Inflation rates are continuing to rise across the globe, with the UK arguably leading this trend. More specifically, the UK inflation rate hit 10.7% in November, and while it dipped slightly from a peak of 11.1% in October, it remained considerably higher than the Bank of England’s target of 2%.

This is impacting the cost of energy and food items markedly, creating a cost-of-living crisis as inflation continues to outstrip earnings across multiple industries.

With earnings and savings rates unable to beat inflation in the current economic climate, the question that remains is whether there are any investment vehicles that can overcome the cost-of-living crisis at present?

In this post, we’ll address forex as a potential solution, while considering which other assets offer value in the current macroeconomic climate?

Forex as an Inflation Beating Asset

In addition to the UK (where inflation reached a 40 year high in October), inflation in the Eurozone has also reached new levels above 8% recently.

The inflation rate in the US has also peaked at its highest level in nearly half a century, with most developed nations reacting to this by initiating incremental hikes in the base rate of interest.

What causes inflation? These interlinked events have created a challenging macroeconomic climate, which in turn continues to impact the forex market directly. More specifically, inflation continues to devalue international currencies and their purchasing power, while central banks are combatting this by hiking interest rates (which enjoy an inverse relationship with inflation) and looking to leverage quantitative easing to prop up the value of fiat currencies.

This means that forex remains a viable way of overcoming inflation through 2023, especially with currencies such as the GBP and EUR having made recent gains against the omnipotent US dollar during the second half of 2022.

This also highlights the speculative and flexible nature of forex trading, which sees currencies traded in pairs and enables you to buy (go long) or sell (go short) and profit regardless of the wider market and macroeconomic conditions. This also enables you to derive short-term profits as you don’t have to assume ownership of the underlying financial instrument, which is arguably ideal in a volatile economic climate.

At the same time, you can leverage your forex trading account to implement viable risk management measures, which can help to minimise losses as market volatility increases.

For example, stop loss and take profit measures automatically close positions once a predetermined level of loss has been incurred, potentially enabling you to bank any remaining profit before revisiting and reconsidering your wider investment strategy.

What Other Asset Classes Offer Value in 2022?

A diversified investment portfolio is central to trading success regardless of the market conditions, but this is especially important during volatile periods or times of recession.

So, although you’ll need to regularly review and update your portfolio as the economic climate evolves, there are a few asset classes that can help you to beat inflation going forward.

These include:

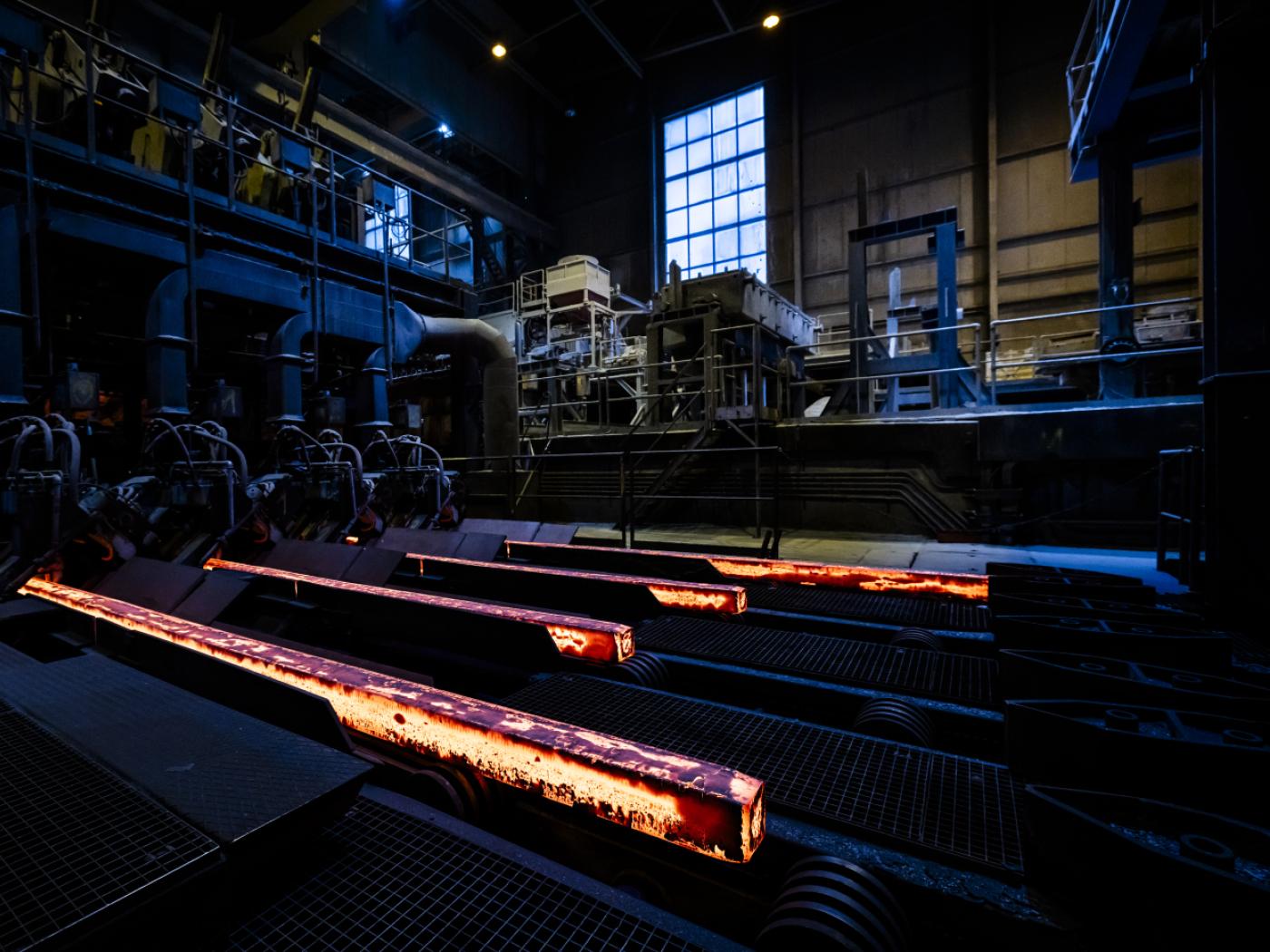

- #1. Commodities: Commodities are well known to provide a viable hedge against inflation, not least because they’re considered to be tangible assets that may see their value appreciate within the complex import and export markets. Overall, commodities tend to be the asset class that is most positively correlated with inflation, meaning that you may want to increase your stake in targeted goods and materials depending on more fundamental factors such as global supply and demand and the balance between these two factors.

- #2. Gold and Silver: Both the UK and Germany have slipped into a technical recession, with other countries expected to follow suit through 2023. During this type of inflationary recession, gold, silver and similar precious metals tend to see their value appreciate in line with demand, as investors adopt a more conservative approach and seek out corporeal assets that serve as a secure and tangible store of wealth. Gold also tends to see its value increase when the purchasing power of major currencies (such as the USD) decline, which is a key macroeconomic trend in the current marketplace.

- #3. Real Estate: We close with real estate, which is a viable option for investors who have access to larger financial resources. Certainly, property prices in the UK have increased consistently and markedly in recent times, and while this trend may be showing signs of abating, this creates an opportunity for investors to buy in at a lower level in anticipation of a subsequent boom in the future. In many ways, real estate is the ultimate hedge against inflation, thanks to consistent demand, an inadequate supply of housing and the disproportionate value of property in the modern age.

Tags: economy,Featured,newsletter