Monthly Archive: February 2021

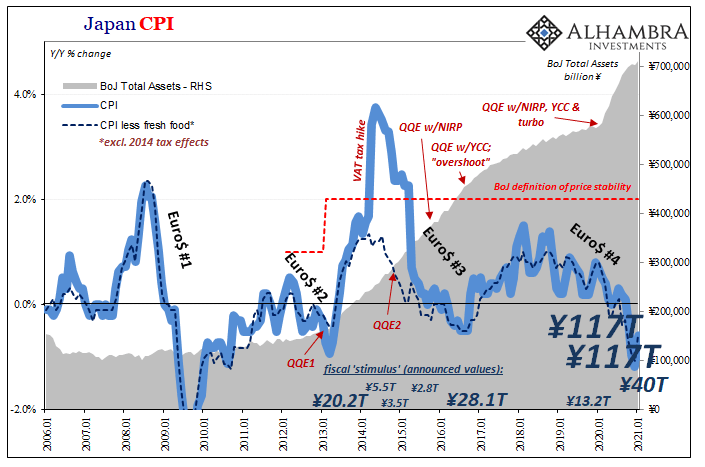

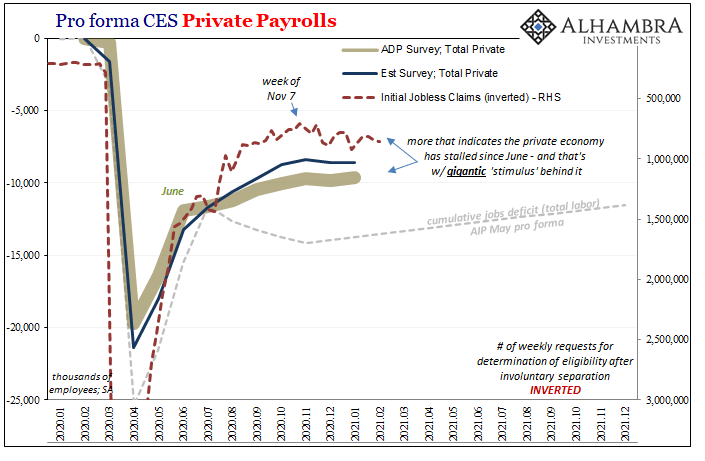

Nine Percent of GDP Fiscal, Ha! Try Forty

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt.

Read More »

Read More »

FX Daily, February 24: Equities Try to Stabilize and Low Short-Term Rates Help Keep the Dollar on the Defensive

Overview: The sharp recovery in US shares yesterday that saw the S&P 500 snap a five-day slide failed to carry into Asia Pacific trading earlier today. All the markets fell save India and Singapore. Losses were led by a 3% drop in Hong Kong as the first increase in the stamp duty (financial transaction tax) since 1993 was announced (0.13% from 0.10%).

Read More »

Read More »

The Death Of Logic

Authored by Matthew Piepenburg via GoldSwitzerland.com,Just over four years ago, as Bitcoin was making its first big moves in both price and public perception, John Hussman of Hussman Investment Trust penned a lengthy as well as seminal report entitled, “Three Delusions: Paper Wealth, a Booming Economy, and Bitcoin.

Read More »

Read More »

Devisen – Euro kostet erstmals seit Ende 2019 mehr als 1,10 Franken

Dieses Niveau hatte es letztmals Ende 2019 gegeben. Auch der US-Dollar hat in den letzten Wochen weiter Boden gut gemacht und nähert sich mittlerweile der 0,91er Marke an. Der Franken habe derzeit keinen leichten Stand bei den Anlegern, hiess es am Markt.

Read More »

Read More »

Socialist America?

The idea of socialism is still alive and well in 2021. Looking at the progressives on the fringes of the Democratic Party – the likes of Bernie Sanders and Elizabeth Warren, one might think they are the real culprits keeping the idea alive. Yet, just looking at the 2020 Democratic Party presidential debates, we can see just how alive socialism truly is.

Read More »

Read More »

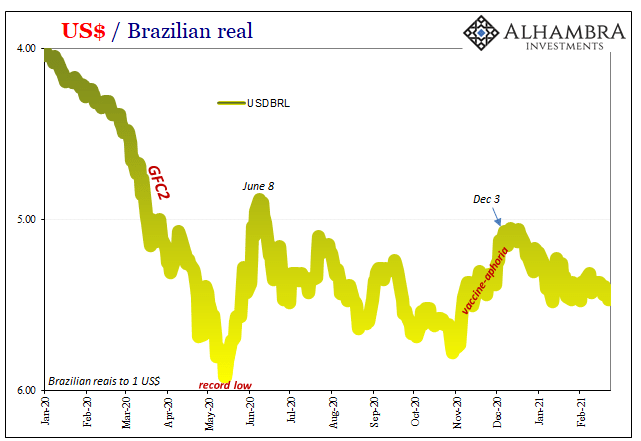

For The Dollar, Not How Much But How Long Therefore How Familiar

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal...

Read More »

Read More »

Just Leave Cuba Alone

Unfortunately, Joe Biden is your prime example of a standard Washington, D.C., politician. As such, as president he will just accept the status quo, defer to the national-security establishment, and do his best to make the welfare-warfare state function efficiently.

Read More »

Read More »

Swiss tourism boss says ski resort openings have been justified

The head of the Switzerland Tourism organisation reckons the decision to open ski resorts in the country this winter has – so far – proven to be a good one.

Read More »

Read More »

FX Daily, February 23: Dramatic Market Adjustment Continues

Overview: Rising rates continue to spur a rotation and retreat in stocks. Yesterday the NASDAQ sold-off by nearly 2.5% while the Dow Industrials eked out a minor gain. Equities are mostly higher in the Asia Pacific region while Japanese markets were on holiday.

Read More »

Read More »

Pandemic pushes Swiss away from cash

Cash has lost its appeal among the Swiss population as the coronavirus pandemic led more people to pay by bank card, mobile app or online, a recent survey has found.

Read More »

Read More »

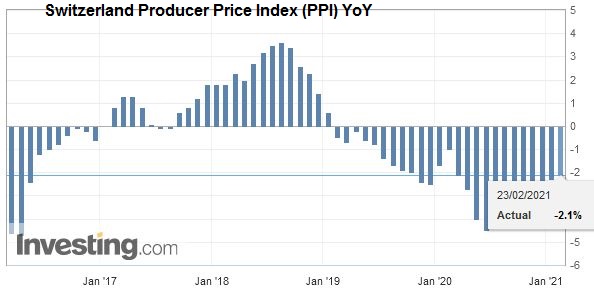

Swiss Producer and Import Price Index in January 2021: -2.1 percent YoY, +0.3 percent MoM

23.02.2021 - The Producer and Import Price Index rose in January 2021 by 0.3% compared with the previous month, reaching 100.3 points (December 2020 = 100). The rise is due in particular to higher prices for scrap, petroleum products, as well as for basic metals and semi-finished metal products. Compared with January 2020, the price level of the whole range of domestic and imported products fell by 2.1%.

Read More »

Read More »

The Drive for State and Federal Protective Tariffs in Early America

Every depression generates a clamor among many groups for special privileges at the expense of the rest of society—and the American depression that struck in 1784–1785 was no exception. If excess imports were the culprit, then voluntary economizing could help matters, and the press was filled with silly fulminations against ladies wearing imported finery.

Read More »

Read More »

“Weapons of Mass Destruction”: The Last Refuge of the Global Interventionist

The threat of “nuclear proliferation” remains one of the great catch-all reasons—the other being “humanitarian” intervention—given for why the US regime and its allies ought to be given unlimited power to invade foreign states and impose sanctions at any given time.

Read More »

Read More »

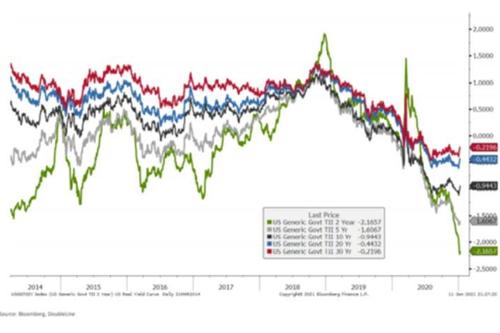

What Might Be In *Another* Market-based Yield Curve Twist?

With the UST yield curve currently undergoing its own market-based twist, it’s worth investigating a couple potential reasons for it. On the one hand, the long end, clear cut reflation: markets are not, as is commonly told right now, pricing 1979 Great Inflation #2, rather how the next few years may not be as bad (deflationary) as once thought a few months ago.

Read More »

Read More »

FX Daily, February 22: Stocks Wilt under Pressure from Rising Yields

Higher interest rates, driven by inflation expectations, is forcing an adjustment to equity markets. The S&P 500 is poised to gap lower today following slides in the Asia Pacific region and Europe. Japanese and Taiwanese indices advanced by steep losses were seen in China, Hong Kong, and India.

Read More »

Read More »

God, Bitcoin, and Asymmetric Bets

Blaise Pascal was a brilliant mathematician, inventor of the calculating machine, and pioneer of probabilistic theory during the 17th century. His philosophical works were published posthumously under the title of Pensées.

Read More »

Read More »

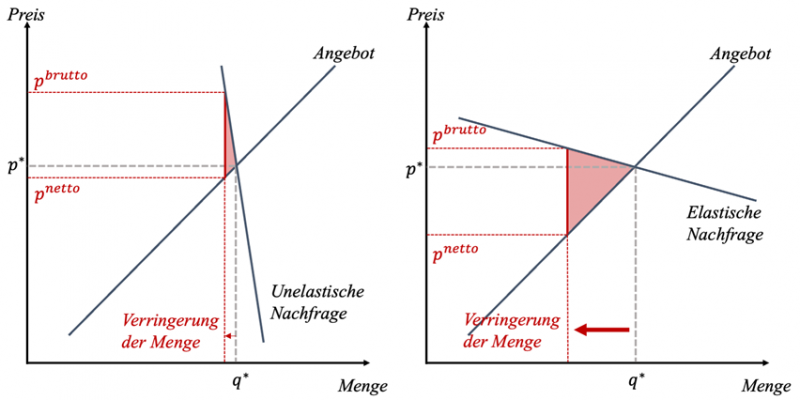

Der Wohlfahrtsverlust durch Besteuerung

Alle Studenten der Wirtschaftswissenschaften werden früher oder später mit der neoklassischen Standardanalyse des Wohlfahrtsverlusts durch Besteuerung konfrontiert. Dabei geht es nicht um die Klärung der Frage, wozu man die Steuereinnahmen des Staates verwenden sollte, sondern vielmehr darum, wie und wo der Staat besteuern sollte, damit es zu möglichst geringen Verzerrungen im Marktgefüge kommt – gewissermaßen so, dass es am wenigsten wehtut.

Read More »

Read More »

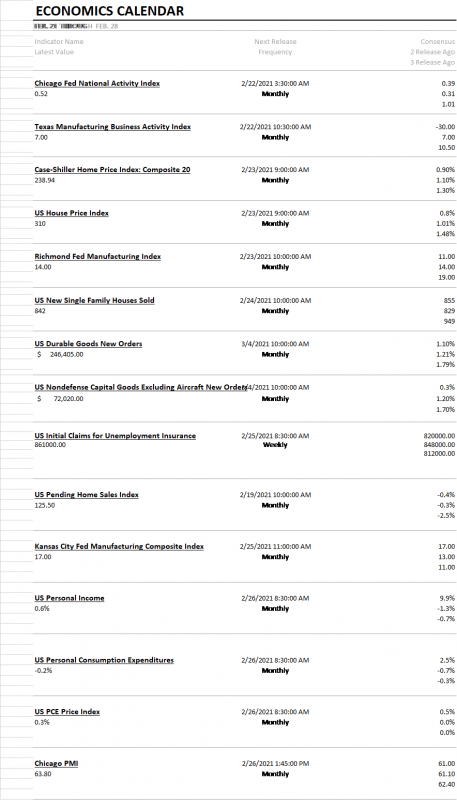

Weekly Market Pulse – Real Rates Finally Make A Move

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery.

Read More »

Read More »

Some Swiss cantons call for earlier restaurant re-openings

Several cantons have called for restaurants to be re-opened a month earlier than the official nationwide plan presented by the government earlier this week.

Read More »

Read More »

Switzerland’s record breaking deficit in 2020

Switzerland’s federal accounts ended 2020 with a record-breaking deficit of CHF 15.8 billion. The deficit was caused by the pandemic.

Read More »

Read More »