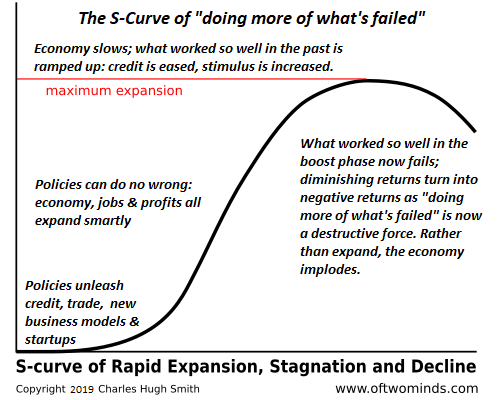

| This dynamic–making problems much worse by forcing more of whatever worked in the previous era into a saturated, increasing unstable new era–receives little attention or understanding.

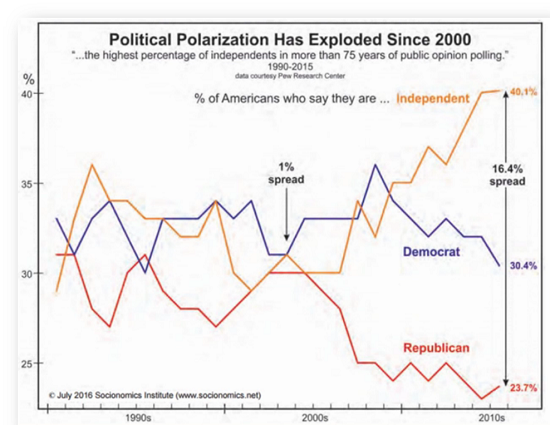

Eras may last decades, and only those who’ve lived long enough to recall previous eras have experienced the transition from one era to the next. The era of financialization, globalization and low-cost, abundant oil/natural gas began over 40 years ago in 1981. The era of digital / Internet technologies took off about 30 years ago. All of these dynamics accelerated in the early 2000s, roughly 20 years ago. Only those 60 and older experienced working in a previous era (pre-1981). All of these dynamics are entering a phase of nonlinear turbulence as the changes are outpacing these highly streamlined / optimized systems’ ability to self-correct. This nonlinear instability is being accelerated by doing more of what worked in the previous era, in the mistaken belief that the 2020s are simply an extension of the eras that began 40 and 30 years ago. |

. |

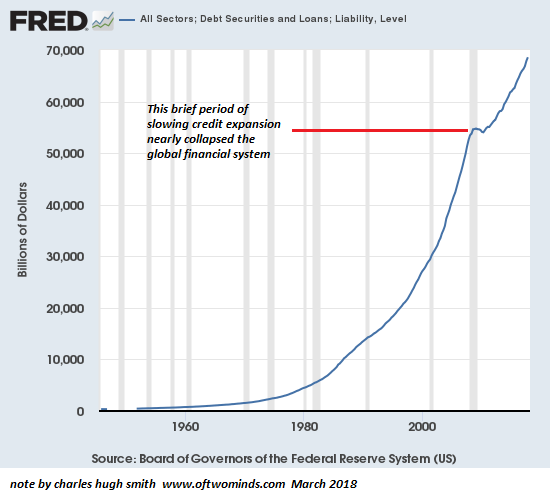

| The fixes that worked in the past won’t resolve the nonlinear instability because all these dynamics have reached saturation: adding more debt no longer generates organic expansion of productivity, all it does is inflate an even larger and more unstable credit-asset bubble.

Globalization has been optimized to the point of saturation: the potential downsides to national security outweigh any remaining marginal gains in corporate profitability. Financialization has so distorted the economy that gambling on useless speculations is now viewed as the best (or only) way to get ahead. When a system has absorbed all it can absorb, adding more is just a waste of resources. We’ve entered a new era, and so the fixes and incentives that worked in the past 40 years no longer work. The idea that the past 30 years were not a permanent era but an anomaly that’s come to an end doesn’t compute for everyone who has only experienced the “glorious 30” years of cheap energy, soaring assets and falling prices due to hyper-globalization and hyper-financialization. The idea that this new era may evolve unpredictably is also anathema to a technocratic culture and economy that prides itself on forecasting and controlling everything with credit and money. The previous 40 years of material abundance has nurtured a belief that the solution to any scarcity is to create more money, as some of this new money will inevitably flow into eliminating the scarcity. |

. |

| The idea that some scarcities cannot be fixed by creating more money doesn’t compute.

It may turn out that all the lessons we learned in the past 40 years will not only be useless in this new era, they will be disastrously counter-productive. Their unparalleled success for decades may blind us to the power of previous solutions to make our problems worse than they would have been had we recognized the new era for what it is rather than seeing the future as a seamless extension of the previous era. This dynamic–making problems much worse by forcing more of whatever worked in the previous era into a saturated, increasing unstable new era–receives little attention or understanding. This dynamic helps us understand why systems that seemed permanent and forever can destabilize and fall apart with astonishing speed. We thought we were fixing it by doing more of what worked in the past, but we were actually accelerating the turbulence and destabilization. We have a hard time letting go of the idea that the recent past is an accurate guide to the future. In stable eras, it generally is, but not when an era ends and a new one begins. |

. |

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter