|

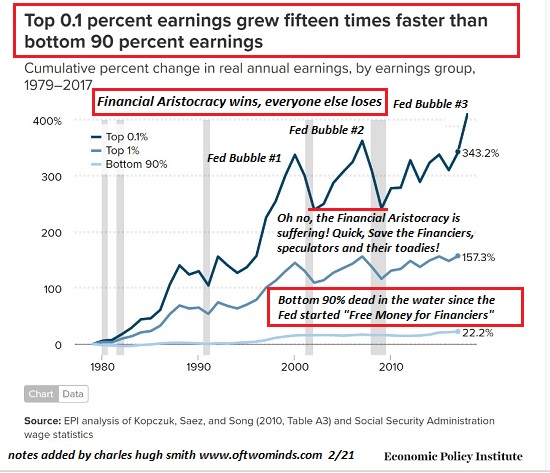

The Fed’s casino isn’t just rigged; it’s criminally unstable. The decay of America’s middle class has been well documented and many commentators have explored the causal factors. The bottom line is that this decay isn’t random; the income of the middle class isn’t going to suddenly increase at 15 times the growth rate of the income of the top 0.1%. (see chart below) The income of the top 0.1% grew 15 times faster than the incomes of the bottom 90% because that’s the only possible output of America’s distorted financial system. The same can be said of the rising asymmetry of wealth: the top 10% own 2.5 more wealth than the middle class (51% to 90%) and 34 times the wealth of the bottom 50% as a result of the asymmetric structure of our financial system. |

|

| In a truly market economy, risk avoidance is rational as risk can wipe you out.

In a financial system rigged to reward the biggest and most aggressive speculators, risk avoidance is irrational because all the gains generated by the economy go to the biggest and most aggressive speculators rather than to the most productive workers or enterprises. The Federal Reserve has stripmined savers and the risk-averse to funnel all the gains to its predatory, parasitic cronies–Wall Street banks, financiers and global corporations, turning rational risk aversion on its head: it’s now rational to gamble in the rigged casino, as that’s the only avenue left to protect one’s stake. |

|

| For 12 long years, savers have been eviscerated while gamblers have been ceaselessly backstopped and bailed out by the Fed. In the Fed’s rigged casino, it’s not only rational to make high-risk bets, it’s rational to borrow as much money as you can to increase your stake and leverage your bets–because the Fed has our backs and so every wager on markets lofting higher will pay off.

It’s crazy not to max out credit and leverage because the Fed has guaranteed every punter will be a winner. I explained the feedback loop this creates–the more the Fed guarantees markets will never be allowed to decline, the greater the incentives to borrow and leverage ever riskier bets in the Fed’s casino–in my post The “Helicopter Parent” Fed and the Fatal Crash of Risk. |

|

| The middle class has finally surrendered the last of its rational risk-aversion and gone all-in on bets in the Fed’s rigged casino. Big players don’t use margin accounts in brokerages; they have immense lines of credit and tools to leverage their bets. It’s the so-called retail traders who use margin, and so the unprecedented highs in margin debt are evidence that the middle class has gone all-in on bets markets will only loft higher forever. (see chart below)

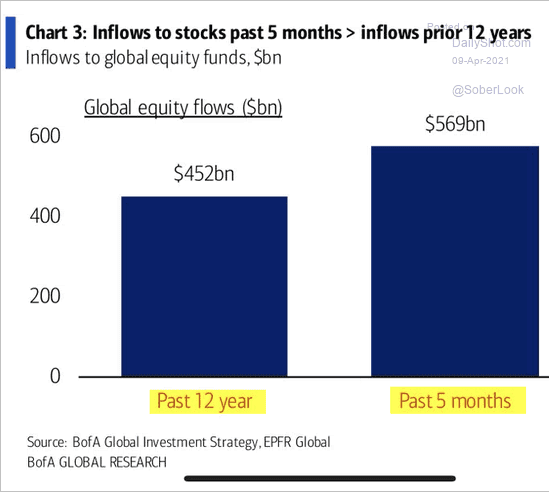

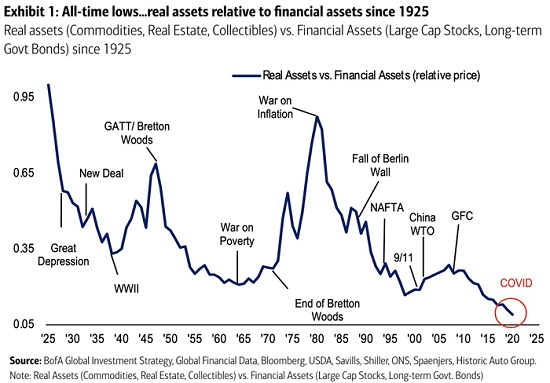

Record inflows into equities adds more evidence that the middle class has been suckered into the Fed’s rigged casino. (see chart below) Why lose money every day in savings and money market accounts when newbie punters are raking in $250,000 a month playing options on Gamestop? Alas, the majority of this “wealth” is phantom, as revealed by the chart of tangible (real) / intangible (financial) assets. The Fed’s casino prints trillions of dollars and gives them to the biggest gamblers for free, and so the artificial semblance of free money for everyone who gambles is compelling. |

|

| Unfortunately, the Fed’s casino is only rigged to benefit the Fed’s cronies. Everyone else is suckered in to lose whatever they have. The Fed’s cronies have been impatiently waiting for the suckers to surrender their rational risk aversion and flood into the rigged casino to share in the Fed’s limitless wealth machine: the more you risk, the more you win!

But the wealth is illusory. The Fed can create currency out of thin air and give it to its predatory, parasitic cronies, but this isn’t real wealth. Real wealth has to be generated by work and investing in productive assets. The Fed’s casino isn’t just rigged; it’s criminally unstable. Once the phantom wealth evaporates and returns from whence it came (i.e. thin air), the unfairness of the Fed’s financial system will trigger a |

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter