Monthly Archive: June 2022

Aktien Schweiz Schluss – SMI fällt auf tiefsten Stand seit März 2021

Am Schweizer Aktienmarkt ist es auch am Dienstag weiter abwärts gegangen. Die Angst vor einem Abgleiten der Weltwirtschaft in eine Rezession hatte die Anleger fest im Griff. Niedriger war das Barometer der 20 grössten börsennotierten Unternehmen letztmals im März vergangenen Jahres. Weiterhin litten die Börsen unter einem "Cocktail aus Inflation, steigenden Zinsen und daraus resultierender Rezessionsangst", so ein Marktanalyst.

Read More »

Read More »

Foreign suitors for Credit Suisse face high hurdles

Switzerland’s typically liberal mergers and acquisitions market might make an exception for such a national institution.

Read More »

Read More »

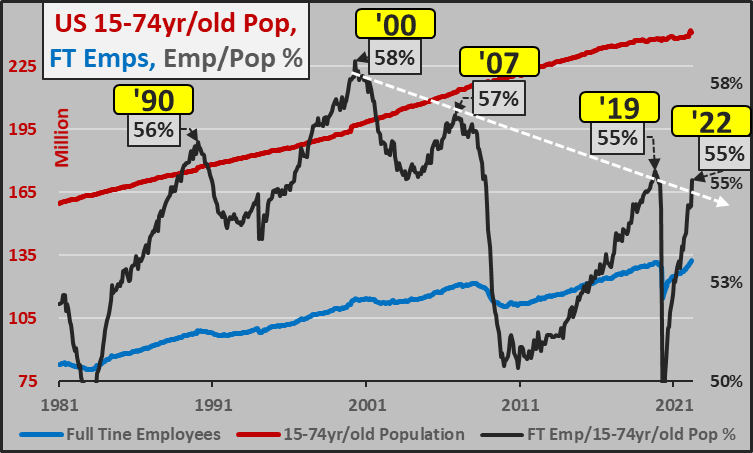

What Happens When the Workforce No Longer Wants to Work?

Workers are voting with their feet, and that's difficult to control. When values and expectations change, everything else eventually changes, too. What happens when the workforce no longer wants to work? We're about to find out. As with all cultural sea changes, macro statistics don't tell the full story.

Read More »

Read More »

US tax authority asks Switzerland for client data from 26 institutions

The US tax authority IRS wants further information from the Swiss authorities on account data at 26 financial institutions. The IRS has made numerous requests for information in the past.

Read More »

Read More »

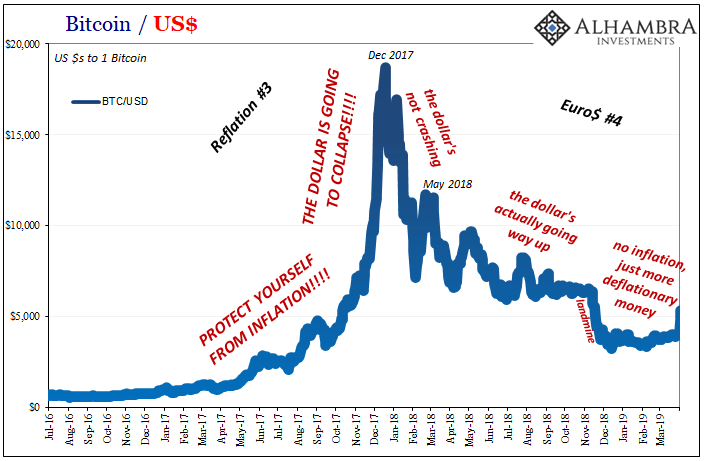

It’s Not Nothing, It’s Everything (including crypto)

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer.

Read More »

Read More »

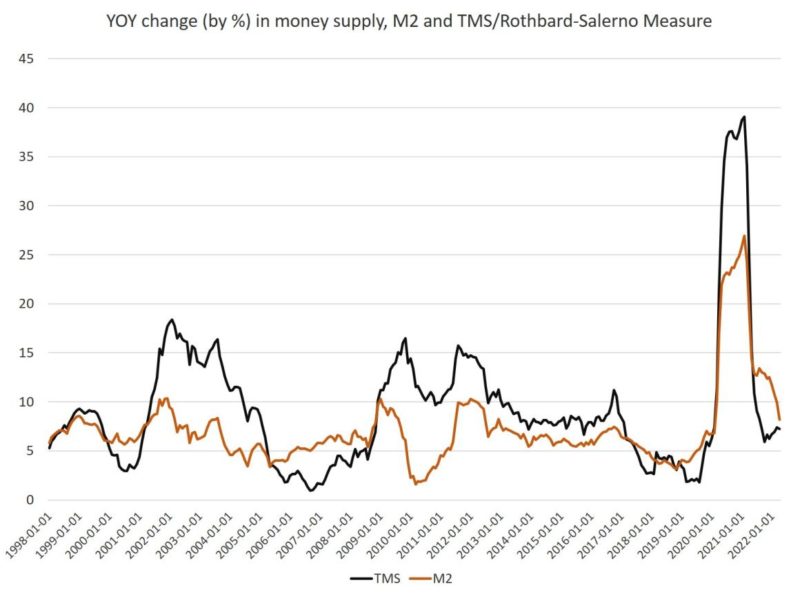

Slowing Money-Supply Growth in 2022 Points to Recession

Money supply growth fell slightly in April, falling below March's eight month high. Even with March's bump in growth, though, money supply growth remains far below the unprecedented highs experienced during much of the past two years.

Read More »

Read More »

Prospects of Aggressive Tightening Sends Shock Waves through the Capital Markets

Overview: The markets' evolving expectations of a more aggressive monetary policy is not limited to the Federal Reserve, where the terminal rate is now straddling the 4% area, around 100 bp above late May levels.

Read More »

Read More »

Markt bricht ein und Binance setzt Auszahlungen mit Bitcoin aus

Der Markt erlebte einen weiteren Einbruch, der den BTC um fast ein Viertel seines Gesamtwertes absacken ließ. Aktuell hält sich Bitcoin nur noch knapp oberhalb von 22.000 US-Dollar. Alle größeren Cryptocoins folgten der Abwärtsbewegung, wodurch eine allgemeine Panik entstand, welche die Gesamtmarktkapitalisierung wieder unter eine Billionen US-Dollar führte. Bitcoin News: Markt bricht ein und Binance setzt Auszahlungen mit Bitcoin ausViele Börsen...

Read More »

Read More »

A crack-up boom in the making

The great Ludwig von Mises first described the concept of a crack-up boom as part of the Austrian business cycle theory, based on real life events that to an unsuspecting bystander might have appeared unconnected, or perhaps even quite bizarre and counterintuitive. Indeed, such a bystander might think the same of today’s economy and would likely have trouble making sense of the picture painted by stock markets, by our monetary and fiscal policies...

Read More »

Read More »

Increase in the number of hours worked in Switzerland in 2021

The total number of hours worked in Switzerland reached 7.798 billion in 2021, representing an increase of 2.5% compared with the previous year. The pre-pandemic level has not yet been regained, however. According to the latest results from the Federal Statistical Office (FSO) and the Statistical Office of the European Union (Eurostat), the volume of work among 20-64 year olds in Switzerland increased slightly more than in the EU.

Read More »

Read More »

Interest Rates Are Rising, but the Fed Continues to Be Reckless

The crushing issue of high inflation caused by central banks can no longer be downplayed. Public displeasure at the increasing currency devaluation has now forced monetary policy makers to act. The US Federal Reserve (Fed) has raised its key interest rate to 1 percentage point.

Read More »

Read More »

Prices As Curative Punishment

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022.

Read More »

Read More »

Market Success Is about Giving People What They Want

Economists are often examining the variables that lead to prosperity, but surprisingly, intelligence is rarely featured in this literature, despite its high replicability in research. Intelligence is a robust predictor of well-being, job performance, and other social outcomes.

Read More »

Read More »

Trafigura posts record half-year profit as commodities volatility intensifies

Geneva-based Trafigura reported record half-year profits as volatility and disruption in commodity markets, exacerbated by the war in Ukraine, supercharged earnings for the world’s biggest traders.

Read More »

Read More »

Dollar Jumps, Stocks and Bonds Slide

The prospect of a more aggressive Federal Reserve policy has spurred a sharp sell-off in global equities and bonds and sent the dollar sharply higher. The large Asia Pacific bourses were off mostly 2%-4%.

Read More »

Read More »

Update The Conflict of Interest Rate(s)

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data.

Read More »

Read More »

Switzerland adopts latest round of EU sanctions against Russia

On 10 June 2022, Switzerland’s government adopted the latest set of EU sanctions against Russia and Belarus, including an embargo on crude oil and certain refined petroleum imports from Russia.

Read More »

Read More »

Tax on airline tickets wins sky-high public support

Almost three-quarters (72%) of respondents to a Swiss survey are in favour of increasing the price of airline tickets for climate reasons.

Read More »

Read More »

The Five Stages of Totalitarianism

Fears of a growing totalitarian tendency in the US have swelled during 2020–22. But how close are we really to a totalitarian state? How have such regimes come about historically and what are the warning signs? This article will answer these questions by examining totalitarian regimes in the eighteenth and twentieth centuries and the pattern by which they came to power.

Read More »

Read More »

Greenback Poised to Challenge May Highs

The firmer than expected US CPI did not change expectations that the Federal Reserve will hike the Fed funds target by 50 bp on June 15. What it did was boost the chances that the 50 bp steps will continue through at least November.

Read More »

Read More »