The Cleanest Dirty Shirt

It’s easy to overestimate the problems the United States faces while underestimating its strengths. The challenges are certainly significant. Politics have seldom been so divisive. The government is running an annual deficit of over a trillion dollars, with a total debt many times that. Inflation has spiked. The Fed has been hiking interest rates at a pace that could imperil the economy. There is enormous wealth disparity. Economic growth has been historically weak since the Great Recession in 2008.

Demographically, the country is getting older as the baby boomers retire. Partly as a result, the fiscal math of social security, Medicare, and many government pensions has some significant problems. Overdose deaths from opioids like fentanyl keep trending higher with over 100,000 estimated last year by the CDC. Violent crimes, such as murder, were up last year after surging in 2020. It’s an exhausting list of worries, before you even get to little things, like lost wars overseas in Afghanistan and Iraq or America’s loss of dominance over the South China Sea with the rise of competing Chinese military power.

| It’s All Relative

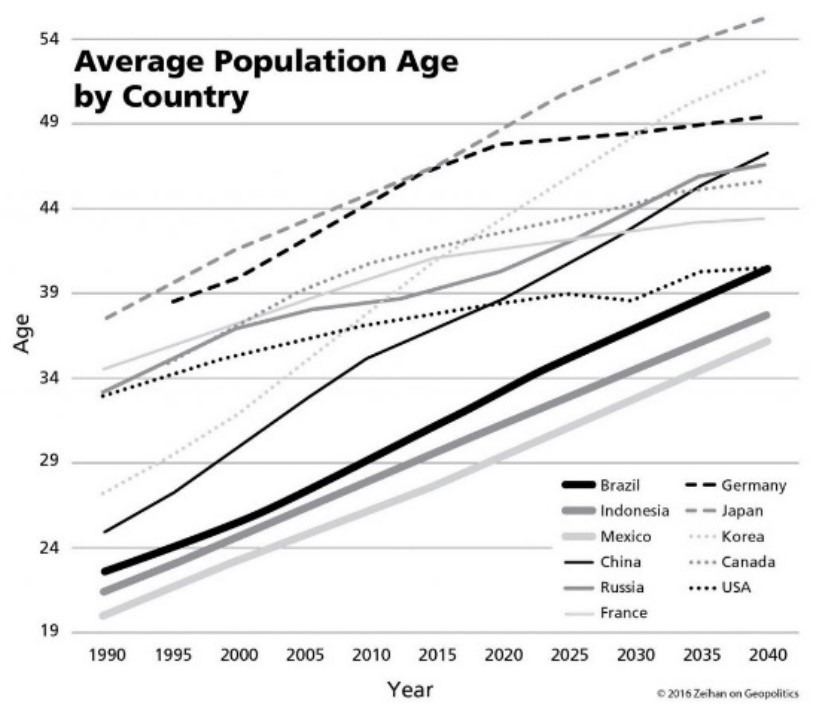

It’s all true. Yes, the United States certainly has its problems. But when you start to compare our situation with the rest of the world, we don’t look so bad. Does anyone really believe the European economy is better positioned than the US? China? The US’ economic shirt may be a tad soiled but it’s the cleanest dirty shirt in the global economic laundry. And that alone may be sufficient to explain the ongoing strength of the U.S. dollar, the appetite for investing in the United States, and the desire to emigrate. Looking out over the years ahead, the United States appears positioned to continue its strong relative performance. This doesn’t mean there won’t be opportunities for overseas investments. The U.S. dollar appears overvalued to us versus many currencies at the present moment. And at some point, non-US dollar investments get so cheap they have to be considered regardless of the dollar trend. We already have investments in international value funds for exactly that reason – and they have outperformed the S&P 500 this year despite the rise in the dollar. Nevertheless, the United States is likely to remain in a very strong position relative to other nations. On an absolute basis demographics are certainly a weakness for the U.S. economy. America’s population is aging. The dependency ratio is rising as fewer workers support more retirees. However, those very same demographics on a relative basis represent a major strength. The United States has some of the least bad demographics of any major power or developed country. Below is a chart sourced from analyst and author Peter Zeihan that shows just how much older countries like China, Japan, and Germany are set to become versus the United States. |

|

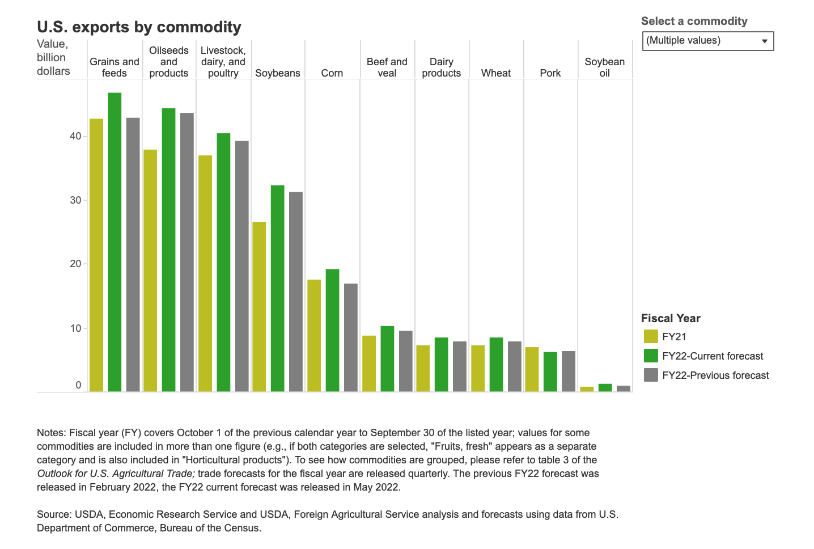

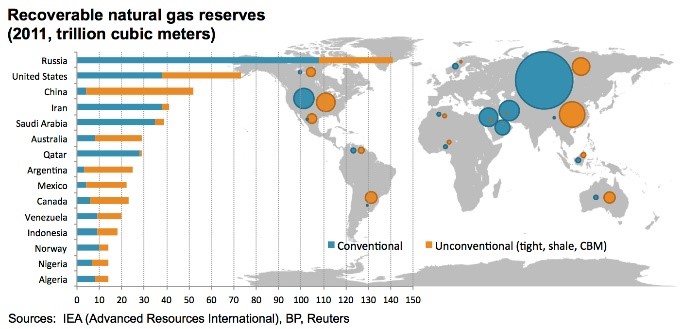

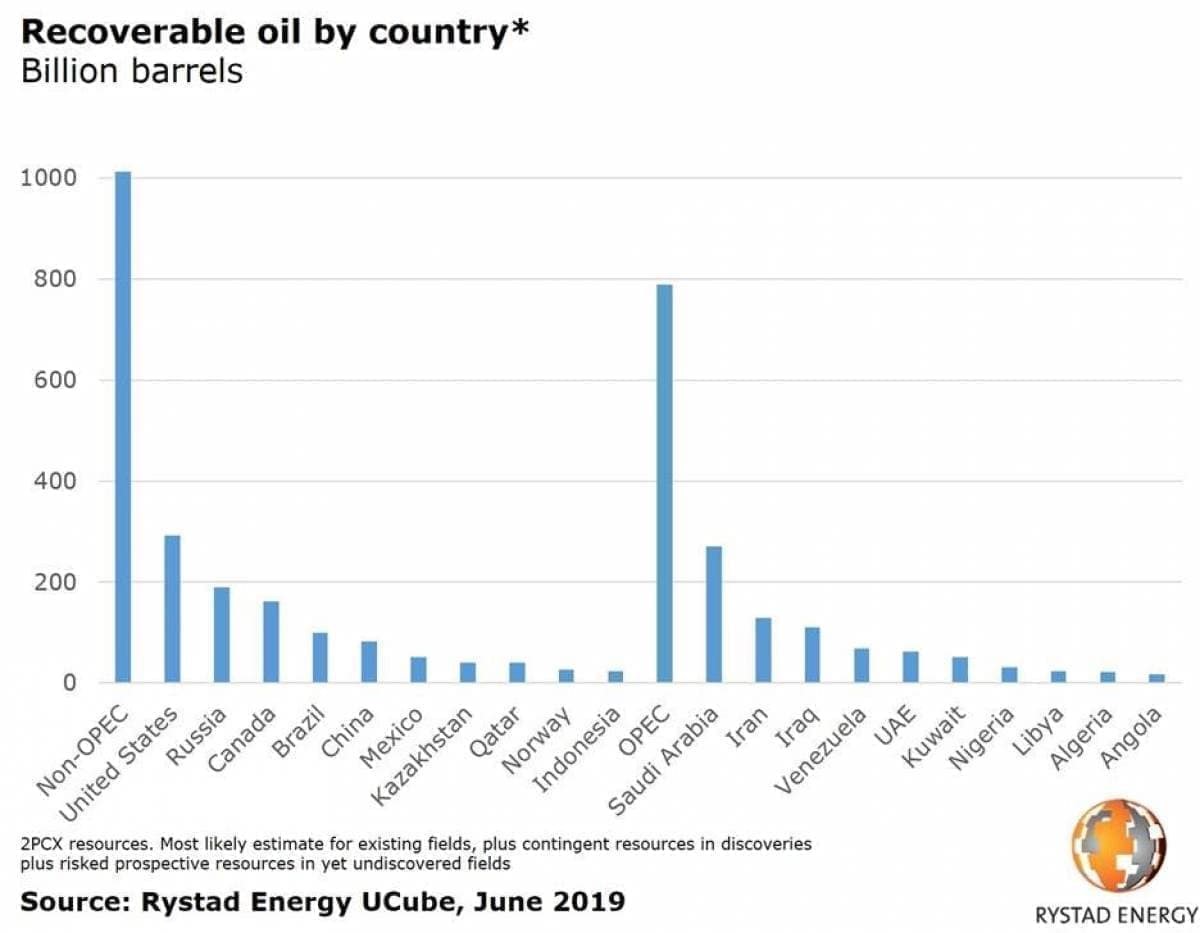

| In addition, the US is rich in natural resources and doesn’t face the same constraints as Europe or China; Americans simply take for granted having secure food and energy resources. Along with substantial natural gas and oil reserves, the United States is also estimated to have more navigable waters than the rest of the world combined. Beyond demographics, the simple geography of the United States puts it in an incredibly strong position versus the rest of the world. | |

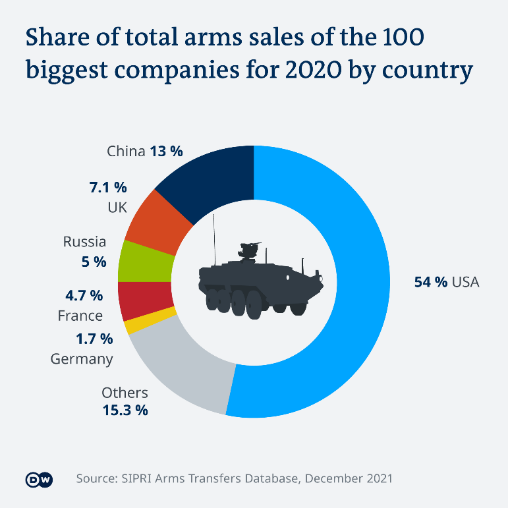

| Of course, part of America’s geographic advantage is not just being connected to the Pacific and Atlantic oceans with some of the world’s best ports, but possessing those oceans as a strategic buffer. The Russian invasion of Ukraine reminded many nations that while there are many things we’d like our governments to do, there is one thing they have to do – national defense trumps everything, including economics. Spending on defense is trending higher, as countries like Germany and Poland are now going on buying sprees. For the United States, national security represents both a relative strength and is also a money maker. The US is not only the largest military in the world but is far and away the largest seller of arms. | |

| Another American Century

None of this is meant to downplay the challenges the United States faces. The “cleanest dirty shirt” title is damning with faint praise; the cleanest dirty shirt is still dirty. Nevertheless, the relative position of the United States versus the rest of the world is so strong that another American century seems a good bet at this point. No other major country has such a relatively strong position on the most important measures. |

Imagined past or present challengers like China, Japan, Russia, and Germany will be encumbered with rapidly aging populations in the decades ahead. This does come with the danger that a country like China might follow the example of Russia and embark on expansionary aims before its number of military-age men shrinks too much. This is certainly destabilizing, but it is a sign of national weakness, not strength.

On the other hand, America’s position of strength is such that it can cut off Russia and rather than worry about keeping the lights on, has more demand for its natural gas exports. The United States can move away from China and it is the Chinese feeling the need to stockpile food. In large part, it is America reshaping the world around its priorities and other countries that will be forced to adjust. Part of this is likely to involve the U.S. moving more high-value manufacturing back home. The Western hemisphere will likely also benefit from growth in low-wage manufacturing and resource extraction sectors.

Despite all its very real challenges, the era of American global power is unlikely to end anytime soon. The U.S. dollar is poised to remain the world’s reserve currency. The American economy, as measured by GDP, is still the world’s largest, our military the most powerful, our financial markets the most important. Maybe if the Chinese Communist Party had not imposed a one-child policy that turned out to be a demographic disaster, this essay would be about China. But the CCP did. And for the foreseeable future, it’s still America that holds the best hand in the global economic and geopolitical poker game.

Full story here Are you the author? Previous post See more for Next postTags: Alhambra Research,currencies,economy,Featured,Markets,newsletter