The Covid-19 pandemic has failed to rattle the Swiss property market. Prices for apartment buildings have hit a record high. But now the war in Ukraine and rising interest rates threaten to turn the tide.

The Covid-19 pandemic has failed to rattle the Swiss property market. Prices for apartment buildings have hit a record high. But now the war in Ukraine and rising interest rates threaten to turn the tide.

The Swiss real estate market recorded a bumper year in 2021. The total return, comprising rental income and value changes on properties, was higher for real estate investors than it had been in seven years. Prices have been heading in just one direction – up – for years, and interest rates are low. This created ideal conditions for those who could afford the high prices and invest in apartments or an apartment building.

But the Russian invasion of Ukraine in late February has turned all forecasts upside down.

“The situation in Ukraine has given us a new baseline,” Donato Scognamiglio, of real estate consultancy IAZIExternal link, said at a media conference in Zurich last month. “Inflation – the risk we didn’t want to look in the eye before – is now here.”

Unscathed by the pandemic

The Swiss real estate market has weathered recent crises well.

“Since 1998 we’ve seen one value appreciation after another,” Scognamiglio said. This is true even for the 2008 financial crisis.

Fritz Zurbrügg, a member of the board at the Swiss National Bank (SNB), said at a lecture in GenevaExternal link in late March: “Unlike in many other countries there was no real estate boom in Switzerland before the global financial crisis, so there was no slump afterwards.”

“Instead, residential property prices have continued to rise steadily since then,” he added.

The Covid crisis did little to change this. The market value of apartment buildings increased by 4.1% in 2021 compared with the previous year, reaching an all-time high.

The situation for the commercial real estate market was more difficult, however. Many retailers in Switzerland struggled with losses after being forced to close temporarily because of pandemic restrictions or people staying home to avoid catching the virus. Yet even commercial properties experienced a 2.7% increase in value in 2021.

How Swiss real estate prices compare

Rising property prices are not unique to Switzerland. Compared with other countries, they are not even increasing particularly fast, as OECD figures show.

According to Zurbrügg, this international trend is the result of scarce real estate supply, increased demand for residential property due to the pandemic, and historically low interest rates in recent years.

Although the Swiss price increase looks moderate by international comparison, property in Switzerland is among the most expensive in the world, even when taking into account the country’s high average disposable income.

Dire warning

Real estate is generally considered to be a safe investment. However, the situation now is one of increased risk.

“Inflation will inevitably be followed by interest rate hikes,” Scognamiglio said. A rise in interest rates could lead to a substantial drop in property values. This would pose a problem, especially for people who have taken out large loans in order to buy property.

And if debtors cannot pay off their mortgages, this is also a risk for the banks, the SNB warns. The Swiss economy, which continues to rely heavily on the banking sector, would be affected. In the current situation, banks are vulnerable to sudden increases in interest rates or a deterioration in the economic situation.

“There are signs of excessive valuations on the stock and real estate markets, and corporate and public debt is high worldwide,” Zurbrügg said.

Housing costs set to increase

Housing will remain expensive not only because of the record-high property prices.

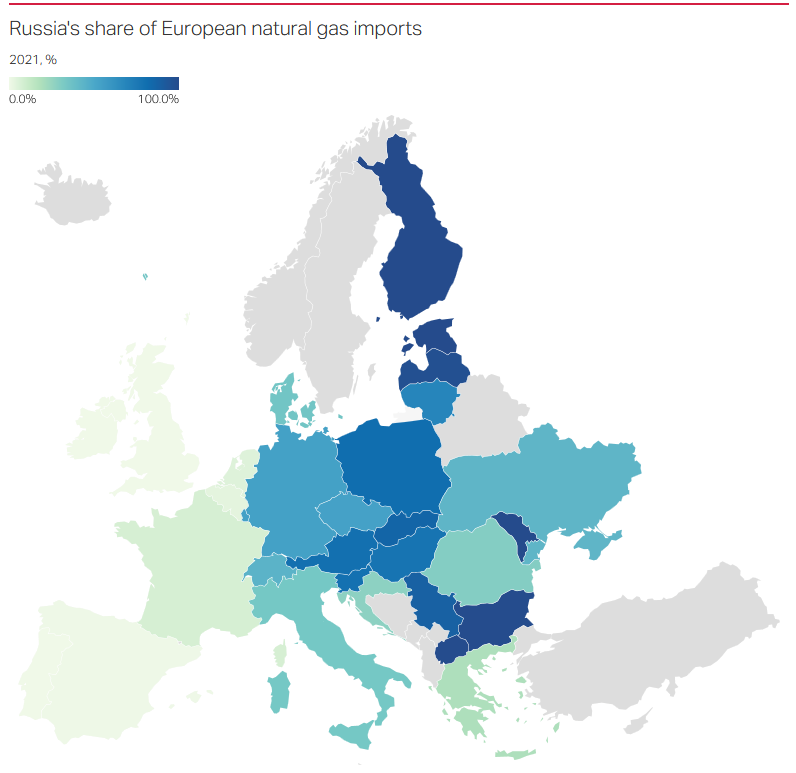

According to the Federal Statistical Office, around 60% of households in Switzerland still heat their homes with oil or gas. The figures are, on average, similar in the European Union. Switzerland, like many European countries, is heavily dependent on Russia for gas. So many Swiss are bound to be affected by rising heating oil and gas prices as a result of the war in Ukraine.

Those looking for a rental apartment will also struggle as a result of the war. As Switzerland is considered an attractive and secure job market, immigration will increase, according to the latest reportExternal link by real estate consultants Wüest Partner. Ukrainian refugees in Switzerland will also need rental accommodation.

Even before the war began, the supply of rental properties had fallen sharply. During the Covid pandemic, people wanted to find more living space as they spent more time at home, including working remotely. The supply of rental apartments has therefore shrunk more in the past 12 months than at any time in the past nine years, according to Wüest Partner.

Translated from German by Julia Bassam

Full story here Are you the author? Previous post See more for Next postTags: Business,Featured,newsletter