Does Bitcoin Fix Defi (Definancialization)?

“Bitcoin fixes this.” I cringe every time I see this popular meme. I find it worse than nails on a chalkboard. Bitcoin and other cryptocurrencies (crypto) supporters seem to wheel this tired trope out for every problem they see, particularly at economic ones. To their credit, they genuinely want to fix the financial system’s problems. I do too! However, crypto’s supporters have their subjects completely reversed.

To be sure, our modern-day financial system has problems. It’s plagued by “Too Big to Fail”, embarrassingly slow innovation, poor user experiences, and recurrent cronyism (real and perceived). Like the crypto-crowd, I see centralization as the root cause. We agree: decentralization is the only cure. We need to decentralize finance (DeFi).

To be sure, our modern-day financial system has problems. It’s plagued by “Too Big to Fail”, embarrassingly slow innovation, poor user experiences, and recurrent cronyism (real and perceived). Like the crypto-crowd, I see centralization as the root cause. We agree: decentralization is the only cure. We need to decentralize finance (DeFi).

Yet, I see crypto as a sideshow. It’s a distraction from the main event—truly decentralizing the financial system. While these innovative tools are worthy of admiration, crypto simply doesn’t address the root causes; and quite frankly, it can’t. Thus, from an investment perspective, I’m cautious when it comes to crypto (at least from a fundamental thesis). Crypto’s best chance for utility is in a decentralized financial system, not the other way around.

Why Decentralization

Decentralized systems are more stable than centralized ones. This broad principle applies to all situations from investment portfolios, to supply chains, to insect colonies. Decentralization ensures that risks don’t concentrate such that a single failure point can bring the whole system down. Centralization breeds instability and fragility. This is all too evident in our financial system.

Unfortunately, there are several modern-day examples of centralized risks threatening entire economies. “Too Big to Fail” banks in 2008 and Long-Term Capital Management’s epic collapse in 1998 are notable ones. Here, the failure of, literally, a handful of institutions endangered the entire economy. How could this possibly be? The global economy is enormous. That we all were thrust into a no-win situation—to foot the bill for these actors’ mistakes or suffer hefty consequences by no fault of our own—is as astonishing as it is unjust. Yet it happened and centralization is to blame.

Decentralized And “Free” Banking

What if there were no banking laws? Would bankers ignore all risks and treat their capital like unconstrained madmen? Of course, they wouldn’t. Those who did would not be in business for long (there are always outliers). History confirms this unpopular view.

Freed from codified capital requirements, banks would create a whole host of different risk management strategies. They would because it’s a business necessity. There is no greater regulator than the market. To be sure, a range of efficacies would emerge with some banks proving safer than others. This diversity, though, would prove protective. It dampens the threat of systemic failure due to anyone bank’s action. The wisdom of crowds protects us all by localizing the damage of mistakes.

In my view, crypto’s biggest promise is to help decentralize financial services—a.k.a. DeFi. DeFi is the practical solution for the centralized financial system’s failures. However, we don’t need crypto to decentralize banking and finance. So-called “free banking” is hardly novel.

ree banking existed to various degrees throughout history, most notably in Scotland, Canada, and the antebellum period in the U.S. During these periods, banks were lightly regulated and issued private notes that were convertible into gold. These notes widely circulated and acted as currency. While far from perfect, the financial system’s stability in these periods compares favorably to our current ones based on central banks. This is due to decentralization.

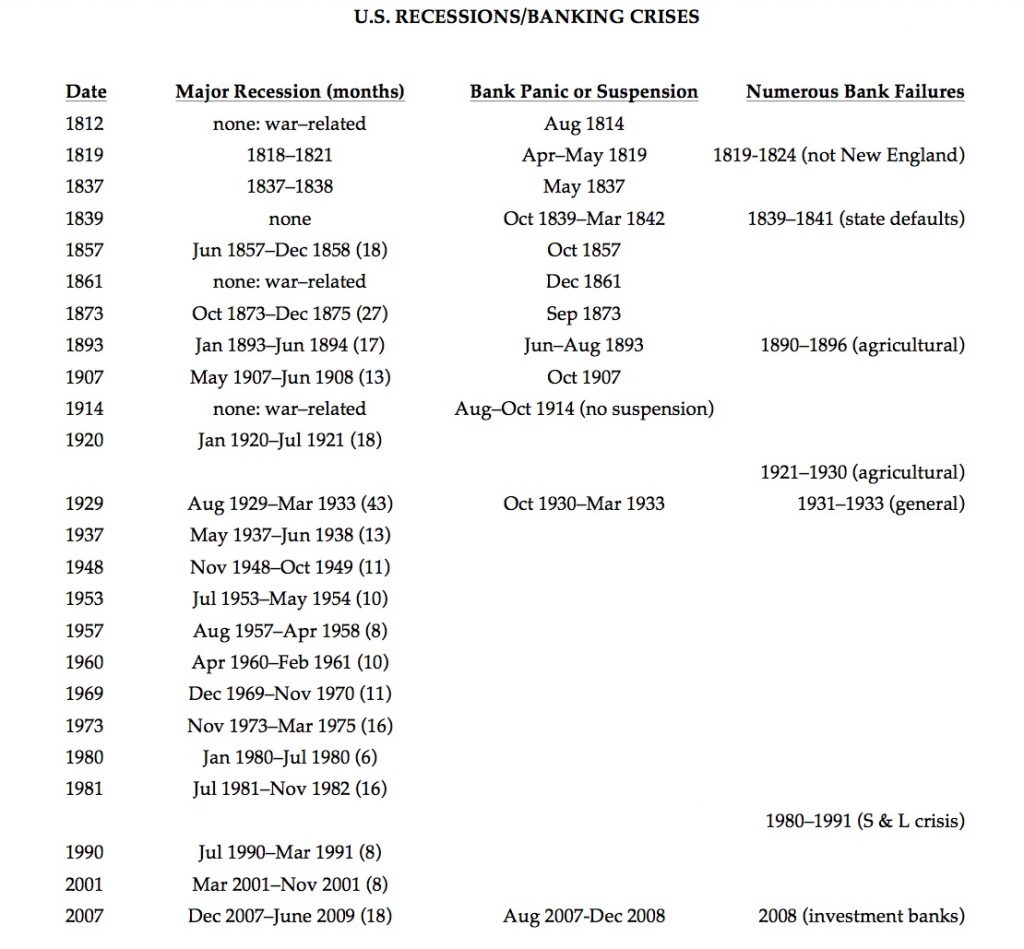

“A tally of recessions, bank panics, and bank failures reveal that “[the] widespread belief among economists, historians, and journalists that the Federal Reserve [created in 1914] was an essential, major improvement appears to be no more than unreflective faith in government economic management, with little foundation in the historical evidence.”

Source: Alt-m.org

Before Crypto, There Were Shadow Banks

The financial system’s fragility is an unnecessary and terrifying risk, in my view. Thus, I absolutely love that crypto’s mission is DeFi. Bitcoin and other cryptocurrencies are essentially workarounds to archaic laws and financial regulations that prevent innovation, competition, and, ultimately, concentrate systemic risks. However, in these regards, crypto is not unique.

There is already a large and burgeoning industry busy working around regulations to increase efficiency in finance. It’s callously known as the shadow banking or Eurodollar system. The shadow banking system is a network of interconnected financial services companies spanning the globe. It operates in the “shadows” (i.e. favorable offshore jurisdictions) to escape regulatory scrutiny and oversight; hence its moniker. In essence, shadow banking is an attempt at DeFi. While it gets a bad rap, particularly due to its role in the GFC, the shadow banks have been quite effective at improving the industry’s performance.

Note though, that when the shadow banking system failed in the GFC it was around common points of centralization. Capital efficiency is the name of the game when it comes to financial services. However, there’s only so much wiggle room to circumvent capital requirement rules. Thus, the shadow banks naturally piled into similar assets as they sought to optimize for these regulatory constraints. Unfortunately, the regulations proved dangerous. The NSROs were very wrong about home prices and the safety of the assets they backed. The result was system collapse around this common vulnerability that regulations created.

Shadow Banking Isn’t Perfect

While the shadow banking system is crafty, it is not perfect. In my view, it wouldn’t exist in a lightly regulated regime. Maintaining this complex patchwork of interconnected entities around the globe requires lots of expertise and skill. Said differently, it’s expensive. Simplifying the landscape removes the need for these workarounds that only add complexity, opacity, and cost to an already intricate industry. Thus, liberalizing banking is the only way to eliminate the shadow banks; it’s the only way to remove their utility. It’s also the only way to create DeFi.

In my view, it’s folly to think crypto is a DeFi gamechanger. Rather, I see it as merely an evolution in the perpetual “cat and mouse game” played between productive financiers and overbearing regulators. Is there really a fundamental difference between shadow banks and decentralized tokens? Both exist to evade jurisdictional roadblocks to efficiency, innovation, and progress. Instead, crypto seems like a new tool to be used towards DeFi’s end.

The post Seth Levine: Bitcoin Doesn’t Fix Defi, Defi Fixes Bitcoin appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,Investing,newsletter