- Virus restrictions across Europe continue to sour sentiment; the dollar is benefiting from the risk-off backdrop

- The stimulus package is deader than Elvis; Fed manufacturing surveys for October will start to roll out; weekly jobless claims will be reported; Chile is expected to keep rates steady at 0.5%

- The unofficial deadline for Brexit has likely been extended; the two-day EU summit in Brussels starts today; Israel reports September CPI

- Australia reported September jobs data; the RBA is likely to add stimulus soon

- China is seeing fading price pressures and a central bank that continues to pump liquidity into the system; protests in Thailand continue to rock the capital

Virus restrictions across Europe continue to sour sentiment. The big news this morning was that London’s risk level will soon be upgraded to “Tier 2,” meaning further restrictions on how households can mix. France imposed curfews for nine cities between 21:00 and 06:00. Germany also seems to be on the edge of some new measures, but the central government is facing resistance by regional governments. Meanwhile, Singapore and Hong Kong have created a “travel bubble” to allow unrestricted travel between the two for the first time in nearly seven months.

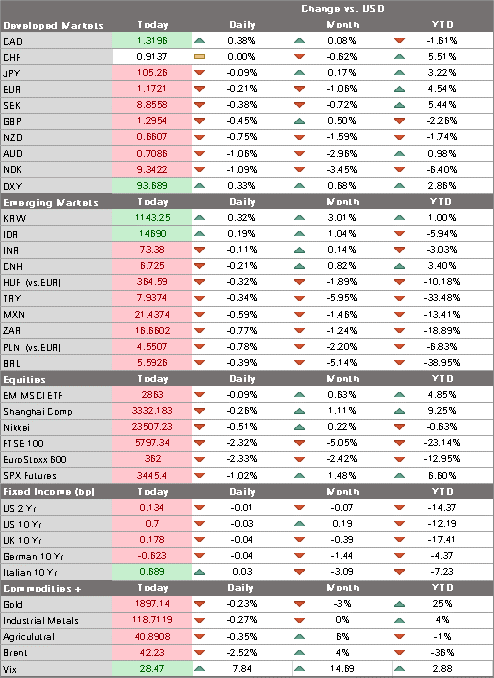

The dollar is benefiting from the risk-off backdrop. DXY is trading at the highest level since October 8, but past bouts of risk-off gains have been unable to puncture the 94 area. With the US outlook softening, this level will remain very tough to break. Once this period of risk-off buying ends, we look for dollar weakness to resume. The euro finding some support near $1.17, while sterling continues to be buffeted by Brexit-related headlines. Despite the likelihood of an extended deadline (see below), broad dollar gains have pushed cable back below $1.30 again. USD/JPY is seeing support near 105 but extended risk-off trading could see this pair break below that level.

| AMERICAS

The stimulus package is deader than Elvis. Treasury Secretary Mnuchin finally admitted that getting something done before the election was difficult, further adding to negative market sentiment. And while he said progress was made on certain issues, talks are still far apart. Mnuchin heads to the Middle East next week, which really is the final nail in the coffin. The penultimate nail was Senate Majority Leader McConnell vowing to pass an even skinnier package next week. While the odds of no deal had fallen sharply in recent weeks, we think markets had held out for some sort of possible compromise. Now, the US economy goes into the winter months without much-needed fiscal stimulus. Fed manufacturing surveys for October will start to roll out. Empire survey will be reported and is expected at 14.0 vs. 17.0 in September. Philly Fed business outlook will also be reported Thursday and is expected at 14.8 vs. 15.0 in September. These are the first snapshots for October and will help set the tone for other manufacturing data to come. Bostic, Quarles, Kaplan, and Kashkari speak. September import/export prices will also be reported. Weekly jobless claims will be reported. Initial claims are expected at 825k vs. 840k the previous week, while continuing claims are expected at 10.55 mln vs. 10.976 mln the previous week. California numbers will remain frozen instead of being revised after a two-week hiatus that was meant to clear a backlog and implement fraud prevention technology. Claims there are now being accepted but the California numbers will remain frozen this week. Indeed, the Labor Department said until the California figures “normalize”, the state’s readings will stay frozen. This could apparently take two to three weeks, and so the claims data will continue to give a distorted view of the labor market until perhaps November. Chile central bank is expected to keep rates steady at 0.5%. September CPI accelerated to 3.1% y/y vs. 2.8% expected and 2.4% in August, the highest since April and back in the top half of the 2-4% target range. At its last policy meeting September 1, the central bank signaled steady rates for the next two years and added it may take further measures if needed. However, with inflation rising and the bank seeing signs of a rebound in retail and manufacturing, we see steady rates for now. |

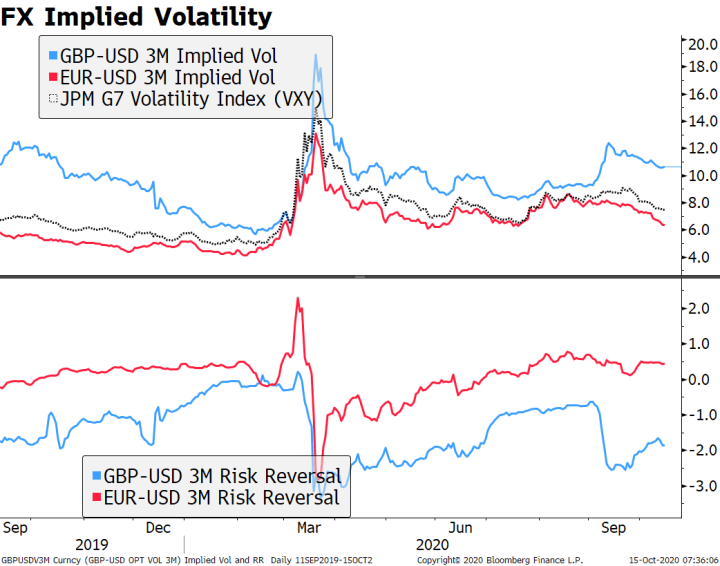

FX Implied Volatility, 2019-2020 |

| EUROPE/MIDDLE EAST/AFRICA

The unofficial deadline for Brexit has likely been extended. This is not to say a deal will be done, but the odds of an upside surprise are the highest they have ever been in quite a long time. Top UK negotiator Frost reportedly told Prime Minister Boris Johnson to ditch his threat to walk away today and to allow negotiations to continue after tentative signs of a fisheries compromise emerged. Johnson will wait until the end of the EU summit to decide if he will accept Frost’s recommendation. If he does, the new deadline will be the end of the month or early November, which may be enough time to work out some sort of “skinny deal” with minor concession and face saving on both sides. As we discussed earlier in the week, we think that UK Prime Minister Boris Johnson has dug himself into a political hole and likely eager to bring back a victory of some sort – a flat out “no deal” Brexit just won’t do. Sterling continues to be buffeted by Brexit headlines but is holding up fairly well overall. Implied volatility measures and risk reversals have come off since September, implying less anxiety about the post-Brexit outcome, but it remain significantly detached from similar measures for other currencies. The two-day EU summit in Brussels starts today. This summit was also considered to be a placeholder of sorts, with no Brexit breakthrough expected yet. With the extension of the deadline, this summit should be fairly uneventful and then all eyes turn to the next one November 15. However, the EU will need to confirm Frost’s optimism on a potential deal. One way to do this is by signaling that EU negotiators are ready to start writing joint legal text after this summit. In related news, reports suggest Germany is pressing France to back down on its fishing demands with officials stressing that curtailed access to UK waters is better than no access under a no deal Brexit. Israel reports September CPI. Deflation is expected to ease to -0.7% y/y from -0.8% in August. If so, inflation would remain well below the 1-3% target range. Next central bank policy meeting is October 22. Rates are expected to remain steady at 0.10% but there is a risk that the bank expands its asset purchases in response to rising bond yields and a steepening curve. Also, recent shekel gains are likely to trigger a stronger response by the bank to prevent excessive appreciation. |

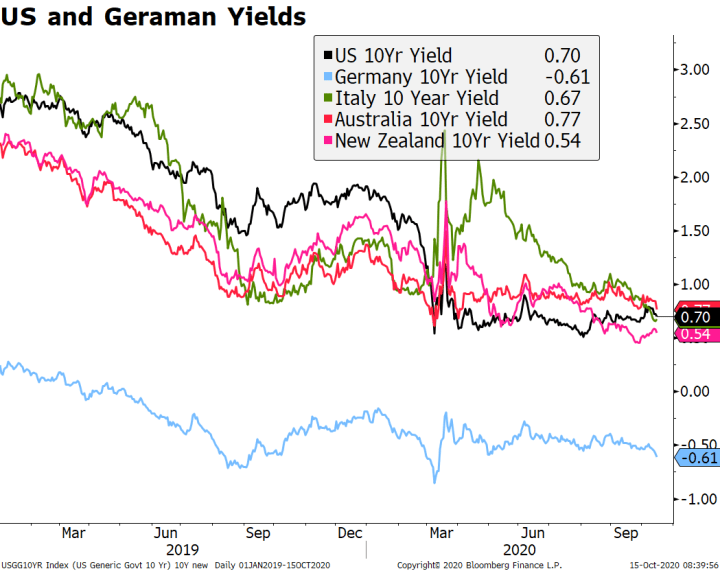

US and Germany Yields, 2019-2020 |

| ASIA

Australia reported better than expected September jobs data. Employment fell -29.5k vs. -40k expected. while August was revised up to 129.1k from 111k previously. September was the first drop since May and reflects the impact of the lockdowns in Victoria. Those losses were more heavily weighted towards full-time (-20.1k) rather than part-time (-9.4kk), while the August gain was more heavily weighted towards part-time (117k) rather than full-time (12.1k) jobs. The unemployment rate only rose a tick to 6.9% vs. 7.0% expected. Overall, the data suggest the labor market remains under stress. No wonder then that the RBA is likely to add stimulus soon. Governor Lowe discussed the possibility of adding 10-year bonds to the YCC program, and even teased a potential rate cut from 0.25% to 0.10%. Lowe noted that Australia’s 10-year yields are higher than “almost everywhere in the world.” At around 0.77%, yields are indeed higher, but not by that much. Yields were down as much as 7 bp in the 10-year maturity and futures continue to forecast a roughly 70% chance of a rate cut coming at the November 3 meeting. The Aussie is the clear underperformer today in the FX space (-0.8% against the USD) while the ASX index outperformed (+0.5%). China is seeing fading price pressures and a central bank that continues to pump liquidity into the system. CPI rose 1.7% y/y vs. 1.9% expected and 2.4% in August, while PPI fell -2.1% y/y vs. -1.8% expected and -2.0% in August. While the PBOC is clearly focused on growth and not inflation, the data gives the bank cover to maintain its expansionary stance. It offered CNY500 bln of liquidity via its one-year medium-term lending facility and would offset CNY200 bln of funding that expires Friday. It also sold CNY50 bln of 7-day reverse repos even though no such funds are maturing this week. Press reports suggest the moves are meant to help banks cope with a liquidity shortage next week, when a large amount of tax payments are due. Either way, money and loan data released this week suggests that the PBOC continues to rely on easy credit to help sustain the recovery. |

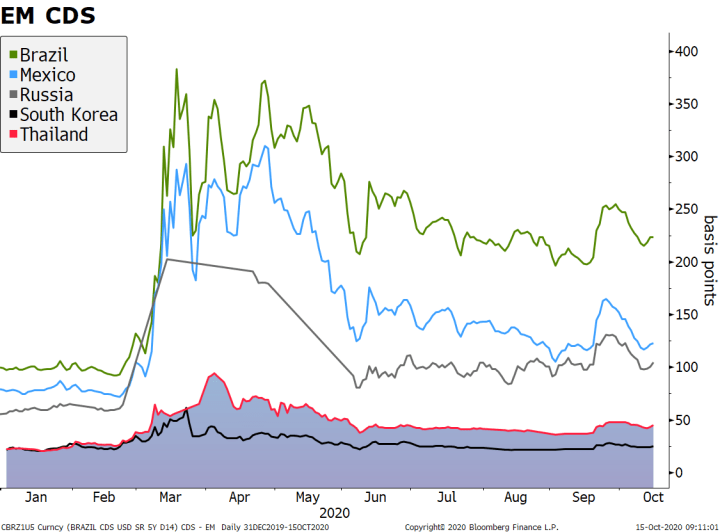

Emerging Markets CDS, 2020 |

| Protests in Thailand continue to rock the capital, but the reaction in asset prices has been mild. Prime Minister Prayuth Chan-Ocha declared a state of emergency in Bangkok as demonstrations swelled. Protesters are demanding that the PM (who came to power though a military coup) step down, a revision of the constitution, and a reform (though not the removal) of the monarchy. Protests and political turbulence are not new to Thailand, to say the least, but this wave is different for being a grassroots movement. It has invigorated younger people and doesn’t seem to revolve as much around prominent political figures such as former PM Thaksin (though he is still involved). We don’t have a strong view about how this story will progress from here, but it’s hard to imagine it ending any time soon. |

. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter