep enough to suggest that whatever reflexive rally arrives could be limited, particularly as money flows have deteriorated over the last few weeks.

While we still expect a rally into year-end, as we will discuss, there is a not-so-insignificant possibility of further turmoil. We suggest continuing to manage risk, and with significant gains already booked for this year, there is little need to stretch for further returns at this juncture.

The Week Ahead

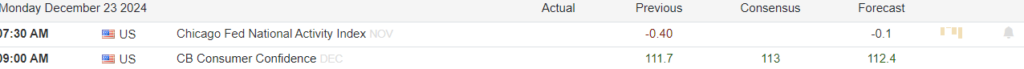

This week will be quiet on the economic data front, and the markets should also be quiet. We’ll receive the December CB Consumer Confidence data today. The consensus estimate is an increase to 113 from 111.7 in November. Data on Durable Goods orders and New Home Sales in November will be released tomorrow. The week will be capped off Friday with Retail and Wholesale Inventory data for November and the S&P/Case Shiller Home Price index for October.

Portfolio managers have already reduced cash allocations to close performance gaps versus their benchmarks, so there isn’t much left to be done through year-end. Most traders are on Christmas vacation; thus, any significant moves in the market will likely be based on light volume and subject to reversal following the holiday season. Equity markets will close at 1:00 PM ET tomorrow for Christmas Eve and remain closed on Christmas Day.

Prediction For 2025 Using Valuation Levels

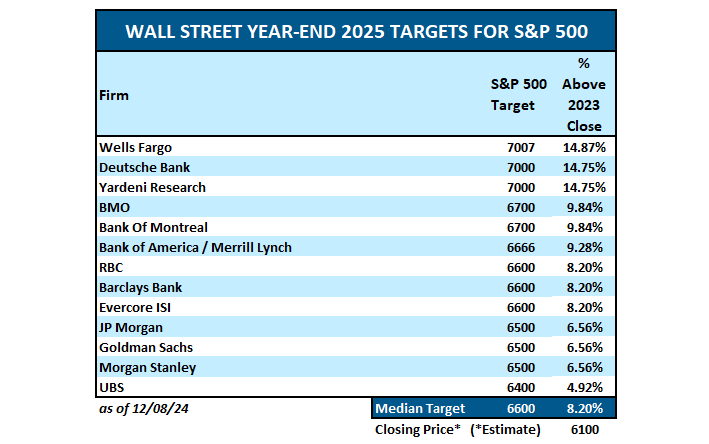

As investors, we must rely on our data, analyze what occurred previously, weed through the present noise, and discern the possible future outcomes. The biggest problem with Wall Street today and in the past is its consistent disregard for the unexpected and random events that inevitability occur.

We have seen plenty in recent years, from trade wars to Brexit to Fed policy and a global pandemic. Yet, before those events caused a market downturn, Wall Street analysts were wildly bullish that it wouldn’t happen.

So what about 2025? We have some early indications of Wall Street targets for the S&P 500 index, and, as is always the case, they are primarily optimistic for the coming year. The median estimate is for the market to rise to 6600 next year, which would be a disappointing return of just 8.2% after two years of 20% plus gains. However, the high estimate from Wells Fargo suggests a 14% return, with the low estimate from UBS of just a 5% return. Notably, there is not one estimate available for a negative return.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post Cash Allocations Send an Ominous Signal appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter