Financial intermediaries, including card schemes and issuing banks, are playing a critical role in the use and promotion of new payment methods in Switzerland. A 2023 research by the Swiss National Bank (SNB) revealed that the rules and standards set by these intermediaries are impacting usage and frequency of contactless payments.

The findings, shared in a new report titled “Consumer adoption and use of financial technology: “tap and go” payments”, are based on an analysis of anonymized, transaction-level data for more than 400,000 payment cards and almost 18,000 merchants in Switzerland between 2019 and 2021. The study looked at data retrieved during four different periods, comparing contactless payment usage in 2019 (Base period), during the weeks immediately before the onset of COVID-19 in Switzerland (Pre-wave 1), during the first wave of COVID-19 and after contactless limits were increased (Post-wave 1), and during the second wave of COVID-19 (Post-wave 2).

Calendar periods applied for sample construction, Source: Consumer adoption and use of financial technology: “tap and go” payments, Swiss National Bank, August 2023

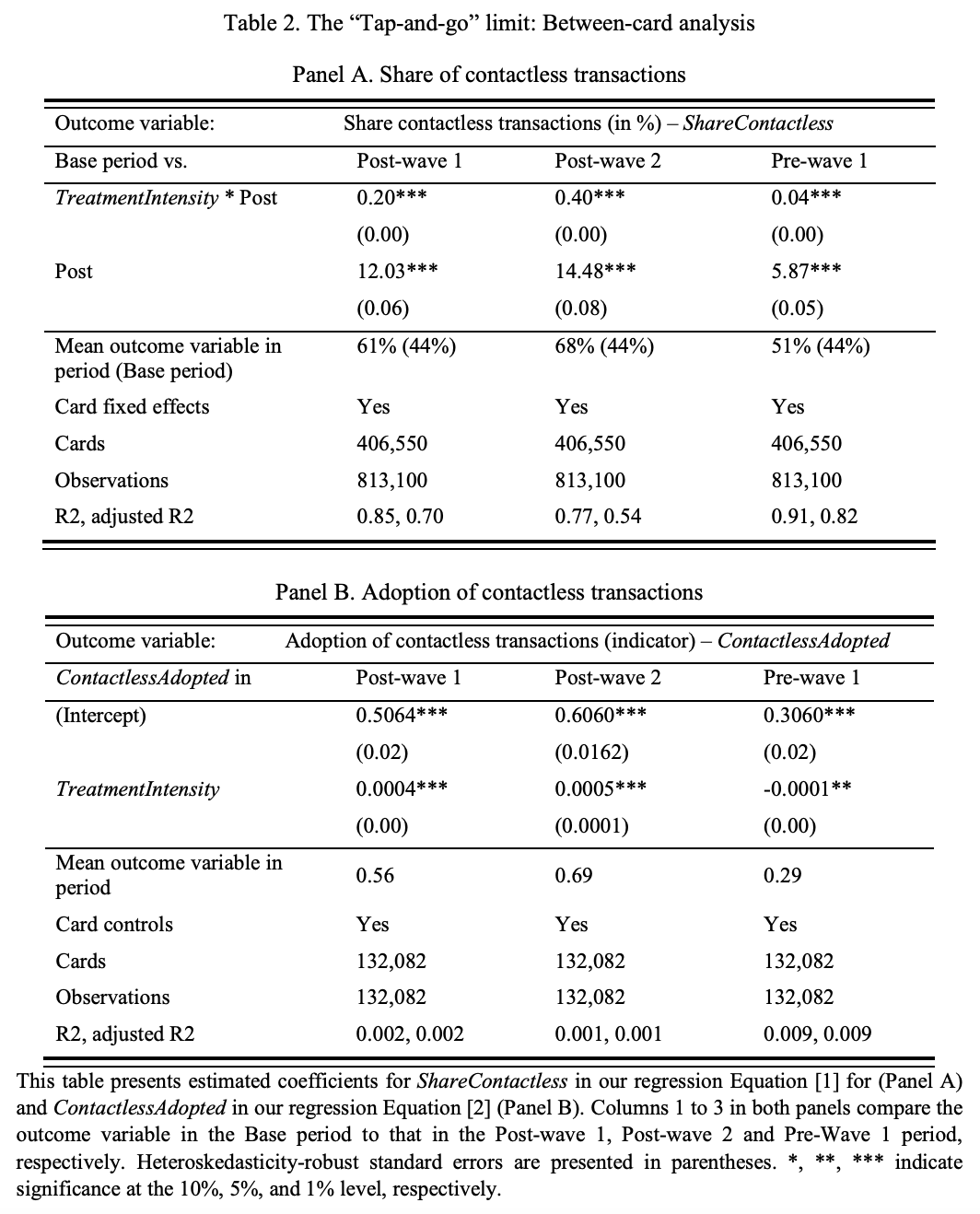

An analysis of the data uncovered a significant increase in the adoption and use of contactless payments following the onset of the COVID-19 pandemic with the share of contactless transactions increasing by 17% points from 44% during the Base period in 2019 to 61% during the Post-wave 1 period in 2020. At the beginning of the pandemic, the increase in contactless payments was four times higher than the trend growth prior to the pandemic outbreak.

The share of cards that were used at least once in contactless payments (adoption rate) also increased between the two periods, rising by 18% points from 68% during the Base period to 86% during the Post-wave 1 period.

Share of contactless transactions and adoption of contactless transactions, Source: Consumer adoption and use of financial technology: “tap and go” payments, Swiss National Bank, August 2023

In Switzerland, the “tap-and-go” limit was doubled from CHF 40 to CHF 80 in April 2020 as a response to the COVID-19 outbreak. This increase was coordinated by the main intermediaries in the Swiss payment industry, including card schemes, card-issuing banks and acquirers, in dialog with the authorities.

Results of the analysis uncovered a substantial causal effect on the use of paytech after an increase in the contactless cardholder verification limit, revealing considerable growth in the use of contactless payments for cards that benefited most from the higher “tap-and-go” limit.

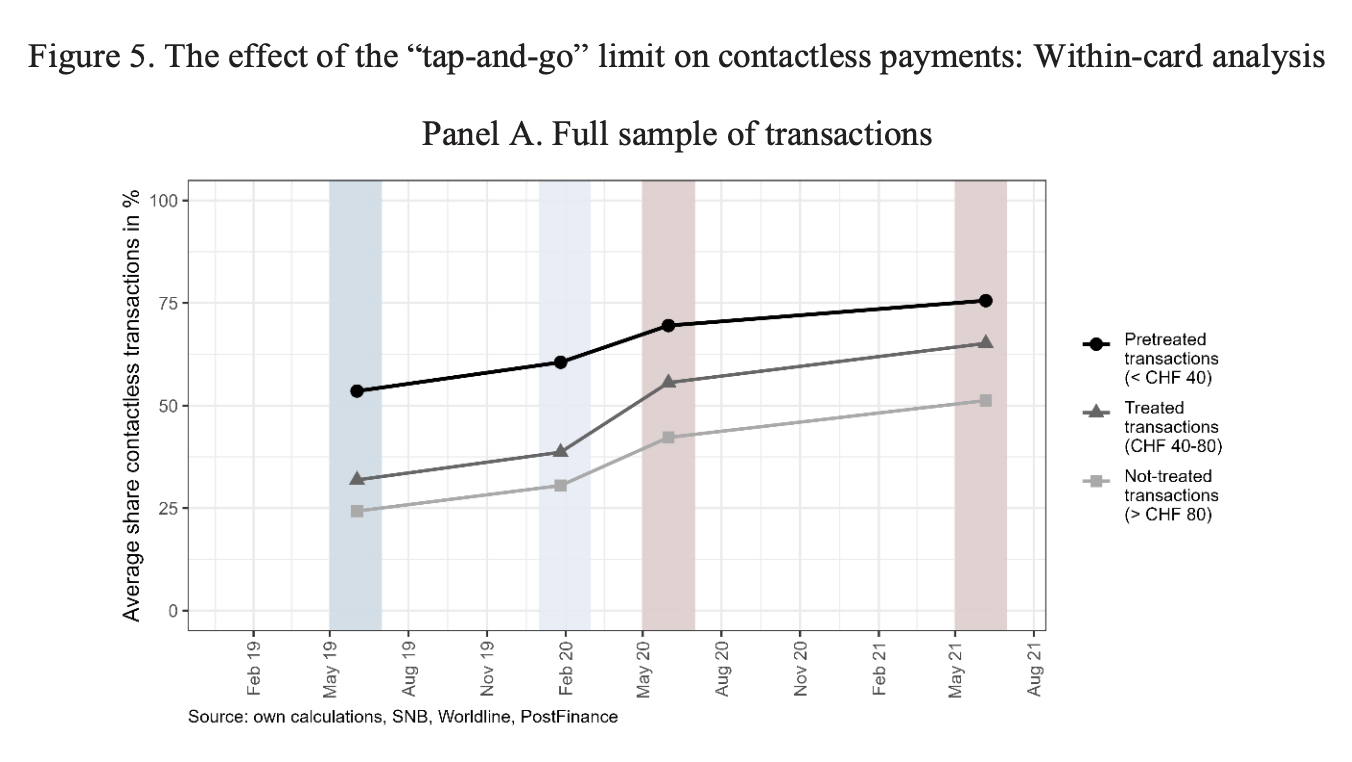

Moreover, transactions that were newly eligible for “tap-and-pay” (CHF 40-80) recorded a stronger growth in contactless payments than transactions that were either previously eligible (below CHF 40) or remained ineligible (above CHF 80).

Between the Base and the Post-wave 1 periods, the share of contactless transactions increased by 24% points for transactions in the range between CHF 40 and CHF 80, compared to 16% for below CHF 40 transactions and 18% points for above CHF 80 transactions.

Effect of tap-and-go limit on contactless payments: within-card analysis, Source: Consumer adoption and use of financial technology: “tap and go” payments, Swiss National Bank, August 2023

These findings provide key insights on how policy-makers and payment system intermediaries should proceed to boost usage of instant payment systems and central bank digital currencies (CBDCs), the report says, revealing that it is critical to provide convenient identity verification for retail payments when promoting new payment instruments. In particular, the results suggest that the value limit for instant verification of payments will affect the intensity of use by consumers who adopt the technology.

The rise of contactless payments

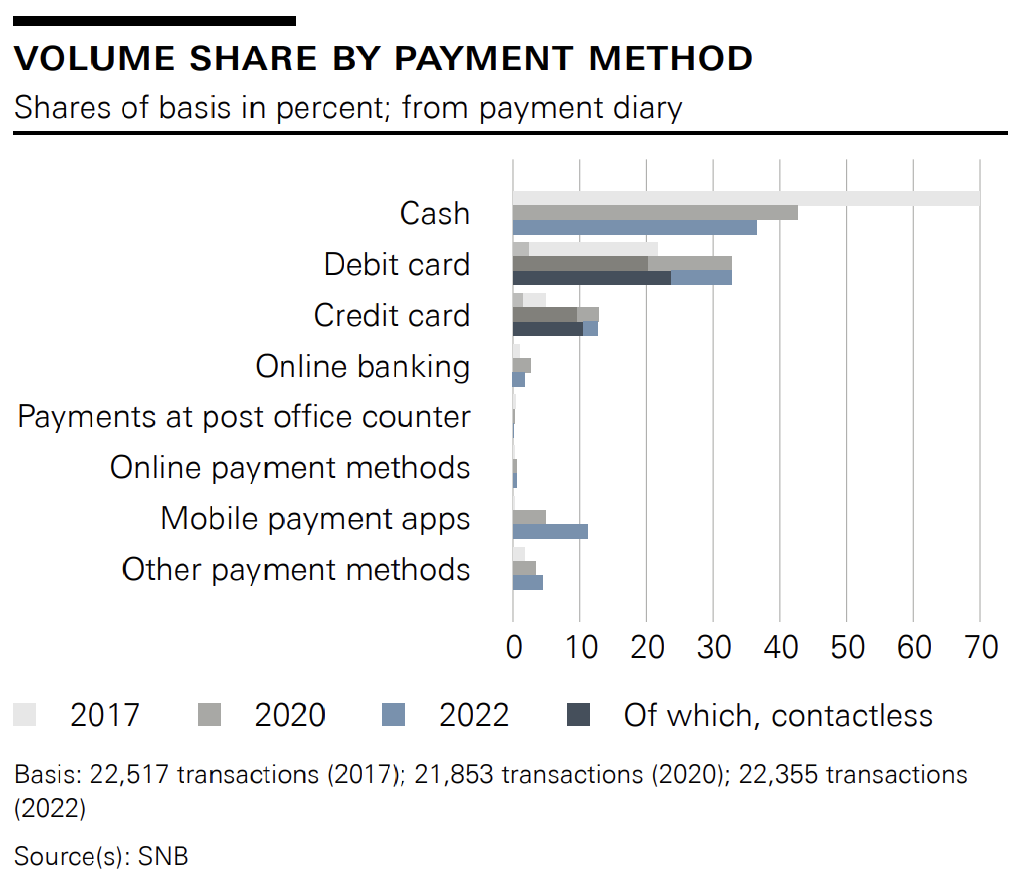

Results of the study are consistent with those of other research which found considerable growth in cashless payments in Switzerland. A 2022 study conducted by SNB revealed a shift from cash to cashless payment methods in the country, with mobile payment apps in particular picking up steam.

The research, which studied more than 22,000 transactions and polled some 2,000 Swiss residents between August and November 2022, revealed that cash was used by the population in 36% of transactions, a figure that’s lower than the 43% and 70% rates observed in 2020 and 2017, respectively. These numbers show that usage of cash in Switzerland has been declining over the past years but that cash remains nevertheless one of the most used payment methods for day-to-day purchases.

Volume share by payment method in Switzerland, Source: Payment Methods Survey of Private Individuals 2022, Swiss National Bank, August 2022

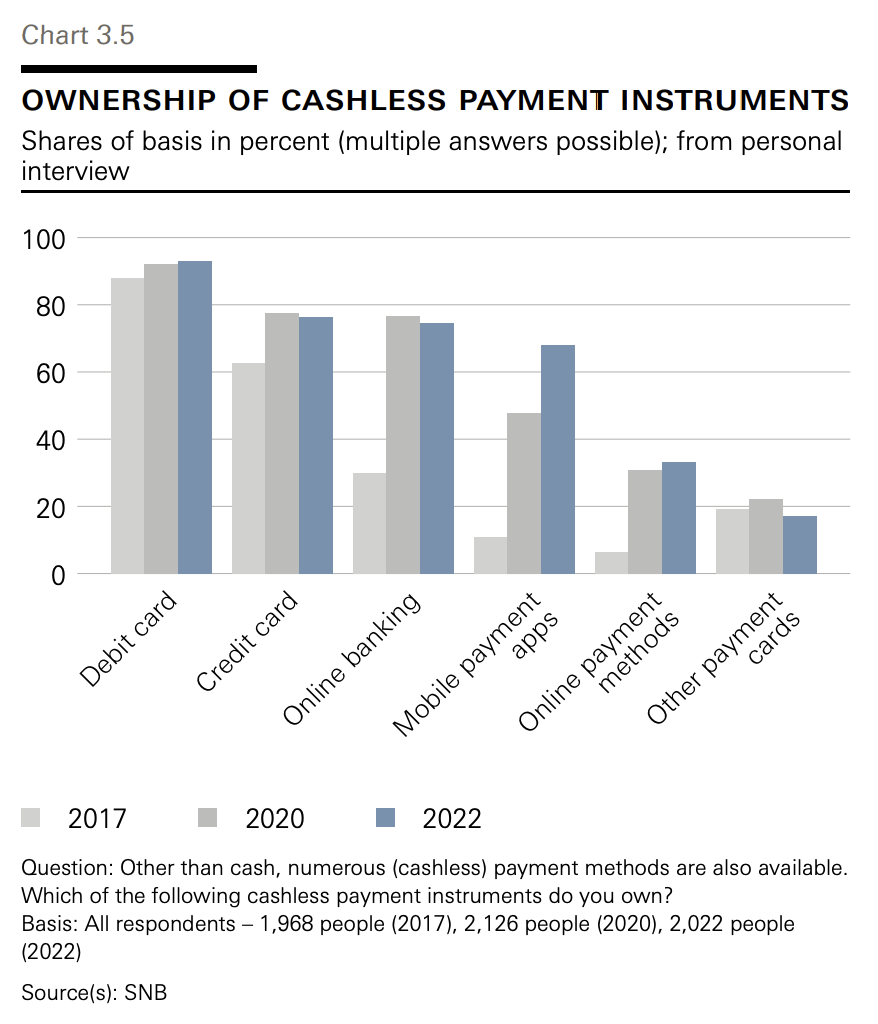

At the other end of the spectrum, cashless payment instruments continued to witness increased adoption with mobile payments apps recording the strongest increase. In 2022, 68% of respondents indicated owning a mobile payment app, representing a more than sixfold increase from 2017. Usage of mobile payment app also grew, rising from a volume share of 5% in 2020 to 11% in 2022.

Ownership of cashless payment instruments, Source: Payment Methods Survey of Private Individuals 2022, Swiss National Bank, August 2022

To address growing consumer preference and usage of mobile payments, Swiss merchants are rapidly integrating these new methods into their payment offerings. A 2023 study conducted by the Zurich University of Applied Sciences and the Management Center Innsbruck revealed that Swiss online merchants are embracing mobile wallets at a fast pace, with local player Twint but also Apple Pay and Google Pay witnessing strong traction.

In 2023, Twint was the second most integrated payment method among Swiss online merchants behind credit cards (90%), with four out of five (79%) Swiss online shops polled indicating supporting the mobile payment app.

Twint is a mobile payment method in Switzerland that allows users to connect their bank account or card through an app to make payments online and at brick-and-mortar stores. The service claims more than 5 million users and says it carried out a total of 386 million transactions in 2022. Established in 2016, Twint is owned by some of Switzerland’s biggest banks, including UBS, PostFinance, Raiffeisen, Banque Cantonale Vaudoise, Zürcher Kantonalbank as well as Swiss stock market operator SIX and French payment company Worldline.

Featured image credit: edited from freepik

The post New SNB Study Reveals Critical Role of Card Schemes and Banks in the Contactless Payment Usage appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter,Switzerland