Home price growth of the sort we’ve seen in recent years simply cannot be sustained without a continued commitment to easy money from the central bank, and it shows.

| Home prices continued to slide in August as the economy cooled, and as the Fed hit the Pause button on quantitative easing while allowing interest rates to rise. Home prices in August were 13.0 percent higher nationally compared with August 2021, according to newly released data from the S&P CoreLogic Case-Shiller Home Price Index. That is down from a 15.6 percent annual gain in the previous month. This is a big shift downward, and as CNBC reported Tuesday, “The 2.6% difference in those monthly comparisons is the largest in the history of the index, which was launched in 1987, meaning price gains are decelerating at a record pace.” The new trend was further described by a Case-Shiller spokesman as “forceful deceleration in U.S. housing prices … while price gains decelerated in every one” of the twenty cities measured by the survey. Every city in the index saw a larger year-over-year decline in August than in July. (In the seasonally adjusted numbers, the month-over-month decline was the largest since 2009.)

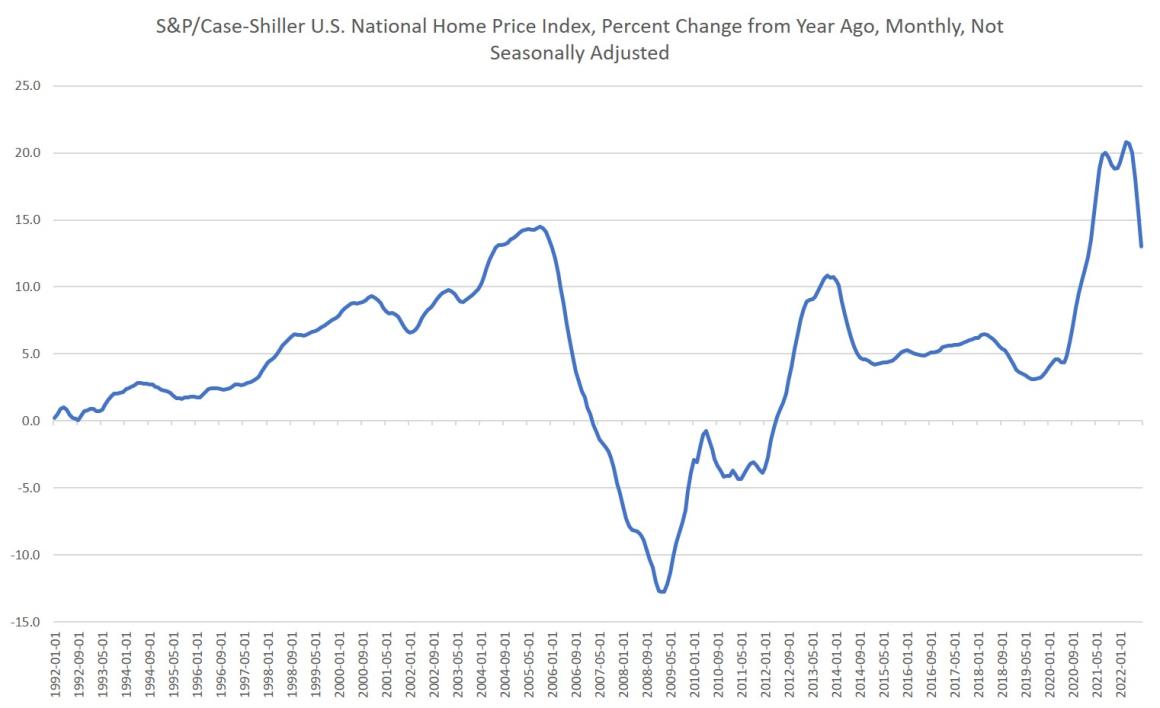

However, even with this rapid deceleration, the year-over-year growth is still similar to what was reported in the boom period of the last housing boom, in 2005. YOY growth peaked at 14.5 percent, year over year, in September 2005, but turned negative by March of 2007. Home price growth during the current cycle appears to have peaked during April of this year at 20.8 percent, but has rapidly moved downward in the four months since. |

|

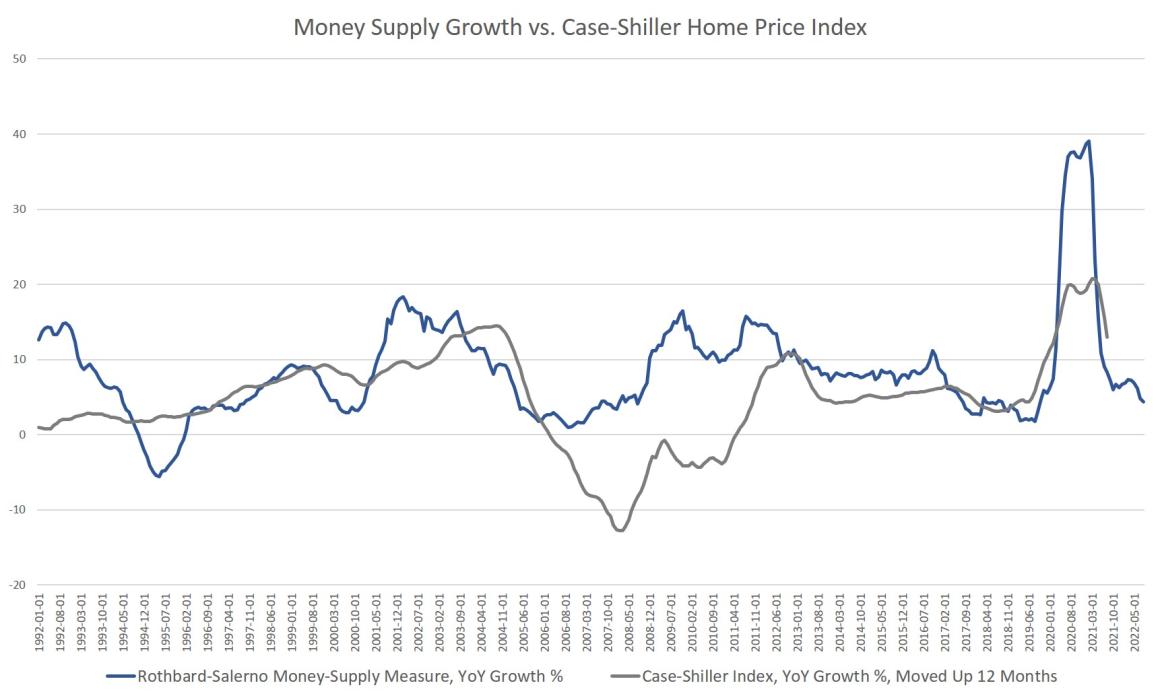

No Easy Money, No Housing Price BoomThis reflects what have been declines in home sales and this has been largely blamed on rising interest rates. For example, pending home sales fell more than 24 percent from a year earlier in August. Meanwhile, the average thirty-year fixed mortgage rate rose from 4.99 percent to 5.66 percent from August 4 to September 1. The 2021 average rate was 2.96 percent. In other words, the average mortgage rate in August was double what it had been in 2021, and this made mortgages more expensive, with monthly payments considerably higher. On a $300,000 loan, the monthly payment at 3 percent is $1,265 per month, while at 6 percent it’s $1,799. Naturally, that’s going to put downward pressure on prices while pushing some people out of the market altogether. So, it is certainly not wrong to note that rising interest rates have been a factor in bringing down home prices and sales totals. But there’s a bigger issue here and that’s the relationship between easy money and asset prices. As Brendan Brown has noted here at mises.org for years, asset price inflation has been the most noticeable outcome of monetary inflation (i.e., easy money policy) over the past twenty years. High levels of consumer price inflation are a far more recent phenomenon. That is, Brown has noted that price inflation has been rampant for years, it’s just been in assets instead of consumer goods. Since at least the beginning of the Greenspan put in the late 1980s, as the money supply has inflated, so have stock prices and prices for homes and other real estate. In fact, one can see a significant correlation between money supply and growth in the Case-Shiller index. There is at least a twelve-month lag between a surge in the money supply and surge in home prices, so I have moved up the home price growth numbers by twelve months in this graph: |

Using the Rothbard-Salerno measure of the money supply, we can see the two variables largely track together. As money supply growth accelerated from the late 1990s to 2004, so did home prices. As money supply growth fell nearly to zero in 2007, home prices took a downward turn. Naturally, we also find that following the historically huge increase in money supply growth in 2020 and 2021, massive amounts of home price growth soon followed. Now that money supply growth has headed downward again, we’re now seeing home prices fall considerably. Many observers of home prices have tried to pin these movements on new construction of housing, demographic changes, and people moving during the pandemic. Certainly, those factors have an effect on home prices in various places, and they can have big effects in specific local markets. But it’s also clear that home prices nationwide are also heavily affected by changes in the money supply.

After all, in times when the Federal Reserve wishes to fuel more monetary growth, it manipulates interest rates downward, thus fueling more home price growth as home buyers can afford larger loans and higher home prices. That promotes more monetary inflation (and thus more asset price inflation) via the commercial banking sector. But the Fed also directly fuels asset price inflation by directly creating new money when the Fed purchases more mortgage-backed securities (MBS). The Fed simply creates new money electronically and then buys up more housing debt to support asset prices. It has been doing this since 2009 and this greatly reduces the risk of greater investment in mortgages for the private sector. Thus, price institutional investors will also pour more money into the housing sector further increasing prices.

So, the housing sector has become heavily dependent on continual injections of new money and central bank manipulation of interest rates to keep the gravy train going. Now that the Fed has slightly backed off its purchases of MBS while allowing interest rates to increase, home prices are falling rapidly. They will likely continue to fall until the Fed ultimately loses its nerve in its fight against Consumer Price Index inflation and finally embraces easy money once again.

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter