Monthly Archive: April 2022

To Fight Russia, Europe’s Regimes Risk Impoverishment and Recession for Europe

European politicians are eager to be seen as "doing something" to oppose the Russian regime following Moscow's invasion of Ukraine. Most European regimes have wisely concluded—Polish and Baltic recklessness notwithstanding—that provoking a military conflict with nuclear-armed Russia is not a good idea.

Read More »

Read More »

Real Wages Fall Again as Inflation Surges and the Fed Plays the Blame Game

Money printing may bring rising wages, but it also brings rising prices for goods and services. And those increases are outpacing the wage increases.

Original Article: "Real Wages Fall Again as Inflation Surges and the Fed Plays the Blame Game"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Energy prices: government considers measures to help households

The Swiss government has set up a working group to examine whether measures are needed to relieve the burden on households caused by rising energy prices.

Read More »

Read More »

Swiss trade unions sound alarm about rising cost of living

Trade unions say middle- and lower-income workers in Switzerland are facing a “shock” in 2022, with wages unable to offset rising inflation and health insurance costs.

Read More »

Read More »

China, Japan, And The Relative Pre-March Euro$ Calm In February

The month of February 2022, the calm before the latest storm. Russians went into Ukraine toward the month’s end, collateral shortage became scarcity, maybe a run right at February’s final day, and then serious escalations all throughout March – right down to pure US Treasury yield curve inversion.Given that setup, it was unsurprising to find Treasury’s February TIC data mostly unremarkable.

Read More »

Read More »

The Nationalities Question

[This article was published in in The Irrepressible Rothbard, available in the Mises Store.]

Upon the collapse of centralizing totalitarian Communism in Eastern Europe and even the Soviet Union, long suppressed ethnic and nationality questions and conflicts have come rapidly to the fore. The crack-up of central control has revealed the hidden but still vibrant "deep structures" of ethnicity and nationality.

To those of us who glory in...

Read More »

Read More »

What’s Your Plan A, B and C?

Nothing unravels quite as dramatically as systems which are presumed to be rock-solid and forever.

Here's the default Bullish case for stocks and the economy: let's call it Plan Zero.

1. The economy and equities can grow forever (a.k.a. infinite growth on a finite planet in a waste-is-growth Landfill Economy)

Read More »

Read More »

Coincub bezeichnet Deutschland als Crypto-freundlichstes Land der Welt

Coincub ist ein Exchange Aggreagator für digitale Assets. Laut Recherche des Unternehmens ist Deutschland das freundlichste Land für die Crypto-Community weltweit. Damit hat Deutschland im ersten Quartal des neuen Jahres Singapur als Nummer 1 abgelöst. Crypto News: Coincub bezeichnet Deutschland als Crypto-freundlichstes Land der WeltInsgesamt wurden 46 Länder auf ihre Crypto-Freundlichkeit hin untersucht. Die dabei durchleuchteten Parameter...

Read More »

Read More »

Easter march through Bern addresses war in Ukraine

The traditional Easter march has taken place in the Swiss capital, Bern. This year the “Walk for Peace” focused on issues including the climate and Russia's invasion of Ukraine.

Read More »

Read More »

Is Switzerland still a safe jurisdiction for precious metals investors?

Over the last two years, we’ve all witnessed state abuses of power and extreme overreaches the likes of which many average citizens had never imagined they’d see in their own lifetimes. This caused a great part of the body politic in many Western nations to revisit their previously held beliefs about what is and isn’t possible for their governments to do and to question whether there really is such a thing as going “too far” or whether anyone in...

Read More »

Read More »

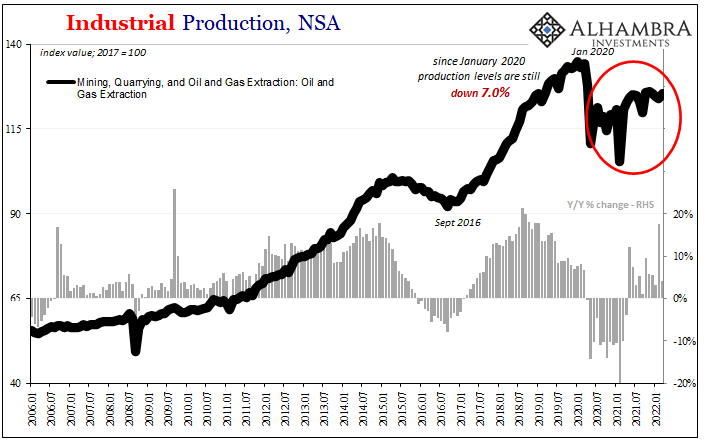

I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Trust the Fed. Ha! It’s one thing for money dealers to look upon Jay Powell’s stash of bank reserves with remarkable disdain, more immediately damning when effects of the same liquidity premiums in the real economy create serious frictions leaving the entire world exposed to the consequences. When all is said and done, the Federal Reserve has created its own doom-loop from which it won’t likely escape.

Read More »

Read More »

Impact of Swiss finance sector on country’s GDP waning

The contribution of Switzerland’s finance industry to the country’s gross domestic product (GDP) has decreased over the past ten years.

Read More »

Read More »

Jon Stewart Asks Great Questions of Federal Reserve Chief

In a recent episode of “The Problem With Jon Stewart,” the former Daily Show host asks former president of the Kansas City Fed Thomas Hoenig why the Fed couldn’t have bailed out homeowners, or just “quantitative ease” away the Treasury’s debt. Hoenig gives muddy answers, so Bob tries to clarify.

Read More »

Read More »

The Yen Bounces after 13-Day Slide and BOJ Defends Yield Cap

Overview: The record-long yen slide has stalled just shy of JPY129.50, even though the Bank of Japan defended its Yield-Curve Control cap on the 10-year bond and will continue to do so for the next four sessions. The greenback fell to almost JPY128 before steadying. China again defied expectations for lower rates (loan prime rate), the yuan's sell-off accelerated and slide to its lowest level since last October.

Read More »

Read More »

The Deferentials

Let’s have a thought experiment. Suppose that North Korean leader Kim Jong-un and Cuban president Miguel Mario Díaz-Canel Bermúdez issued a joint announcement stating that North Korea had accepted an invitation to install some of its nuclear missiles in Cuba. The announcement made it clear that although the missiles could reach any American city, they would be entirely for the defense of Cuba, not for the purpose of attacking the United...

Read More »

Read More »

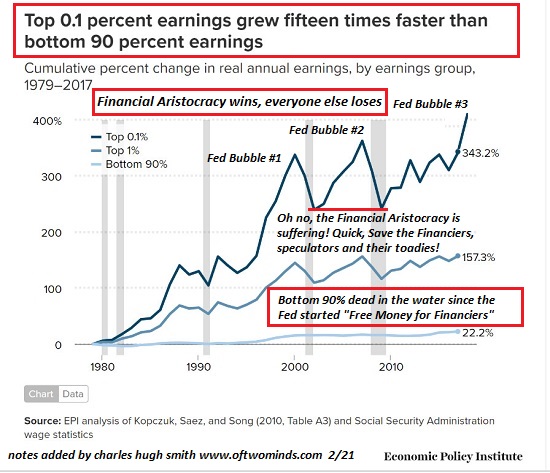

A Couple of Thoughts on Big Numbers

Let's ask "cui bono" of the $33 trillion in added debt and the $9 trillion added to GDP: to whose

benefit?

I've been thinking about how hard it is to get our heads around big numbers.

Read More »

Read More »

Swiss to decide individually on Russian commodity deals

Switzerland will decide case by case whether to curtail traders' purchases from Russia's state-controlled companies under European Union sanctions. The State Secretariat for Economic Affairs (SECO) which is in charge sanctions confirmed the Swiss policy to follow in principle the EU measures, which aim to limit commodity deals to those deemed "strictly necessary" from mid-May.

Read More »

Read More »

Yen Blues

Benchmark 10-year bonds yields in the US and Europe are at new highs for the year. The US yield is approaching 2.90%, while European rates are mostly 5-8 bp higher. The 10-year UK Gilt yield is up nine basis points to push near 1.98%. The higher yields are seeing the yen's losing streak extend, and the greenback has jumped 1% to around JPY128.45 The dollar is trading lower against the other major currencies but the Swiss franc.

Read More »

Read More »

Zahlungen mit Cryptocoins auf Amazon noch weit entfernt

Zurzeit würde wohl nichts die Mass Adoption mehr fördern, als wenn Amazon Zahlungen mit Cryptocoins akzeptierte. Doch Amazons CEO macht der Crypto-Community wenig Hoffnung, wenn es um eine baldige Implementierung von Zahlungen mit Bitcoin und Co. geht. Crypto News: Zahlungen mit Cryptocoins auf Amazon noch weit entferntOffenbar gibt es derzeit keine Pläne, Zahlungen mit Cryptocoins auf Amazon zu akzeptieren. CEO Andy Jessy sprach auf CNBC über den...

Read More »

Read More »

Debt Saturation: Off the Cliff We Go

When the system can't borrow more and distribute the insolvency, it implodes. I started writing about debt saturation back in 2011. The basic idea is we can continue to borrow and spend as long as one of two conditions hold: 1) real (inflation-adjusted) income is rising, so there's more income to service additional debt, or 2) the cost of borrowing declines so the same income can support more debt.

Read More »

Read More »