Monthly Archive: March 2022

ECB Meeting and US and China’s CPI are the Macro Highlights in the Week Ahead

One of the most significant market responses to Russia's attack on Ukraine is in the expectations for the trajectory of monetary policy in many of the high-income countries, including the US, eurozone, UK and Canada. The market has abandoned speculation of a 50 bp hike in mid-March by the FOMC and the Bank of England. It has also scaled back the ECB's move to 20 bp this year from 50 bp.

Read More »

Read More »

Asiatische Börsen schließen Russland aus

Die Sanktionen gegen Russland gehen weiter. Inzwischen schließen sich weltweit Finanzinstitute, Banken und Börsen an. Vier der größten Cryptobörsen Südkoreas haben sich gestern entschieden, russische IP-Adressen zu blocken, zusätzlich wurden bereits 20 Konten eingefroren. Crypto News: Asiatische Börsen schließen Russland ausZu den Börsen gehören Gopax und Upbit, zwei der größten Börsen im ostasiatischen Raum. Und auch in Japan bereiten sich einige...

Read More »

Read More »

China Needs to Pop Its Property Bubble

The financial woes of the giant real estate developer Evergrande, which carries an estimated debt of $300 billion, have rekindled global fears that China’s property bubble is about to burst. Such predictions have occurred repeatedly in the past, in particular since 2010, and have been fueled by the rapid rise of property prices, construction volumes, and real estate debt. Today, many analysts fear that if the property bubble collapses, the impact...

Read More »

Read More »

Switzerland builds business case for non-fungible tokens

NFTs have hit the headlines with spectacular sakes of digital artworks, such as the wildly popular CryptoPunks. Keystone / Obs/4artechnologies

The latest blockchain phenomenon, the non-fungible token (NFT), has generated vast profits for artists and a raft of fraudulent scams. Several Swiss NFT projects have set out to prove that the technology can have a lasting impact beyond the spectacular headlines.

This content was published on March 5,...

Read More »

Read More »

Switzerland simplifies process of employing foreign workers

Companies will no longer have to prove there are no Swiss job candidates in some sectors. Moves to cut red tape for non-EU foreign workers in Switzerland will not necessarily lead to more work visas being issued.

On Friday, the government announced measuresExternal link to make it easier to hire skilled workers from such countries as India, Britain, China and the United States.By making it simpler to award B and L work permits, Switzerland hopes...

Read More »

Read More »

Switzerland triggers wide range of sanctions against Russia

More than a million Ukrainians have fled their country since the Russian invasion.

Switzerland said it is activating sanctions against Russia on Friday, including a ban on many industrial exports and wide-ranging restrictions on financial activities, which includes cutting Russian banks from the SWIFT financial messaging system.

Read More »

Read More »

Capital and Commodity Markets Strain

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia,...

Read More »

Read More »

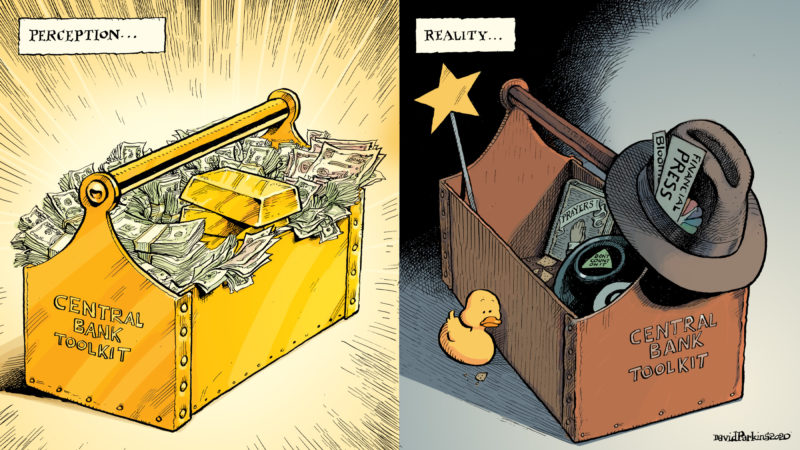

Hiking Rates Into Peak Valuations Is A Mistake

Hiking rates into a wildly overvalued market is potentially a mistake. So says Bank of America in a recent article.

Optimists expecting the stock market to weather the rate-hike cycle as they’ve done in the past are missing one important detail, according to Bank of America Corp.’s strategists.While U.S. equities saw positive returns during previous periods of rate increases, the key risk this time round is that the Federal Reserve will be...

Read More »

Read More »

European Currencies Continue to Bear the Brunt

Overview: Russia's invasion of Ukraine and the global response is a game-changer, as Fed Chair Powell told Congress yesterday. The UK-based research group NISER estimated that world output will be cut by 1% next year or $1 trillion, and global inflation will be boosted by three percentage points this year and two next.

Read More »

Read More »

Ukrainer nutzen Cryptocoins in der aktuellen Krise

Während die Medien weiterhin versuchen, Cryptocoins mit kriminellen Machenschaften in Verbindung zu bringen, zeigt die Krise in der Ukraine, wie Cryptocoins den Bürgern helfen können, sich vor den Folgen eines Krieges zu schützen. Bitcoin News: Ukrainer nutzen Cryptocoins in der aktuellen KriseMit der Auseinandersetzung im Osten der Ukraine wird nun auch der Kollaps des nationalen Bankensystems erwartet. Nicht nur eine Kapitalflucht steht bevor,...

Read More »

Read More »

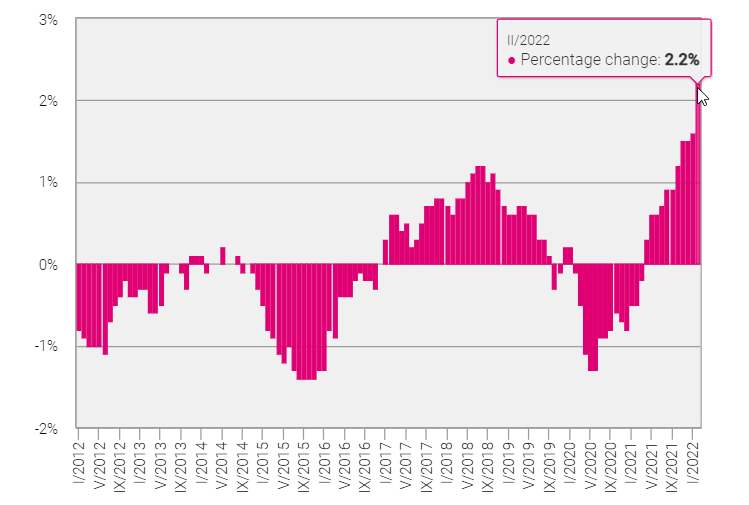

Swiss Inflation Rises to 2.2 percent

The consumer price index (CPI) increased by 0.7% in February 2022 compared with the previous month, reaching 102.4 points (December 2020 = 100). Inflation was +2.2% compared with the same month of the previous year.

Read More »

Read More »

SWIFT Isn’t The ‘Nuclear Option’ For Russia, Because Russia can sell the dollars elsewhere and NOT via Swift

As everyone “knows”, the US dollar is the world’s reserve currency which can only leave the US government in control of it. Participation is both required and at the pleasure of American authorities. If you don’t accept their terms, you risk the death penalty: exile from the privilege of the US dollar’s essential business.From what little most people know about that essential business, it seems like it has something to do with that thing called...

Read More »

Read More »

Israel beschlagnahmt Crypto-Accounts

Die offizielle Begründung lautet, dass die spezifischen Konten mit der Hamas in Verbindung stehen sollen. Insgesamt handelt es sich um 30 Accounts auf 12 unterschiedlichen Crypto-Börsen. Das israelische Finanzministerium schafft damit einen weiteren Präzedenzfall, der weitreichende Folgen haben könnte.

Read More »

Read More »

Sell Energy Stocks? The Time May Be Approaching

“Sell Energy Stocks” Was Originally Published At Marketwatch.com

Sell energy stocks? Such certainly seems counter-intuitive advice given high oil prices, geopolitical stress, and surging inflation. However, some issues suggest this could indeed be the time to “sell high.”

Before we go further, it is essential to state that I am not recommending selling energy stocks in total. As is always the case, portfolio management is...

Read More »

Read More »

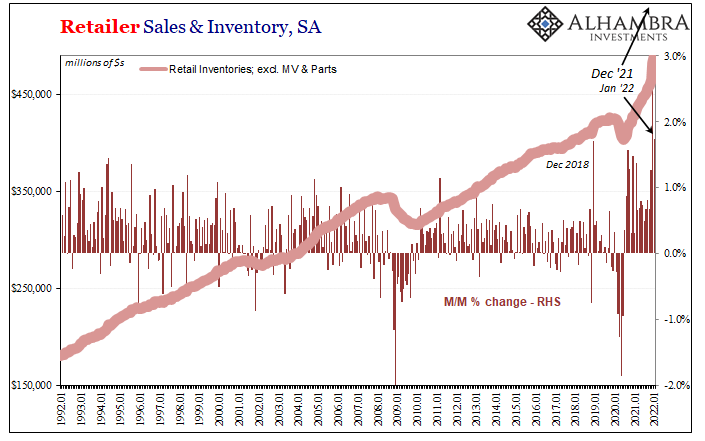

Briefing Even More Inventory

Retail sales stumbled in December, contributing some to the explosion in inventory across the US supply chain – but not all. Inventories were going to spike even if sales had been better. In fact, retail inventories rose at such a record pace beyond anything seen before, had sales been far improved the monthly increase in inventories still would’ve unlike anything in the data series.

Read More »

Read More »

Ukraine’s Regime Is Now Kidnapping Fathers for Military “Service”

As the Ukraine regime has imposed martial law in the wake of the Russia invasion, it has also apparently imposed a new near-universal conscription order. USA Today reports: The Ukraine State Border Guard Service has announced that men ages 18 to 60 are prohibited from leaving the country, according to reports.

Read More »

Read More »

SWIFT Ban: A Game Changer for Russia?

2022-03-04

by Stephen Flood

2022-03-04

Read More »