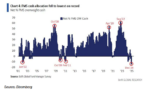

Administrative Note: We will not publish a daily market commentary tomorrow or Wednesday. Everyone at RIA Advisors would like to extend our sincere blessings to you and your families and our wishes for a very Merry Christmas. _________________ According to Bank of America, institutional fund managers are sitting on record low cash allocations as they …

Read More »2024-12-23