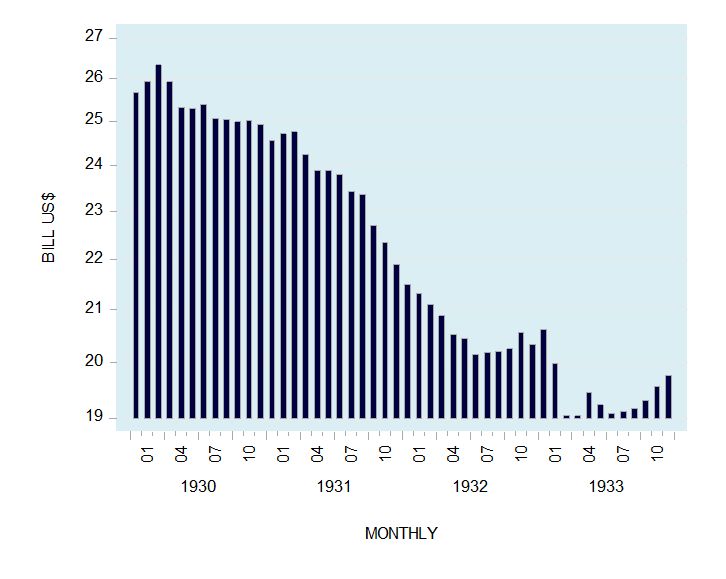

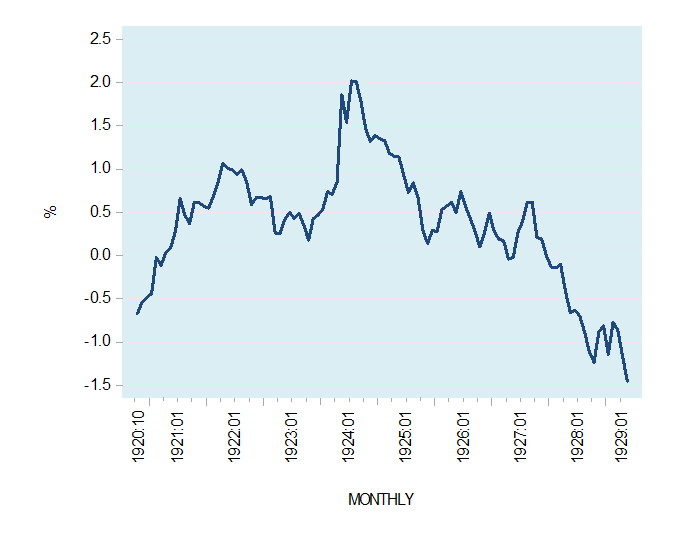

The leading monetarist, Milton Friedman, blamed the Federal Reserve System’s policies for causing the Great Depression of the 1930s. According to Friedman, the Fed failed to pump enough reserves into the banking system to prevent a collapse of the money stock. Because of this, Friedman held that M1, which stood at $26.34 billion on March 1930, fell to $19.00 billion by April 1933—a decline of 27.9 percent.

Figure 1: US M1 money supply, 1930–33

Source: Data from FRED.

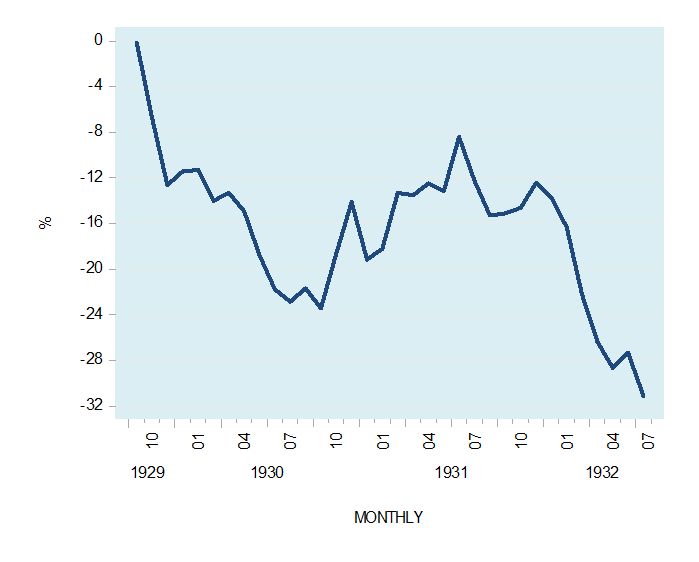

According to Friedman, as a result of the collapse in the money stock, economic growth followed suit. Year-over-year industrial production by July 1932 fell by over 31 percent (see chart). Also, year over year, the consumer price index plunged. By October 1932, the Consumer Price Index had declined by 10.7 percent.

Figure 2: Change in industrial production, 1929–32 (percent year over year)

Source: Data from FRED.

But is it possible that the failure of the Fed to lift the money supply caused the collapse of economic growth? If this is the case, money should be regarded as an agent of economic growth. The whole idea that economic growth requires monetary expansion gives the impression that money somehow sustains economic activity.

Murray Rothbard wrote, “Money, per se, cannot be consumed and cannot be used directly as a producers’ good in the productive process. Money per se is therefore unproductive; it is dead stock and produces nothing.” Money’s main function is simply to fulfill the role of the medium of exchange. Money doesn’t sustain or fund economic activity.

By fulfilling the role of the medium of exchange, money facilitates the flow of goods and services. Moreover, within the framework of a free market, there cannot be such a thing as “too little” or “too much” money. As long as the market is allowed to clear, no shortage of money can emerge.

Consequently, once the market has chosen a particular commodity as money, the given stock of this commodity will always be sufficient to secure the services that money provides.

According to Ludwig von Mises,

As the operation of the market tends to determine the final state of money’s purchasing power at a height at which the supply of and the demand for money coincide, there can never be an excess or deficiency of money. . . . The services which money renders can be neither improved nor repaired by changing the supply of money. . . . The quantity of money available in the whole economy is always sufficient to secure for everybody all that money does and can do.

The Pool of Real Savings and the Great Depression

We suggest that it is the decline in the pool of real savings that caused the economic depression of the 1930s. This decline occurred because of the previous loose monetary policies of the Fed. A closer examination of the historical data shows that the Fed was actually pursuing very easy monetary policy in its attempt to revive the economy.

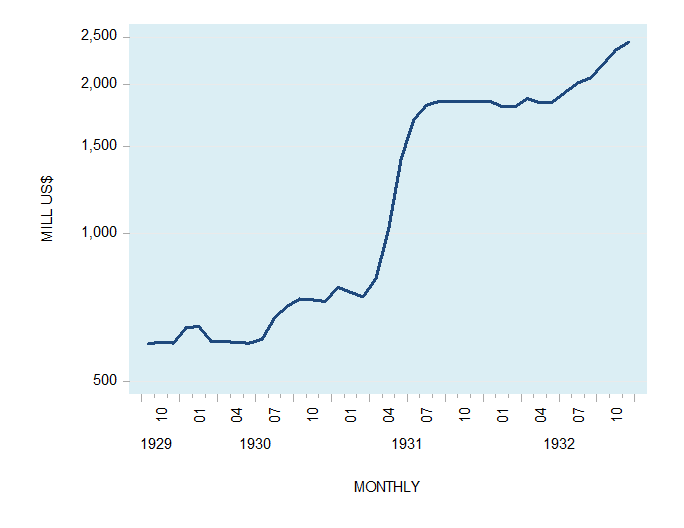

The extent of the monetary injections is depicted by the Fed’s holdings of United States government securities. In October 1929, holdings of US government securities stood at $165 million. By December 1932, these holdings had jumped to $2.432 billion—an increase of 1,374 percent (see chart).

Figure 3: US government securities held by the Fed, 1929–32

Source: Data from FRED.

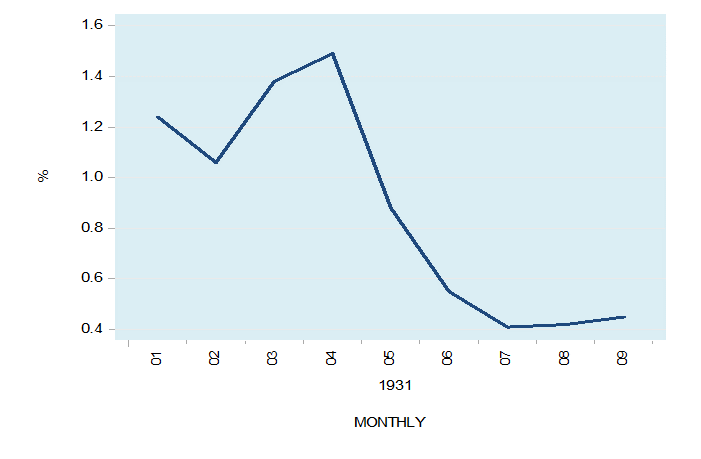

Also, the three-month Treasury bill rate fell from almost 1.5 percent in April 1931 to 0.4 percent by July 1931 (see chart). Another indication of a loose monetary stance on the part of the Fed was the widening in the differential between the yield on the ten-year T-bill and the three-month T-bill rate. The differential increased from 0.04 percent in January 1930 to 2.80 percent by September 1931 (see Chart 5). (An upward sloping yield curve indicates loose monetary stance.)

Figure 4: US three-month T-bill rate, 1931

Source: Data from FRED.

The sharp fall in the money stock during 1930 to 1933 is not indicative that the Federal Reserve did not try to pump money. Instead, the decline in the money stock came as a result of the shrinking pool of real savings brought about by the past loose monetary policies of the Fed.

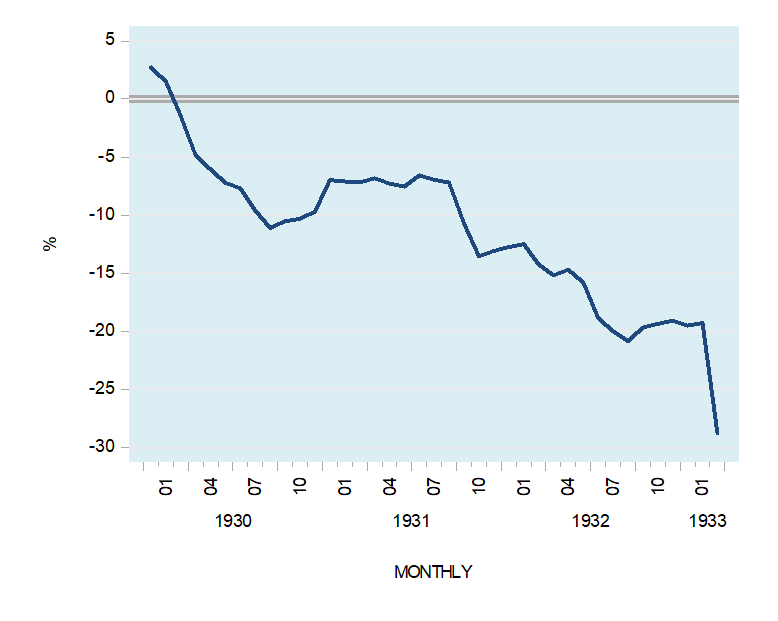

Thus, the yield spread increased from −0.67 percent in October 1920 to 2.00 percent by August 1924. Again, an upward sloping yield curve indicates an easy monetary stance.

The reversal of the stance by the Fed, which saw the yield spread decline from 2.00 percent in August 1924 to −1.45 percent by May 1929 burst the monetary bubble (see chart).

Figure 5: Ten-year and three-month T-bill interest rate differential, 1920–29

Source: Data from FRED.

In addition to this, at some periods prior to the Great Depression, the monetary injections were massive. For instance, the yearly growth rate of M1 increased from −12.6 percent in September 1921 to 11.0 percent by January 1923. Then from −0.4 percent in February 1924, the yearly growth rate accelerated to 9.8 percent by February 1925. Such large monetary pumping amounted to a massive exchange of nothing for something.

The large monetary pumping resulted in the diversion of real savings from wealth generators to various nonproductive activities that emerged on the back of loose monetary policy. This real savings diversion resulted in the depletion of the pool of savings.

As long as the pool of real savings is expanding and banks are eager to expand credit, nonproductive activities can continue to prosper. Whenever the extensive generation of credit out of “thin air” lifts the pace of wealth consumption above the pace of wealth production, the flow of real savings is arrested and a decline in the pool of real savings begins.

Consequently, the performance of economic activities starts to deteriorate, and banks’ bad loans start to pile up. In response to this, banks curtail their lending “out of thin air,” and this in turn sets in motion a decline in the money stock. Note that the pool of real savings is the heart of economic growth. (Savings sustain individuals who are employed in the various stages of production.)

After growing by 2.7 percent year over year in January 1930, bank loans had fallen by a massive 29.0 percent by March 1933 (see chart).

Figure 6: Change in bank loans (percent year over year), 1930–33

Source: Data from FRED.

Now, when loaned money is fully backed by savings, on the day of the loan’s maturity it is returned to the original lender. Thus, Bob—the borrower of one hundred dollars—will pay back to the bank on the maturity date the borrowed sum plus interest.

The bank in turn will pass to Joe, the lender, his one hundred dollars plus interest adjusted for bank fees. The money makes a full circle and goes back to the original lender. In contrast, when credit generated out of “thin air” is returned on the maturity date to the bank, this results in the withdrawal of money from the economy—i.e., a decline in the money stock. The reason for this is that there was no original saver/lender since this credit was generated out of “thin air.” (Again, savings do not support the credit here.)

Observe that economic depressions are not caused by the collapse in the money stock but come in response to a shrinking pool of real savings on account of the previous monetary pumping. A decline in the money stock is the result of a decline in the pool of real savings. Note again that the decline in this pool is due to the previous loose monetary policies of the central bank and mirrors a weakening in the process of wealth generation.

Consequently, even if the central bank were to be successful in preventing the decline of the money stock, this could not prevent the economic depression if the pool of real savings is declining.

Those commentators who are of the view that by means of the monetary pumping one can prevent economic depressions hold that this pumping is going to strengthen aggregate demand. With the increase in aggregate demand, it is held, the aggregate supply will follow suit. However, without an expanding pool of real savings that enhances and expands the infrastructure, it is not possible to increase the supply of goods and services. It is not possible to increase something out of nothing.

Conclusion

Contrary to popular thinking, economic depressions are not caused by a strong decline in the money stock but rather by the depleted pool of real savings. This depletion emerges because of the previous loose monetary policies. A tighter monetary stance arrests the depletion of the pool of real savings, thereby laying the foundation for an economic recovery.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter