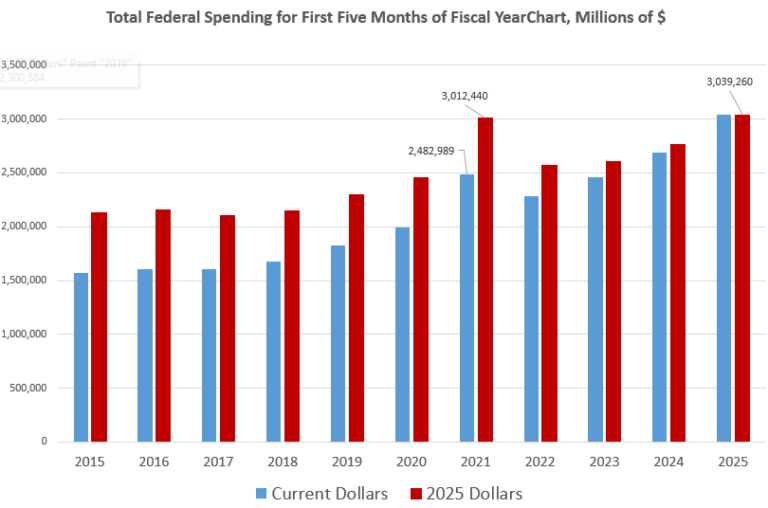

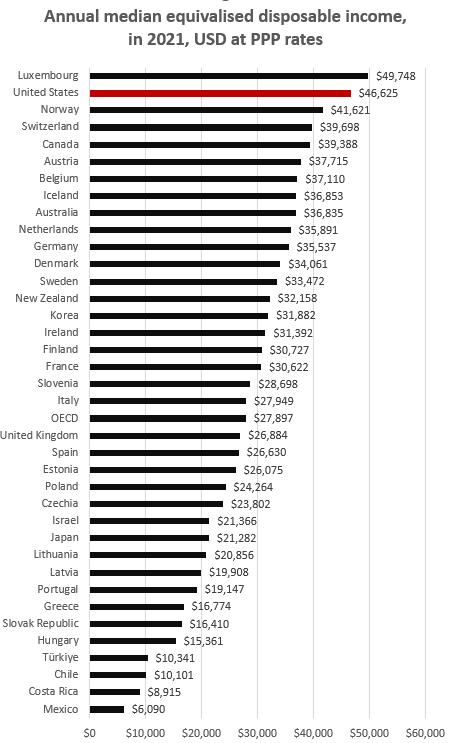

| Driven by rising prices, Swiss foreign trade increased significantly in nominal terms in 2022. Although exports rose by 7.2%, they stagnated in price-adjusted terms. Meanwhile, imports grew by 16.8% in nominal terms and edged up slightly in real terms. Trade declined in both directions in the fourth quarter. The year ended with a trade surplus of CHF 43.5 billion.

In brief: ⇑ Exports: watches and jewellery set new records ⇑ Exports to Slovenia and Italy soared (+44.1% and +37.1%) ⇑ Energy imports doubled due to price spikes ⇑ Imports from the United States rose by a quarter Export trend: ⇑ Import trend: ⇑ |

Swiss exports and imports, seasonally adjusted (in bn CHF), December 2022(see more posts on Switzerland Exports, Switzerland Imports, ) |

Overall trendIn 2022, exports climbed by 7.2% to an all-time high of CHF 278.6 billion. Imports surged by 16.8% and likewise reached a new high. Trade in both directions was driven almost exclusively by price increases (real: +0.1% and +0.7%). On a quarterly basis, both directions of trade were negative in the last quarter, following three positive periods. The trade surplus at year-end was CHF 43.5 billion (previous year: 58.5 bn). |

Switzerland Trade Balance, December 2022(see more posts on Switzerland Trade Balance, ) Source: investing.com - Click to enlarge |

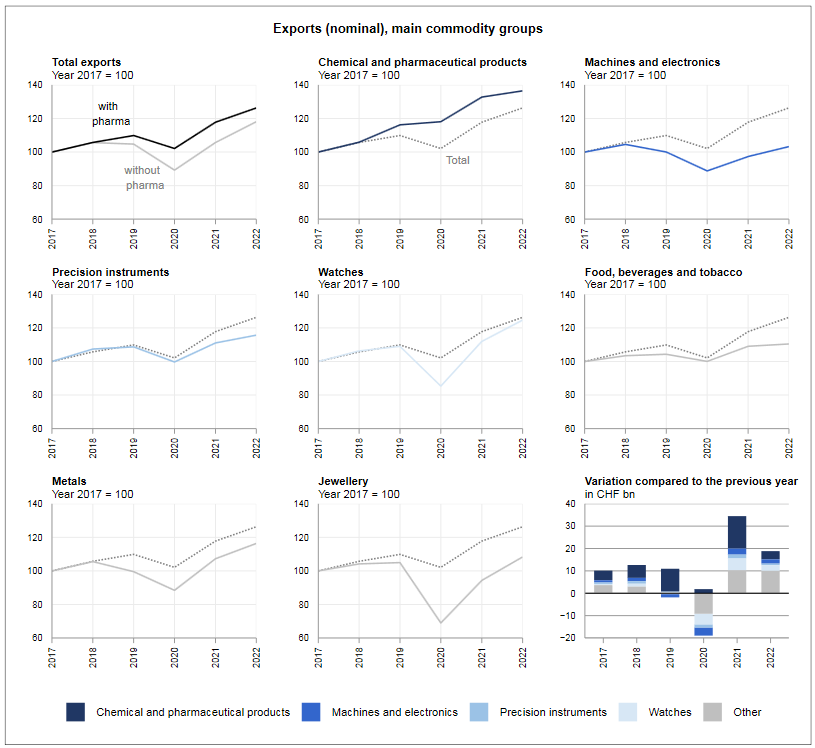

Broad-based export growthThe export growth of CHF 18.8 billion seen in 2022 was broad-based, with nine of the eleven main groups posting an increase. Chemical and pharmaceutical products, the group with the highest turnover, made the largest contribution (3.7 bn), driven by raw and primary materials and immunological products (4.1 bn in total). In contrast, like a year earlier, some of the strongest growth rates were achieved by watches and jewellery, both of which posted double-digit increases of 11.4% and 14.8%, respectively, and set new records. Exports of machines and electronics (+1.9 bn, or +6.1%), metals (+1.2 bn, or +8.5%) and precision instruments (+729 mn, or +4.2%) likewise rose, albeit less sharply. The Swiss export industry sold more goods in all three major economic areas: deliveries to Asia were up by 8.6% year on year, those to North America by 7.8% and Europe by 6.3%. In the case of Europe, exports to Slovenia (+44.1%; chemical and pharmaceutical products) and Italy (+37.1%; electricity, chemical and pharmaceutical products) were particularly robust. Deliveries to Slovenia were 2.5 times higher than in 2020. In Asia, Japan was the strongest driver, with an increase of a fifth, while in North America, exports to the United States grew by 7.9%. |

Swiss Exports per Sector, December 2022(see more posts on Swiss Exports, ) |

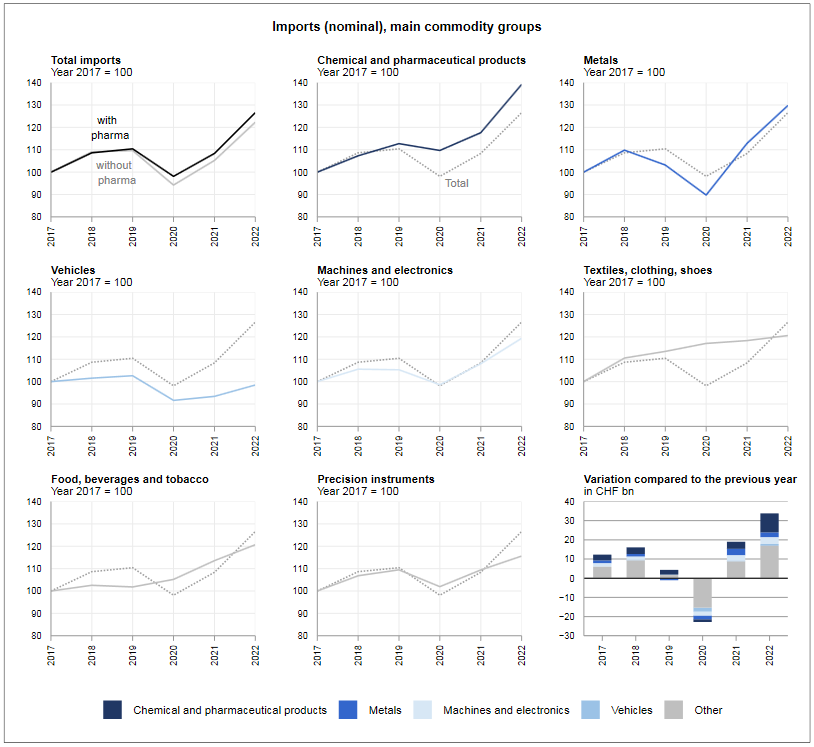

Three quarters of the increase in imports came from EuropeOn the import side, the entire range of goods was up in 2022. Rising energy prices caused a twofold increase in purchases of energy sources, bringing them to CHF 12.7 billion (real: –1.4%). As a result, this group was responsible for more than a third of the total growth. Imports of chemical and pharmaceutical products also surged by CHF 10.1 billion (+18.3%). Imports of metals (+15.0%), jewellery (+11.7%) and machines and electronics (+10.5%) likewise posted double-digit growth rates. In the case of machines and electronics, imports of electrical and electronic articles jumped by a fifth. Imports from all three major economic areas also rose. Imports from Europe climbed by CHF 26 billion, or 18.2%, and all EU countries of relevance for trade were up. Almost half of the total import growth was attributable to France, Germany and Italy; imports from those countries grew by between 13.3% and 33.0%. Slovenia also stood out, as imports from there tripled. The increase in Asia (+4.5 bn) was due primarily to additional imports from China (+13.5%). However, coming in at 22.0%, North America (United States) had the strongest growth of all three regions. |

Swiss Imports per Sector, December 2022(see more posts on Swiss Imports, ) |

Tags: Featured,newsletter,Switzerland Exports,Switzerland Imports,Switzerland Trade Balance

& Portfolio | Finanzfluss Live

& Portfolio | Finanzfluss Live

#versicherungen

#versicherungen