| “People aren’t investing, they’re just chasing.”

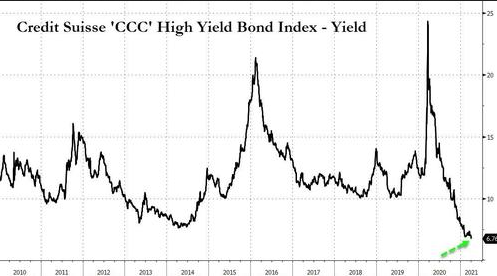

That is the ominous, ponzi-like warning from Adam Cohen, Caspian Capital’s managing partner as the distressed debt investor has chosen to return some money to investors because the rewards don’t justify the high risks anymore. He is not wrong as it’s party time for zombie companies everywhere as “high yield” is now officially “low yield.” “People aren’t investing, they’re just chasing.” That is the ominous, ponzi-like warning from Adam Cohen, Caspian Capital’s managing partner as the distressed debt investor has chosen to return some money to investors because the rewards don’t justify the high risks anymore. He is not wrong as it’s party time for zombie companies everywhere as “high yield” is now officially “low yield.” |

|

| While this avalanche of junk is great news for zombie corporations which will be able to obtain cheap access to cash, allowing them to continue their cash burning, deflationary existence for another year or two, it’s an ominous sign for the bond investors buying paper at the absolute top of the market because even the smallest hiccup would send yields soaring.

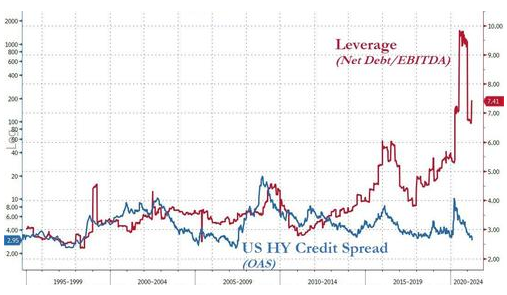

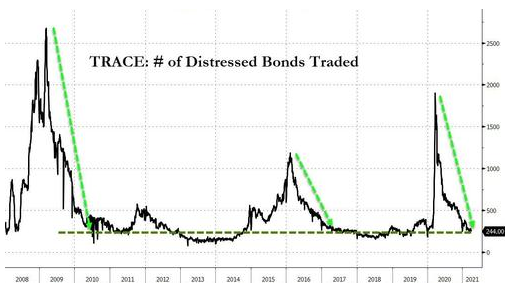

And, while the party can and will go on as long as there are greater fools, one look at the fundamentals… … confirms that the party will only last as long as central banks keep injecting hundreds of billions into the market each and every month. All leaving, as Bloomberg puts it, too many larger firms chasing the few big situations that are left. Distressed-debt specialists – who at one point last year had $131 billion to spend – rummaging for increasingly elusive bargains.

And as The Fed has killed the US distressed debt business once again… |

|

| …investors have been forced to get creative.

As Bloomberg reports, Arena Investors is picking through convertible bonds and real estate loans cast off by banks. And giants of the business like Oaktree Capital Management are rustling around in Asia for opportunities. Fund managers like Olympus Peak are also looking at companies that are too small to tap into the seemingly limitless bond and equity markets, which were supercharged last year by the unprecedented wave of federal stimulus. All of which come with even more risks – including the highest levels of illiquidity – prompting Caspian’s Cohen to warn: “Money always burns a hole in your pocket. The best thing you can do now is not make a mistake. That can save you a lot more money than mediocre trades can make you.” |

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,newsletter