The USA is dominant in the cryptocurrency venture capital (VC) game, representing more than 71% of the total amount of capital under management from the top 50 crypto-focused VC funds, a new report by Coinstack Partners, a boutique investment bank for crypto and Web 3.0 companies, shows.

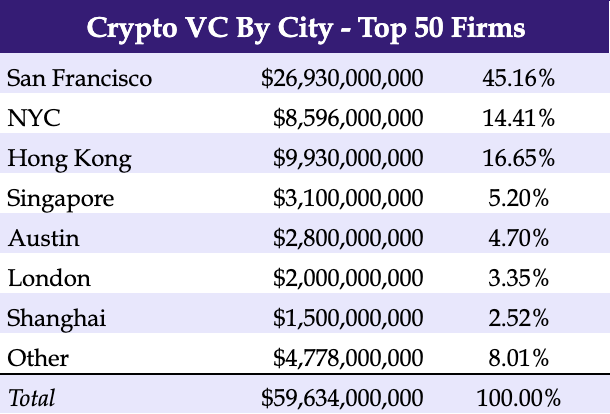

Global crypto VC by city – Top 50 firms, Source: The Crypto VC List 2023, Coinstack, March 2023

The report, which looks at VC funding activity in the crypto space, reveals that US crypto funds are now managing more than US$42.4 billion worth of assets of the total US$59.6 billion under management from the top 50 crypto-focused VC funds. The figure makes the US the biggest VC investor in the crypto space, well ahead of other prominent locations such Hong Kong, the UK and Singapore.

Looking at the world’s top crypto VC cities, the research found that San Francisco is the number one city for crypto VC firm capital with US$26 billion worth of assets under management. The city is followed by Hong Kong (US$9.9 billion), New York City (NYC) (US$8.6 billion), Singapore (US$3.1 billion) and Austin (US$2.8 billion).

Crypto VC by city – Top 50 firms, Source: The Crypto VC List 2023, Coinstack, March 2023

A deep dive into crypto VC firms worldwide shows that A16Z Crypto, a venture fund from Andreessen Horowitz, is currently the world’s biggest crypto fund with US$7,565 million under management. The San Francisco fund is followed by Binance Labs from Hong Kong (US$7.5 billion), Multicoin from Austin (US$2.8 billion), Pantera from San Francisco (US$2,523 million), and Paradigm (US$2.5 billion) from San Francisco.

Top 25 crypto VC firms as of March 2023, Source: The Crypto VC List 2023, Coinstack, March 2023

The report also looks at the top crypto VCs by the number of all-time investments they’ve made into the sector. The ranking paints a different picture of the top 25, revealing that Coinbase Ventures is currently the most active crypto VC investor with 355 investments, followed by Digital Currency Group (332), NGC Ventures (265) and AU21 Capital (258).

Coinbase Ventures is the corporate venture capital (CVC) arm of publicly listed crypto exchange Coinbase. Launched in 2018, the fund provides financing to early-stage cryptocurrency and blockchain startups with a focus on building out the crypto ecosystem.

Companies in its portfolio include Animoca Brands, a leader in non-fungible token (NFT) and blockchain gaming valued at a reported US$5.9 billion, Amber Group, a diversified crypto trading platform focused on the Asian market valued at US$3 billion, and Airtm, a global peer-to-peer (P2P) payment network based in Latin America.

Digital Currency Group (DCG) is a crypto VC company and a conglomerate in the digital asset space. DCG has five subsidiaries: CoinDesk, a news website specializing in crypto and blockchain; Foundry, a crypto-mining firm; Grayscale Investments, a digital asset management company; Luno, a digital asset exchange; and Genesis, a digital asset focused financial services firm for institutional clients that recently went bankrupt.

Companies in DCG’s portfolio include BCB Group, an European bank serving crypto-native businesses; BitGo, a company that offers institutional staking, custody and trading services; and BitOasis, a leading crypto exchange in the Middle East and North Africa (MENA) region.

Top 25 crypto VC firms by investment count, Source: The Crypto VC List 2023, Coinstack, March 2023

Crypto bull run incoming

Despite the prolonged so-called “crypto winter”, 2022 was a record-breaking year for crypto VC investment, reaching all-time highs for capital invested, at US$26.2 billion, and number of deals set, at 2,541, data from Pitchbook show.

Crypto VC deal activity, Source: Pitchbook, February 2023

The momentum is carrying on this year, with US$1.4 billion invested in January and February 2023 alone, the Coinstack report says. This sum represents a 3.1x increase from January and February 2019 during the last bear market (US$471 million), it says, showcasing the maturing of the sector and hinting at increased institutional participation.

Bitcoin is currently trading at around US$26,800, down more than 60% from its all-time high of almost US$69,000 in November 2021. Crypto markets crashed last year as central banks hiked rates to set price increases down and digital asset companies collapsed.

According to Coinstack, the crypto VC capital market is poised for a big comeback in 2024 and 2025, amid the upcoming Bitcoin halving. A Bitcoin halving is an event where the reward for mining new blocks is cut in half, reducing the rate at which new coins are created. Halvings are part of the process of capping the Bitcoin supply at 21 million tokens.

The next Bitcoin halving event, scheduled to take place around April 2024, will likely result in a crypto bull market in 2025, the report says. Looking at historical data and trend models, the crypto industry has tended to return to a bull market every four years for about 18 months, it says.

Coinstack predicts that bitcoin can scale pass US$69,000 and ether US$4,800 by December 2024 or January 2025, a projection that’s shared by Bloomberg Intelligence and Matrixport analysts whom expect the price of bitcoin to reach US$50,000-US$65,000 by April 2024.

This article first appeared on fintechnews.am

Featured image credit: Edited from Freepik

The post The Top 50 Crypto VC’s in 2023 appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain/Bitcoin,Featured,newsletter,USA