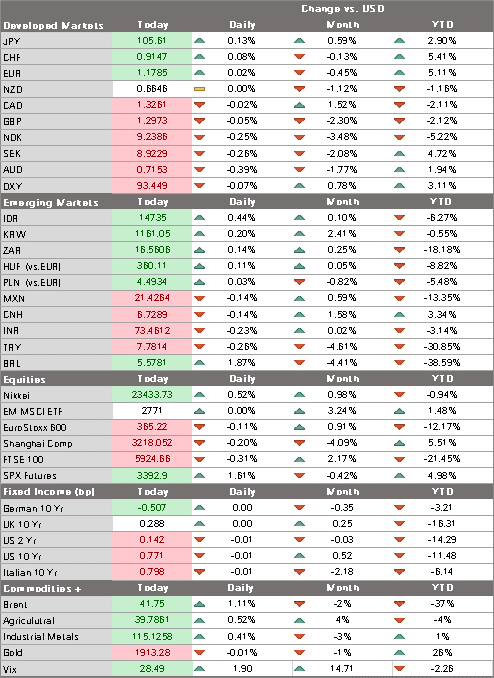

- The dollar remains under pressure; the US curve continues to steepen; a compromise on fiscal stimulus before the election still seems unlikely; this is another quiet day in terms of US data

- President Lagarde said the ECB is prepared to inject fresh monetary stimulus to support the recovery; we expect the ECB to increase its PEPP in Q4

- German factory orders came in much stronger than expected; Russia reports September CPI

- RBA delivered a dovish hold; the Australian government released an aggressive budget; Indian government appointed three new external members to the RBI’s MPC

The dollar remains under pressure. DXY broke below the 93.51 area Monday, which sets up a test of the September 21 low near 92.749. Similarly, the euro has broken above the $1.1775 area, which sets up a test of its September 21 high near $1.1870. Looking further out, a break above the $1.18 area would set up a test of the September 10 high near $1.1915 while a break above the $1.1860 area would set up a test of the September 1 cycle high near $1.2010. We believe the dollar is likely to remain soft, saddled by a slowing recovery and lack of fiscal stimulus as well as ongoing political uncertainty that feeds into policy paralysis.

| AMERICAS

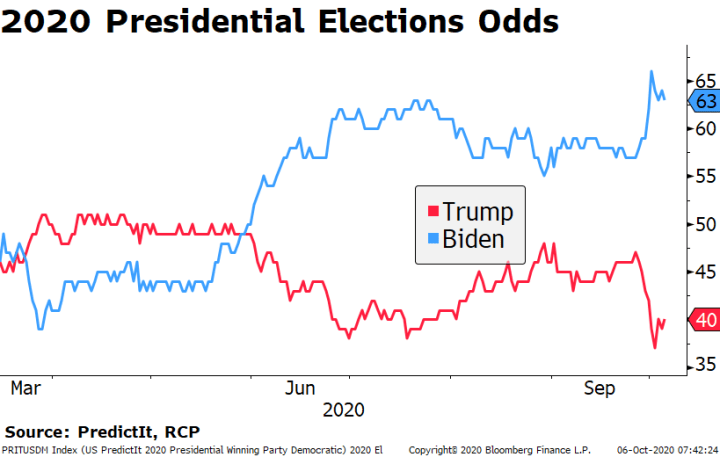

Official communication from the White House suggest President Trump’s health is improving. In fact, he intends to participate in the October 15 debate if doctors approve. The latest polls continue to show a post-debate bounce for Biden, consolidating his lead. According to analysts at FiveThiryEight, for example, Biden’s average national poll advantage increased by 1 percentage point to 8.1 points following the debate. Polls released since Trump’s Covid diagnosis don’t show a meaningful sympathy bounce, at least not yet. Betting odds for Biden have come off from recent highs but are still holding above 60%. The US curve continues to steepen. The 10-year yield of 78 bp yesterday was the highest since August 28. It has since eased to 77 bp today but a break above that level would set up a test of the June 5 high near 96 bp. The 30-year yield is leading the move, as it has already broken above its August 28 high near 1.57% to trade at 1.59% and is on track to test its June 5 high near 1.76%. As noted previously, this fits in with our view that markets are pricing in greater odds of a Democratic sweep. Massive fiscal stimulus and increased UST issuance would fit into the reflation trade of s steeper US curve. We think most would also agree that such an outcome would likely be dollar-negative, with the Fed forced to expand its balance sheet further to help absorb the new UST issuance. A compromise on fiscal stimulus before the election still seems unlikely. House Speaker Pelosi and Treasury Secretary Mnuchin held another round of talks Monday but no progress has been revealed. The Democrats stand at $2.2 trln and the Republicans at $1.6 trln. While that gap is the narrowest it’s ever been, there are no signs that a deal is within reach. Representative Ted Lieu said that Democrats would consider a deal “somewhat less” than $2.2 trillion, but not “dramatically less.” We believe Mr. Lieu could hold a second job writing forward guidance for the Fed. This is another quiet day in terms of US data. August trade (-$66.2 bln expected) and JOLTS job openings (6500 expected) will be reported Tuesday. Rosengren, Bostic, Kashkari, Williams, and Evans all speak. Canada reports August trade. |

2020 Presidential Elections Odds |

| ASIA

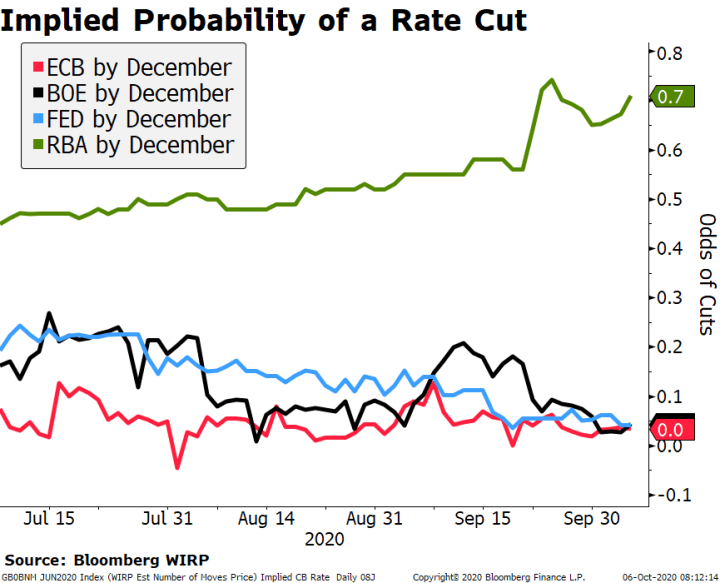

Reserve Bank of Australia delivered a dovish hold. As expected, the cash rate and 3-year yield target were both kept at 0.25%, but the language left the door open for further easing. The communication noted that the bank “continues to consider how additional monetary easing could support jobs as the economy opens up further.” The RBA is not as close to the lower bound as other central banks are and it still has several levers to pull on, including the Term Funding Facility. A cut in November seems very likely at this point, with futures markets implying around a 70% chance, according to the Bloomberg WIRP model. The AUD tends to strengthen on RBA decision days. Of the past 11 dating back to November 2019, AUD has strengthened on 8 of them. AUD is underperforming on the day at -0.4% vs. USD and so that streak may not be extended today. Elsewhere, the Australian government released an aggressive budget. The deficit is expected to expand to AUD213.7 bln in the FY20/21 ending next June 30, or 11% of GDP. As a result, the debt to GDP ratio will peak at 43.8% of GDP in June 20245, up from 24.8% in FY19/20. As previously leaked, income tax cuts due to take effect July 2022 will be backdated to July 2020, while AUD14 bln of new and accelerated infrastructure spending will be seen this FY that is meant to provide 40k jobs. Indeed, Treasurer Frydenberg stressed that this budget was all about jobs, as he sees the unemployment rate peaking at 8% this year but remaining stubbornly high at 6.5% by the end of FY21/22. |

Implied Probability of a Rate Cut |

| The Indian government appointed three new external members to the Reserve Bank of India’s Monetary Policy Committee. The lack of a quorum led to the postponement last week of a scheduled policy meeting.

The Finance Ministry announced the following names to the six-member MPC: Ashima Goyal, a professor at the Mumbai-based Indira Gandhi Institute of Developmental Research, Jayanth R Varma, a professor of finance at the Indian Institute of Management in Ahmedabad, and Shashanka Bhide, an agricultural economist and a senior adviser with the National Council of Applied Economic Research in New Delhi. The policy meeting has been rescheduled for this week, with a decision due Friday. We assume that these new MPC members were chosen for their dovish credentials, as Prime Minister Modi wants the RBI to provide further monetary stimulus. As such, we see some risks of a dovish surprise. |

EUROPE/MIDDLE EAST/AFRICA

President Lagarde said the ECB is prepared to inject fresh monetary stimulus to support the recovery. She admitted in an interview that the recovery looks “a little bit more shaky” as a second wave of infections impact the region. Madame Lagarde acknowledged that the ECB currently views other policy tools as more effective than a rate cut, but added that the ECB hasn’t yet reached the point where a rate cut would do more harm than good. Lastly, she again called on governments to maintain their fiscal support.

We expect the ECB to increase its PEPP in Q4. We look for the ECB to add stimulus at its December 10 meeting, when new macro projections are released. There are reports of some resistance within the Governing Council but we do not think it is enough to prevent the ECB from delivering another round of stimulus. We firmly believe that the ECB will not take rates more negative. It may, however, continue to tinker with its PELTROs and TLTROs in order to shield banks from the harmful impact of negative rates by basically pay banks to take funding from the ECB and lend it out to households and businesses.

German factory orders came in much stronger than expected. August orders rose 4.5% m/m vs. 2.8% expected and a revised 3.3% (was 2.8%) in July. As a result, the y/y rate improved to -2.2% from a revised -6.9% (was -7.3%) in July. German IP (1.5% m/m expected) will be reported Wednesday and trade and current account data Thursday. Still, we fear that the string of positive data won’t last long with the second wave of virus infections taking hold and depressing orders from other European countries. Indeed, Germany registered the highest one-day increase in infection since mid-April. There were 3,100 new cases over the last 24 hours, though this is still well below the peak of nearly 7,000. Elsewhere, UK September construction PMI jumped to 56.8 vs. 54.0 expected and 54.6 in August.

Russia reports September CPI. Headline inflation is expected to accelerate to 3.7% y/y from 3.6% in August. If so, it would be the highest since October 2019 and closer to the 4% target. After a smaller than expected 25 bp cut to 4.25% in July, the bank kept rates steady in September, as expected. Next policy meeting is October 23 and no change is expected then either. Despite the negative impact of lower oil prices on the economy, we think ruble weakness argues against a rate cut anytime soon.

Full story here Are you the author? Previous post See more for Next postTags: Articles,Daily News,Featured,newsletter