Monthly Archive: March 2022

USA will Pro-Russland Cryptobörsen sanktionieren

Die finanziellen Sanktionen gegen Russland haben bereits den Devisen- und Rohstoffhandel durchgeschüttelt. Nun haben die USA angekündigt auch den Cryptomarkt zu beobachten und Sanktionen gegen Börsen auszusprechen, die Russland dabei helfen, die Sanktionen zu umgehen. Crypto News: USA will Pro-Russland Cryptobörsen sanktionierenEiner der führenden Finanzminister der USA kündigte gegenüber CNBC an:“We want to make it very clear to cryptocurrency...

Read More »

Read More »

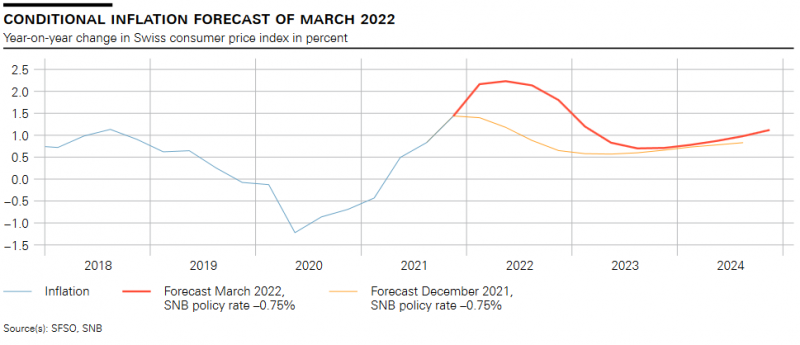

Quarterly Bulletin 1/2022 – Monetary policy report

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of March 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 24 March 2022’) is an excerpt from the press release...

Read More »

Read More »

Will Biden Sanction Half the World to Isolate Russia?

The United States is no longer in any position to remake the world in its image. It's not 1945 or even 1970. Yet the US seems to be gearing up to bully half the world into compliance with the US Russia sanctions.

Read More »

Read More »

Why Saudi Arabia Won’t Abandon Dollars for Yuan

There are numerous articles mentioning that Saudi Arabia may use the yuan, China's domestic currency, for its oil exports. How much does Saudi Arabia export to China? According to the Organisation of Economic Co-operation and Development, the kingdom's main exports are to China ($45.8B), India ($25.1B), Japan ($24.5B), South Korea ($19.5B), and the United States ($12.2B). Exports of crude oil reached $145 billion in total.

Read More »

Read More »

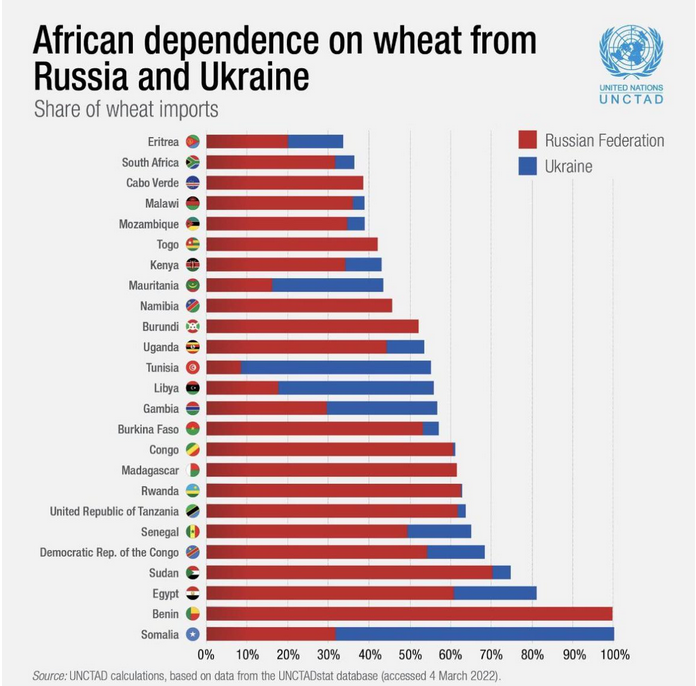

Weekly Market Pulse: The Cure For High Prices

There’s an old Wall Street maxim that the cure for high commodity prices is high commodity prices. As prices rise two things will generally limit the scope of the increase. Demand will wane as consumers just use less or find substitutes. Supply will also increase as the companies that extract these raw materials open new mines, grow more crops or drill new wells.

Read More »

Read More »

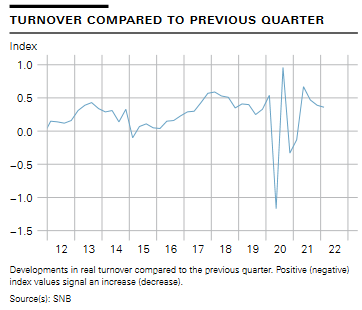

2022-03-30 – 1/2022 – Business cycle signals: SNB regional network

Report submitted to the Governing Board of the Swiss National Bank for its quarterly assessment. The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 241 company talks were conducted between 18 January and 8 March.

Read More »

Read More »

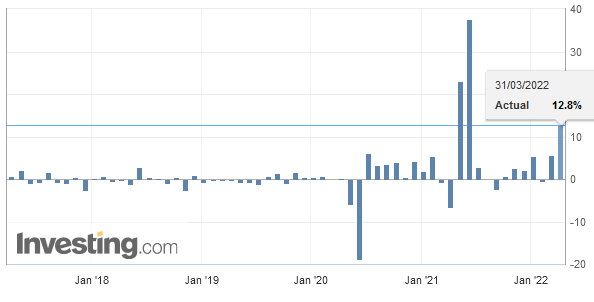

Swiss Retail Sales, February 2022: 13.3 percent Nominal and 12.8 percent Real

31.3.2022 - Turnover adjusted for sales days and holidays rose in the retail sector by 13.3% in nominal terms in February 2022 compared with the previous year. This sharp increase can partly be explained by the low figure for February 2021, when COVID-19 protective measures were reintroduced. Seasonally adjusted, nominal turnover rose by 0.4% compared with the previous month.

Read More »

Read More »

Fritz Zurbrügg: Macroprudential policy beyond the pandemic: Taking stock and looking ahead

In the aftermath of the Global Financial Crisis (GFC), national regulators and international institutions joined forces to build the foundations of our current macroprudential frameworks. These comprise policies aimed at containing the build-up of vulnerabilities to which the banking sector is exposed, and at strengthening banking sector resilience.

Read More »

Read More »

Switzerland to drop all Covid restrictions

On 30 March 2022, Switzerland’s government announced the end of all measures aimed at reducing the spread of the SARS-CoV-2 virus from 1 April 2022. Currently, the only federal measures left are the requirement to wear masks on public transport and in health facilities and the obligation to self-isolate after infection with the disease.

Read More »

Read More »

BOJ Steps-Up its Efforts, US 2-10 Curve steepens, and the Dollar Softens

Overview: A pullback in US yields yesterday and the Bank of Japan's stepped-up efforts to defend the Yield Curve Control policy helped extend the yen's recovery. This spurred profit-taking on Japanese stocks, where the Nikkei had rallied around 11% over the past two weeks.

Read More »

Read More »

Ukraine conflict: A dispassionate analysis

I realize that I shouldn’t be surprised at the way the crisis in Ukraine has divided our societies or at the blind fanaticism the conversations around it have provoked. After all, virtually every other development of consequence has tuned out exactly the same. From covid to the economy and from freedom of speech to science itself, rational, respectful and productive debates are nowhere to be found.

Read More »

Read More »

SNB’s Zurbruegg: It is not roll of monetary policy to cure risks to financial system

Vulnerabilities have increased and Swiss real estate market. Swiss apartments overvalued by 10% to 35%. SNB continues to monitor developments in real estate market. It is not roll of monetary policy to curb risk to financial system. The USDCHF is trading back below its 100 hour moving average at 0.93129 and its 200 hour moving average at 0.93304.

Read More »

Read More »

SNB introduces possibility of repo rate transactions being indexed to policy rate

This will be added to the SNB's monetary policy repertoire moving forward but not before some test operations are conducted. For the time being, the central bank implements monetary policy by setting the SNB policy rate so this just adds to the tools they can play around with. However, I still see the key policy rate as being the main weapon in the armory.

Read More »

Read More »

In 2020, the median wage was CHF 6665

28.03.2022 - For the entire Swiss economy (private and public sectors together), the gross monthly median wage for a full-time job was CHF 6665 in 2020. The gap between the highest and lowest earners in the wage pyramid remained stable overall between 2008 and 2020. The Swiss wage landscape continues to be characterised by major differences between the economic sectors and regions.

Read More »

Read More »

Central Banks Have Broken the True Savings-Lending Relationship

Most people believe lending is associated with money. But there is more to lending. A lender lends savings to a borrower as opposed to "just money." Let us explain. Take a farmer, Joe, who has produced two kilograms of potatoes. For his own consumption, he requires one kilogram, and the rest he agrees to lend for one year to another farmer, Bob. The unconsumed kilogram of potatoes that he agrees to lend is his savings.

Read More »

Read More »

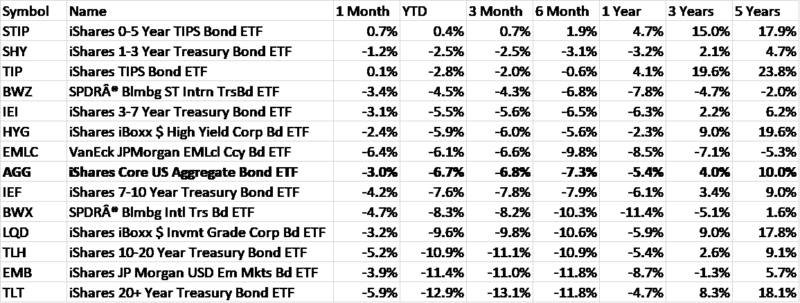

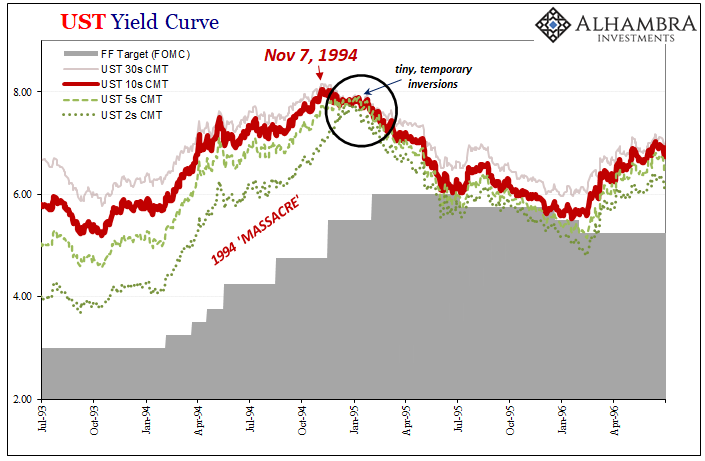

We Can Only Hope For Another (bond) Massacre

To begin with, the economy today is absolutely nothing like it had been almost thirty years ago. That fact in and of itself should end the discussion right here. However, comparisons will be made and it does no harm to review them.I’m talking about 1994, or, more specifically, the eleven months between late February 1994 and early February 1995.

Read More »

Read More »

Calmer Markets: Hope Springs Eternal

Overview: Interest rates continue to rise, but equities are looking through it today and the dollar is drawing less succor. Asia Pacific equities were mostly higher. With half of Shanghai in lockdown, Chinese equities were unable to join the regional advance. Europe's Stoxx 600, led by energy and consumer discretionary sectors, is rising for the third consecutive sessions. US futures have a small upward bias.

Read More »

Read More »

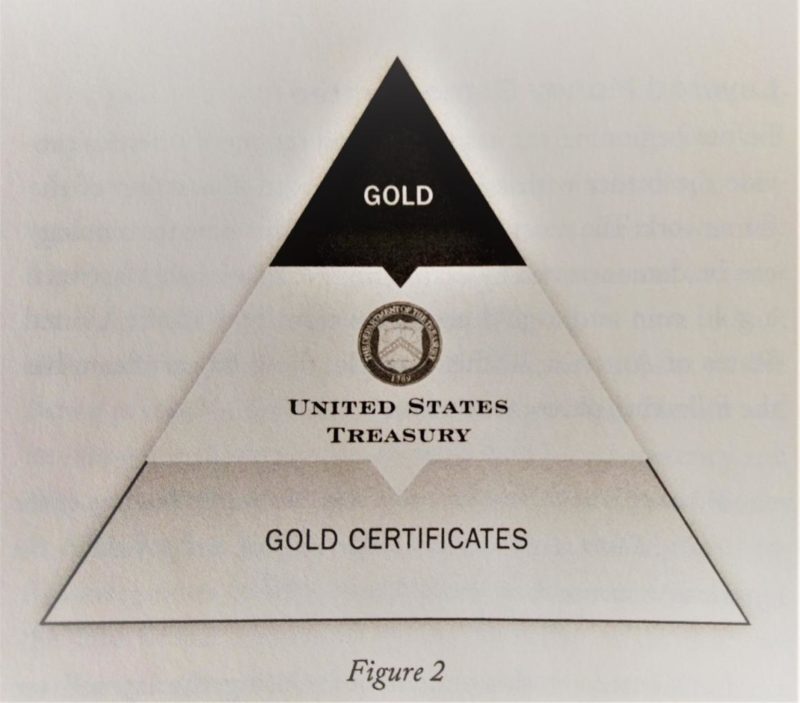

A Review of Nik Bhatia’s Layered Money: From Gold and Dollars to Bitcoin and Central Bank Digital Currencies

For understanding our modern monetary troubles, Nik Bhatia’s pamphlet-sized book from last year hits exactly the right intersection between money and banking, between the past and the future. Clocking in at around 150 pages of easy prose, it’s accessible but not dumbed down, revealing but not inaccurate. It has a simple framework that Bhatia explains and explores with great expertise.

Read More »

Read More »

Will Smith Cryptocoin explodiert nach den Oscars

Am Wochenende fand wieder die alljährlichen Oscarverleihung statt. Doch in diesem Jahr waren es weniger die Preise und vielmehr Will Smith, der einen Comedian auf der Bühne ohrfeigte, der im Mittelpunkt des Medieninteresses stand. Infolgedessen zeigte sich auch die Unberechenbarkeit des Cryptomarktes. Crypto News: Will Smith Cryptocoin explodiert nach den OscarsInnerhalb von 24 Stunden nach dem Oscar-Event explodierte ein Token, der mit dem Namen...

Read More »

Read More »