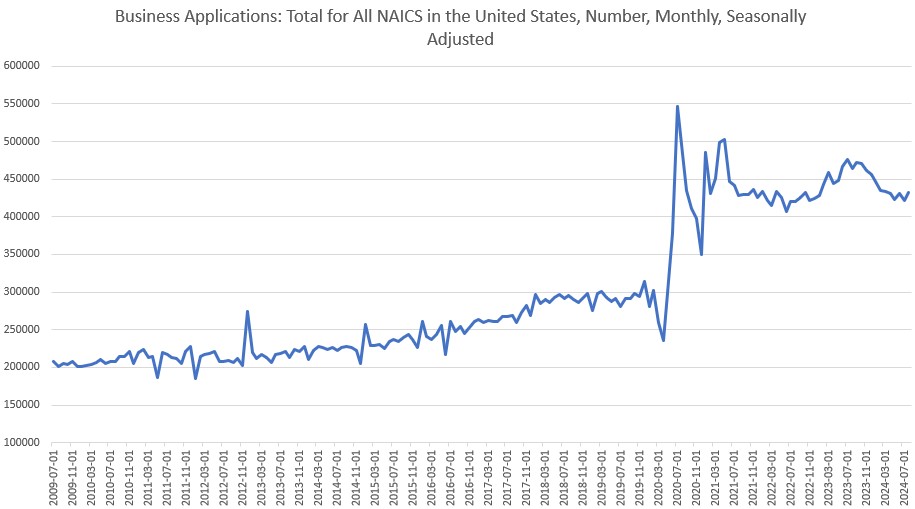

For more than four years now, the Biden Administration has been insisting that the state of small business in America is better than it has ever been. This claim, however, is based on a single government statistic: the business applications metric published by the Census Bureau, which is a record of applications for an employer identification number (EIN).

The Administration has repeatedly and enthusiastically promoted the surge in these new applications. According to a press release from the Small Business Administration in January, business applications prove the US is in the midst of the “Biden-Harris small business boom” with “historic” numbers of new business applications.

Wow, that all sounds very impressive. The economy must be, as Jerome Powell puts it, “in great shape.”

If we look at the trend in business applications over time, what we see is a huge surge in applications beginning in May 2020. Moreover, this surge does not return to the previous trend but remains well above the pre-2020 trend. In fact, if we go off this metric alone, we’re left thinking that the small business economy is better now than it’s been in decades.

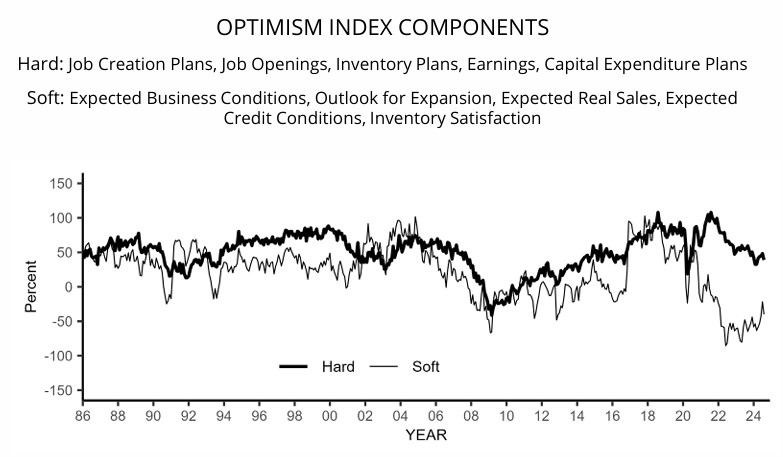

What is behind this apparently amazing performance? Has small-business optimism ascended to new heights? Do small businesses see historic opportunities for growth? Well, if we look beyond this single metric of business applications, it’s difficult to find corroborating evidence that we live in times of unmatched prosperity for small businesses.

For example, if we take a look at the NFIB’s surveys of small business owners we see no evidence that small-business optimism is at historic highs. For example, the NFIB’s optimism index is now below where it was in 2016. The general trend for job creation and plans for capital expenditures since 2022 has been only down.

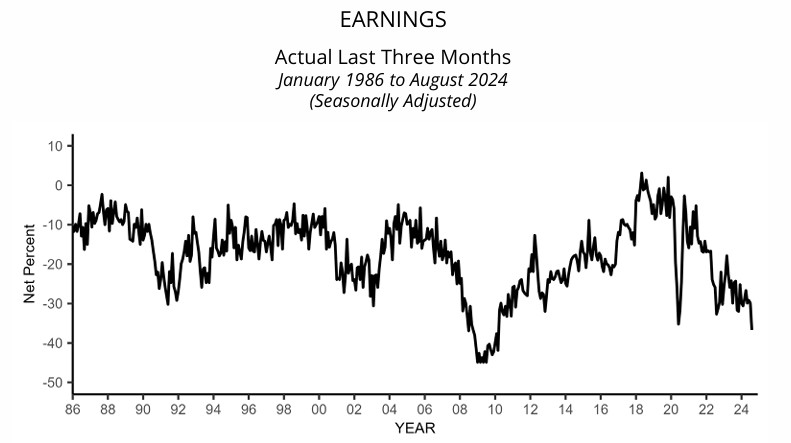

Moreover the survey shows that small-business owners report the trend in earnings has been in moving down since 2018.

There’s no sign here of historic prosperity for small business.

But, if business owners don’t report much optimism in terms of plans for spending, hires, and earnings, why are there so many new business applications?

The answer largely lies in the fact that business applications don’t necessarily have anything to do with the creation of new full-time jobs or the creation of anything more than gig-economy “businesses” that have no employees. Each “business application” is only a case of a person applying for an employee ID number (EIN) for tax purposes.

Driven by the Gig Economy

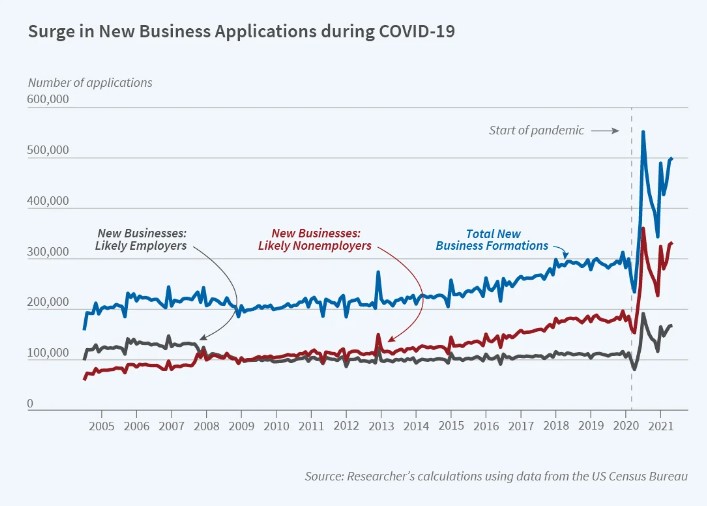

According to a June 2021 report from economist John Haltiwanger, most of the new applications are from business enterprises unlikely to hire any employees. Haltiwanger shows most of these have been in the areas of non-store retail and food and accommodation services. He also notes that these same sectors “have suffered especially large declines in the pandemic, [so] these patterns are consistent with restructuring induced by the pandemic.” This “restructuring” can be seen in how the new surging business applications are part of a process of new business replacing old failing businesses that disappeared during the pandemic. Further evidence of this restructuring is seen in the very high levels of worker turnover that existed from 2020 to 2022.

It also appears that the lockdowns and economic disruptions of the Covid Panic accelerated a trend that has existed since at least 2010. Non-employer new businesses have been increasing for years, and, according to Haltiwanger: “this reflects an increase in the gig economy including and especially the ridesharing industries. The evidence ... highlight[s] that much of non-employer activity reflects supplemental and stopgap activity.”

Given all this, only the most superficial and naive interpretation of the business applications metric would lead us to believe that we are living in a golden age for small business. Rather, the surge in new business applications is driven by new businesses that will not hire employees, and which are “supplemental and stopgap” in nature.

Regulatory Changes Fuel More Business Applications

This turn toward the gig economy also fuels a legal and regulatory change behind the surge in business applications. In the wake of the Covid Panic, the IRS lowered the threshold of reportable business revenue from $20,000 to $600. Many gig-economy-related apps also started requiring more careful records. This has led to a need for more EINs, which means more business applications. This does not necessarily reflect any improvement in the business environment, but simply reflects a change in regulatory requirements.

Employment Has Not Surged with Business Applications

More evidence of the supplemental and stopgap nature of these new businesses can be seen in how job creation in recent years has been driven by part-time work. It is clear in the household employment data that the surge in new business applications is not reflected in surveys of actual jobs or employees.

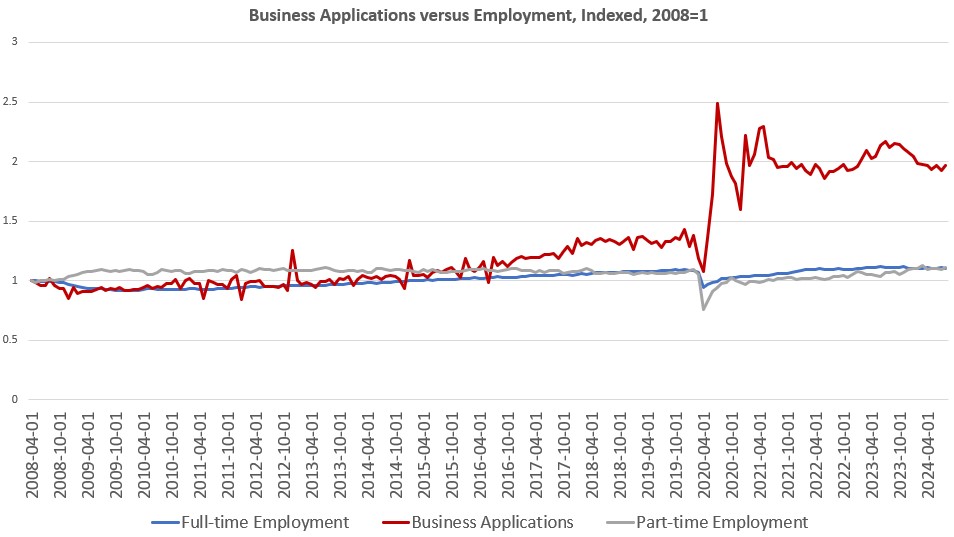

As we’ve been seeing for months, full-time employment has been falling, year over year, while part-time employment has been responsible for the middling gains that have been seen in overall employment. Since December 2019, new business applications have grown by a whopping 37 percent. Full-time jobs, on the other hand have increased by 1.5 percent over that period. Part-time employment has increased 4 percent.

Clearly, business applications do not translate into actual job growth. Rather, the new businesses being created are likely replacing disappearing jobs with new supplemental forms of employment.

A longer-term look at full-time work versus business applications further supports Haltiwanger’s thesis. Since 2009, growth in business applications has been increasingly strong compared to full-time job growth. Since 2008, business applications grew 96 percent while full-time employment grew 11 percent. (Part-time employment also grew 11 percent during the period.)

So, there is no reason to interpret growth in business applications as evidence of big gains in employment or in business enterprises that are likely to hire anyone at all.

Unfortunately for workers, it looks like the “Biden-Harris business boom” isn’t much of a boom at all.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter