That the era of stability has ended and a new era of increasingly chaotic volatility has begun is not on anyone’s radar as a possibility.

The standard debate about the future of the economy is: which will we get, high inflation or a deflationary collapse of defaults and asset bubbles popping?

The debate goes round and round in widening circles of complexity as analysts delve into every nuance of the debate.

A recent conversation with my friend A.T. raised a third possibility few seem to consider: increasingly chaotic volatility will be the new normal, as wild swings between inflation and deflation will increase in amplitude and ferocity as the system destabilizes.

Increasingly chaotic volatility is a classic sign of a system that has lost equilibrium and is attempting to regain its dynamic stability by going into overdrive.

The amplitude and violence of these fluctuations increase as each attempt to restore stability fails.

This loss of stability is not what people expect. The experience of the past 60 years has been that any hiccup in financial stability–a recession or market crash–is temporary, as the system responds with monetary and fiscal stimulus which quickly restores the system’s stability.

That the era of stability has ended and a new era of increasingly chaotic volatility has begun is not on anyone’s radar as a possibility.

Human physiology offers a useful analogy: blood glucose homeostasis, which is the system of insulin production and sensitivity that maintains the dynamic stability of glucose in our bloodstream for use as energy.

Insulin is produced as needed after a meal to regulate the level of glucose within the ideal bandwidth of homeostasis, i.e. the range of dynamic stability that optimizes insulin production and glucose levels. (3.5 to 5.5 mmol/L or 70 to 130 mg/dL)

In metabolic disorders, the body’s sensitivity to insulin declines, and in response the body increases the production of insulin to compensate for the decline in sensitivity.

As the disease progresses, sensitivity drops further, forcing the production of insulin into overdrive. Eventually this overdrive degrades the body’s ability to produce insulin and the regulatory system managing glucose levels crashes.

In the economic analogy, the system is responding to the decline of surpluses and efficiencies by pumping ever larger sums of new money into the system as quantitative easing (financial stimulus) and fiscal stimulus (more federal spending funded by borrowing).

Lower interest rates are intended to stimulate more private borrowing, another form of stimulus.

The initial massive dose of financial insulin has created enormous asset bubbles and a frenzied rush to restock inventories depleted during the pandemic.

The conventional media is echoing the Federal Reserve and other authorities who claim the resulting spike of inflation is temporary and will soon fade. Other analysts fear the scarcities are not transitory, as they reflect depletion of real-world resources that cannot be overcome by injecting more insulin (money) into the system.

Meanwhile, other analysts are looking at the skyrocketing leverage in the system, where million-dollar speculative bets are leveraged into billion-dollar bets that cascade into crashes and defaults when the bets go bad.

Leverage is difficult to assess as much of it is in the shadow / off-balance-sheet banking system, where exotic financial instruments are buried deep in footnotes and even experts have trouble unraveling the complex bets embedded in CDOs and various multi-party swaps.

So we have all the necessary ingredient for both inflation and asset-debt deflation, and this is the backdrop for the binary debate of inflation or deflation.

But perhaps the future is not one or the other, but a rapidly destabilizing system that will become increasingly prone to semi-chaotic swings of ever greater amplitude as regulatory agencies (central banks and Treasuries) attempt to flood the system with enough insulin to restabilize debt / leverage / asset prices that are increasingly desensitized to conventional stimulus.

As each new flood of stimulus pushes debt, leverage and assets higher, it further desensitizes the system, setting the stage for yet another collapse of speculative leverage, which then prompts an even larger flood of monetary insulin, which then triggers an even more dramatic crash when then causes an even large dose of monetary insulin, and so on until the system crashes.

Eventually the monetary insulin has none of the desired effects, and the mechanisms for producing more insulin (money) break down as well.

In other words, both critical mechanisms break down: the economy no longer responds to new injections of stimulus and the issuance of money no longer functions as desired.

As the financial system loses stability, injecting more monetary insulin only pushes the system further into chaotic volatility.

For three generations, the Warren Buffett investment strategy worked wonderfully: just buy Coca-Cola etc. and never sell. We see this same mindset in the never sell crypto, diamond hands of the current speculative mania.

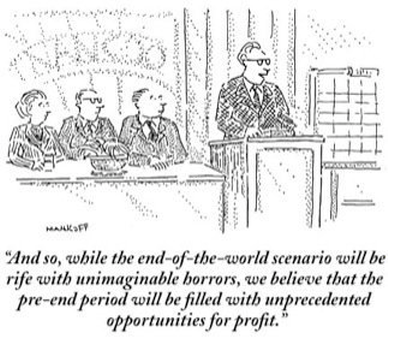

If the financial system loses stability, this buy-and-hold strategy will fail. The winners in increasingly chaotic volatility will be those who no longer see any value in the inflation-deflation debate and no longer expect one or the other–or a return to stability. It won’t be that simple or that easy.

Tags: Featured,newsletter