Some gold and Bitcoin bugs claim the U.S. dollar is being inflated away and that our politicians and the Fed are abusing its status as the world's reserve currency. While the narrative may sound logical, the fact of the matter is that the opposite is occurring. Despite growing de-dollarization narratives in traditional and social media, the dollar's use in global transactions is increasing.

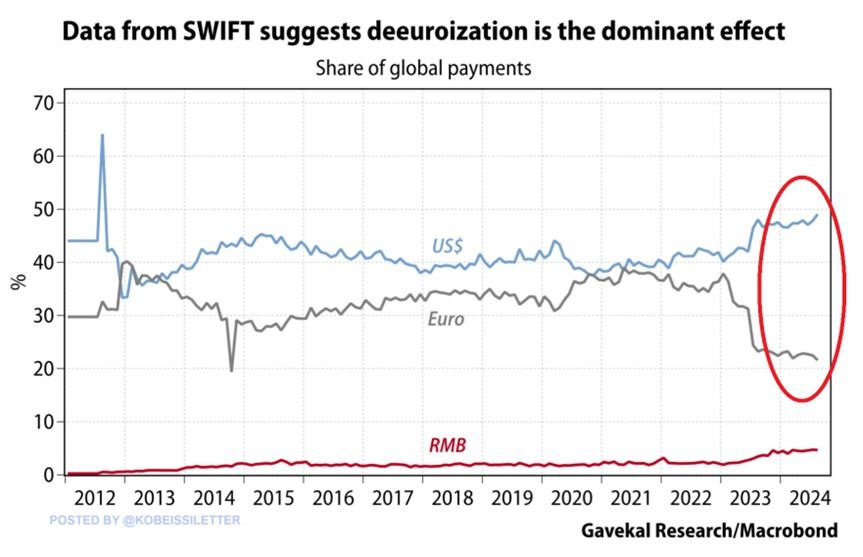

The Gavekal Research graph below shows that the dollar's share of global payments using the SWIFT system is at its highest level in twelve years. Moreover, the Euro, the one currency some experts thought could be a replacement reserve currency, has seen its share of global payment transactions nearly cut in half over the last five years. A few people believe China's Yuan might be a viable replacement at some point. While its share has risen, it only represents 5% of global payments. Since 2021, the dollar's share has risen 9% to the yuan's 4%.

De-dollarization is a myth. What those pushing de-dollarization fail to appreciate is that the rule of law, the world's most liquid capital markets, military might, and economic status make the dollar the only option as a reserve currency. The reality, as the graph shows, is that re-dollarization is the current trend. For more on the topic, read our two-part article, Four Reasons The Dollar Is Here To Stay.

What To Watch Today

Earnings

Economy

Market Trading Update

As discussed yesterday, the market held support at the 50-DMA and bounced nicely off that level. This morning, stocks are surging, with the Dow, S&P, and Nasdaq up 2% and the Russell 2000 index up 5%. President Trump's strong win and control of the Senate set the markets up nicely for a year-end rally in anticipation of pro-economic policies next year.

With the election behind us, we now focus on the Federal Reserve and its next rate-cut decision today. Overall, the market continues to trade mostly as expected. Once past the FOMC announcement, the market should begin to pick up into year-end as buybacks, performance chasing, and window dressing all commence.

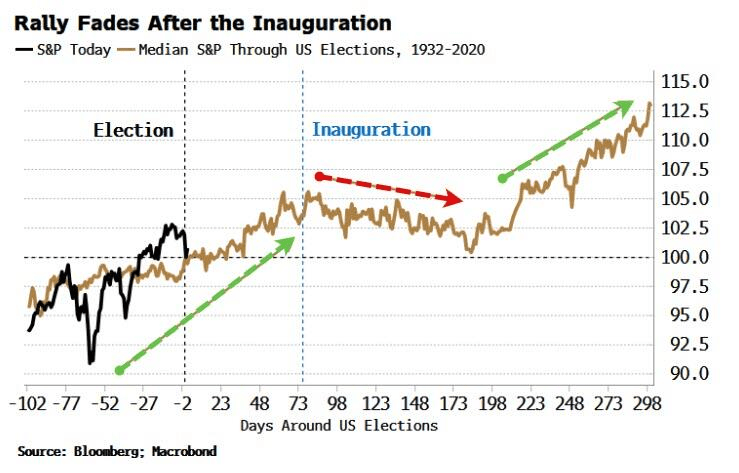

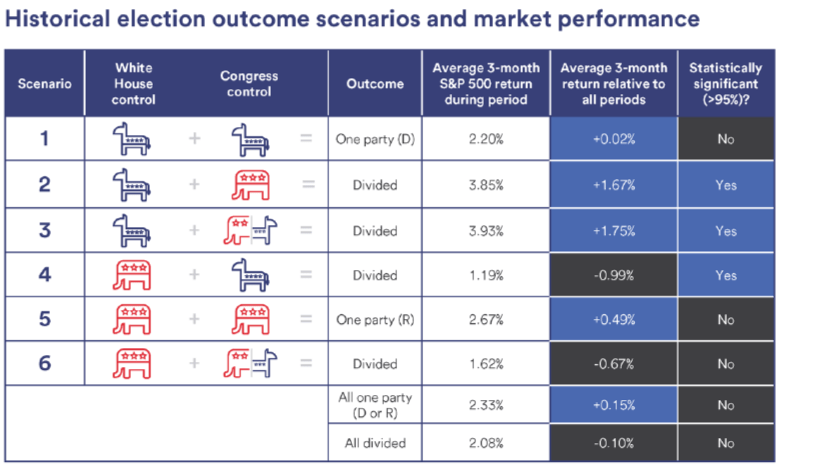

The good news is that regardless of your opinion of the election, the market doesn't care much. Historically, market returns are fairly standard across elections and tend to rise into year-end. The market tends to fade through the inauguration, mainly because it reverses the previous overbought and extended conditions, setting up a rally for the rest of the year.

As shown, the market continues to perform bullishly for now. If it holds, today's rally will take the market back above the 20-DMA, confirming the bullish trend and spotlighting our target of 6000 by year-end. Continue to manage risk as always, but there is little need to be overly defensive.

What To Expect From The Fed

Having met yesterday and today, the Fed will release its monetary policy statement, and Jerome Powell will follow with a press conference this afternoon. As we share below, the market firmly believes the Fed will cut by 25 basis points today. While not shown, the odds they cut again in December are currently 80%. Since the cut is highly likely, what will be more telling is the Fed's recent take on employment and possibly the election. As we have noted, employment is challenging to assess due to the Boeing strike and recent hurricanes. However, prices continue to trend lower, allowing the Fed latitude to cut further even if the labor market doesn't weaken further.

The other significant consideration for the Fed is bond yields. Since they last cut, bond yields have risen by about 50bps. In some respects, they may like that as it will provide a further headwind to growth and, thus, inflation. However, in some respects, it's a warning to the Fed that cutting further will incite inflation.

Plan For Volatility

Therefore, delaying certainty in the election outcome could increase short-term market volatility. However, history suggests market performance has been fairly reliable despite short-term uncertainty. Markets tend to dip the day after the election, with historical data showing that the S&P 500 drops by an average of 0.66% following Election Day. This reflects both disappointment when expected outcomes don’t materialize and uncertainty about the policy direction under a new administration. However, markets typically recover by December, with the S&P 500 posting gains in about 61% of election years. However, these gains are often muted compared to non-election years, with average year-end increases below 1%

As we have stated, the risk is a contested election. Contested elections, such as in 2000 and 2020, have historically prolonged market volatility. Following the Bush-Gore election in 2000, the S&P 500 fell 5% over the next month as the legal battle dragged on. In 2020, delayed vote counts and legal challenges heightened volatility, keeping investors on edge for weeks.

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”

Please subscribe to the daily commentary to receive these updates every morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media, or contact us to set up a meeting.

The post De-dollarization Or Re-dollarization? appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter