Natural orders are things that emerge on their own or reflect the true nature of how something is or was meant to be. Two of my favorite books, both of which dramatically changed my outlook on the world, are A Hunter-Gatherer’s Guide to the 21st Century (by biologists Heather Heying and Bret Weinstein) and Company of Strangers: A Natural History of Economic Life (by economics professor Paul Seabright). Even though they deal with different subject matters, what unites them is the emphasis on the real and natural — the pursuit of true, established, consistent ways in thing which species, humans, economies, trade, and all manner of other important things flourish.

It is not the case that the world can be any which way its people want — or the way us moderns may delude ourselves into thinking it should be instead. There are hard rules and bright shining lines that lead us toward prosperity, well-being, harmony, and conflict-minimization. Rules, morals, behaviors, and most importantly economic arrangements are not arbitrary.

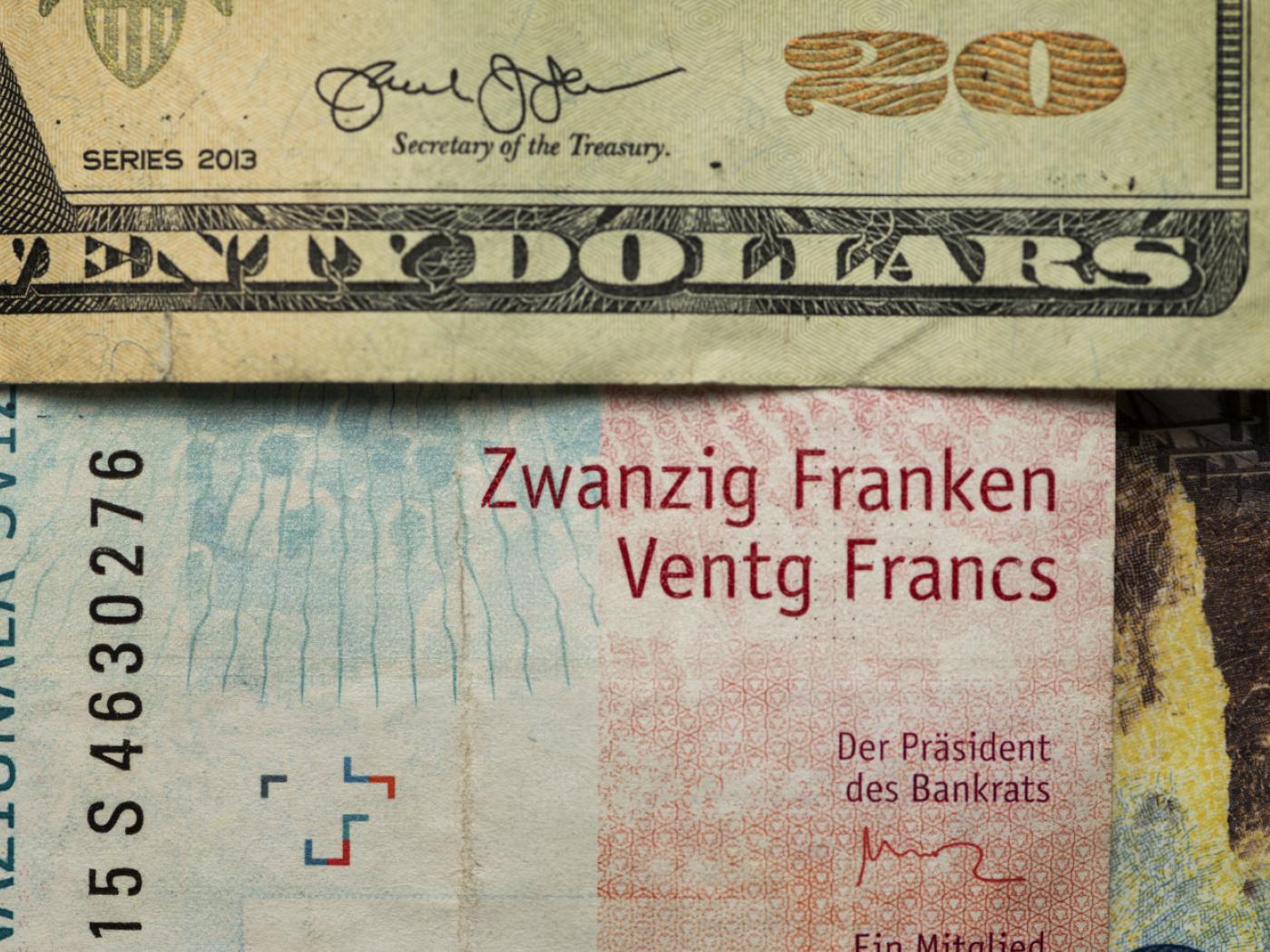

In The Natural Order of Money, Roy Sebag, a goldbug and former CEO and founder of a bitcoin mining company, tries to convince us that there is a similar non-arbitrary order of money itself. In this neat booklet-length treatment, he points to ecological accountability and the necessary tie to the underlying and real.

Money is the extension of the natural order ruling the primary industries — those with direct feedback from ecology, like farming, fishing, or mining — to the service industries. It’s the thing that keeps the service industries beholden to natural limits. No matter how complex or intricate human societies become, they “remain accountable to the regularities and vagaries of the natural world,” as Sebag opens the book.

“We cannot harvest a crop at the wrong time, lazily neglect a flock of sheep, or mine for rare substances where they do not exist without incurring some kind of loss.” The real world has tangible feedback to false behavior; nature decides. “The natural standard means that there is a primary and objective judgement of nature upon the actions of the real economy. Notions of good and bad work, of success and failure, are derived from the farmer’s inescapable accountability to this natural standard.”

In a review of NPR’s Jacob Goldstein’s popular book Money from a few years back I commented:

Top-down planners have always struggled with emergent order and dynamic systems. Without a discernible commissar in place, institutions become ‘weird,’ arbitrary, or random. Money can be anything we like, Goldstein concludes; every monetary arrangement is a choice, which means we can choose whatever we want.

Natural Order is a powerful, vehement objection to that very common and popular current idea: money, institutions, and wealth can be whatever we want them to be, operate any which way we like, be arranged and re-arranged any which way we prefer. The way Sebag sees money, and thus gold, is that it first has to be harvested from nature: it’s an “energy embodiment” that must be resistant to entropy. He concludes therefore that the “only remaining option is for money to be elemental.”

Interestingly enough, Knut Svanholm, a prolific Bitcoiner with a deep interest in Austrian economics, has already delivered that elemental connection to bitcoin. In Bitcoin: Everything Divided by 21 Million he writes that bitcoin is the essential element, element zero, the top-left and missing piece of the periodic table — a pure, unforgeable object of pure (economic) energy without mass.

Sebag doesn’t see it that way, but instead obsesses over weights, as if the physical quantity of something — the gold, the harvest — is what economically matters. But it was never the quantity preservation aspect of gold that made it a functional and flourishing base money in the nineteenth century, but its built-in long-run price stability. The upward-sloping cost of production for gold (i.e., its “difficulty adjustment”) and prices set in gold created a regression-to-the-mean in consumer prices which, for instance, made long-run contracts viable.

At one point Sebag gets at monetary premium, and confidently concludes that “[i]n a society that has moved beyond subsistence, a superior money will be neither food nor fuel.” While accurate and persuasive, what’s so strange about the observation that is that he doesn’t grasp the monetary premium inherent in gold itself when used in monetary role. Whatever physical object we use as money conveys upon it a monetary premium. If it has any real-world uses, its monetary use “crowds out” that use, and make us poorer for it: the price at which the money object trades is higher than that same object would have traded without its monetary role, meaning that non-monetary uses of that object becomes too costly to pursue.

Bitcoin is 100% monetary premium and that’s the point; it doesn’t crowd out natural, real-world use of material, even the precious metals that Sebag would have us waste away in our pockets and our banks’ vaults. In this narrow and specific way, the resource-cost critique about hard money have a point: using real-world objects for money when those objects have alternative uses crowds out that very real-world use.

My Bitcoin buddy Mark Maraia, author of business management book Rainmaking Made Simple, stumbled upon the concept of “natural money” at a Bitcoin event in Costa Rica recently. The concept is simple, yet powerful: money, constrained by and connected with the natural order:

Start with something natural and end with bitcoin […] You start with running water or methane gas, or hydrocarbons or wind or solar. All these elements come from nature and are then converted to electricity that allows bitcoin miners (ASICs) to begin hashing. [The concept of] natural money quietly, peacefully and softly creates curiosity around the idea there is such a thing in the world as natural money.

Semantical quibbles aside, bitcoin seems pretty nature-bound and nature-connected. Still, Natural Order is a curious case, way too short for its own good. In the beginning of the book, the author mentions a manuscript ten times the size that he opted not to move forward with. Perhaps he should have published that one instead.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter