- The dollar remains firm on continued safe haven flows but we still view this situation as temporary

- Fed Chair Powell appears before the House Financial Services Panel with Treasury Secretary Mnuchin; the text of Powell’s testimony was released already

- House Democrats plan to vote on a stopgap bill today; Fed manufacturing surveys for September will continue to roll out; Brazil COPOM minutes will be released

- UK CBI September industrial trends survey came in weak; BOE Governor Bailey reiterated the discussion on negative rates but confirmed that implementation is nowhere in sight; new restrictive measures are trickling out in the UK

- Riksbank kept policy unchanged, as expected; Hungary is expected to keep rates steady at 0.60%; Deputy Governor Debelle said the RBA is still weighing options to further support the economy

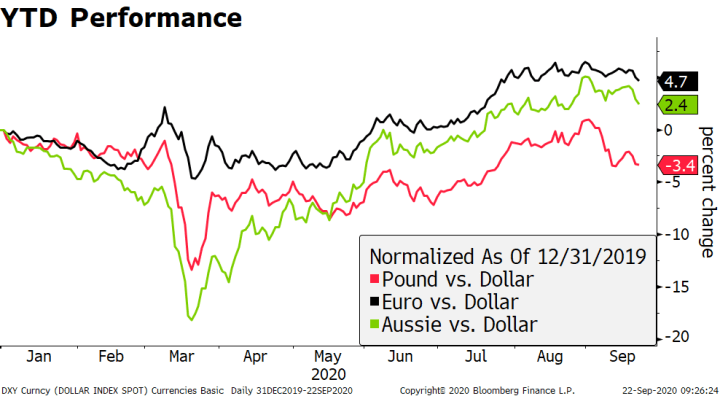

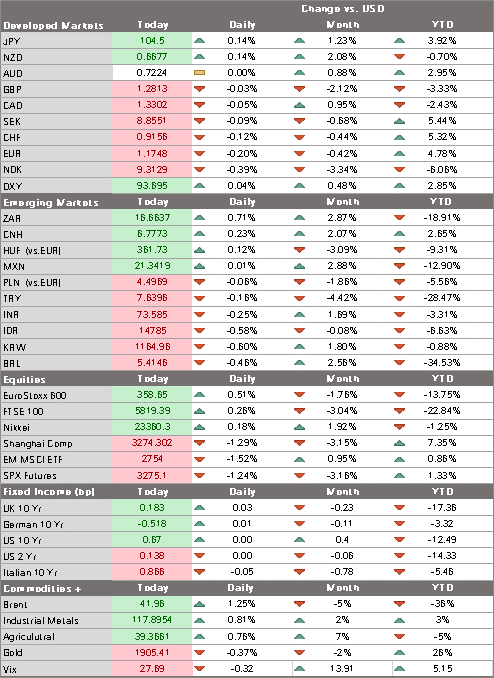

The dollar remains firm on continued safe haven flows but we still view this situation as temporary. DXY has so far proven unable to break above the key 94 area, with the euro seeing support just above $1.17 and cable bouncing off support at the 200-day moving average near $1.2725 today. USD/JPY recovered yesterday after trading at a new low near 104 but remains heavy.

The broad-based weak dollar trend should resume as we remain negative on the dollar due to the now-familiar combination of an ultra-dovish Fed and softening US economic data. We may get both of those again today, with Powell appearing before Congress and another September regional Fed survey due out.

AMERICAS

Fed Chair Powell appears before the House Financial Services Panel with Treasury Secretary Mnuchin today. He then appears by himself before the House Panel on Covid-19 tomorrow and appears with Mnuchin again before the Senate Banking Committee Thursday. The two are required to appear before Congress each quarter under the Cares Act. With the media embargo lifted, quite a few other Fed officials will speak this week. Evans and Barkin speak today.

The text of Powell’s testimony was released already. Powell sees the US economy improving but still has a long way to go before recovering fully. He said that more is required from both fiscal and monetary policy in order to prevent long-term damage to the economy. Lastly, Powell defended its Main Street Lending Program but noted that the Fed has responded to feedback and made some adjustments. This is all pretty boiler-plate but we suspect the Q&A could shed some more light on the Fed’s current thinking.

House Democrats plan to vote on a stopgap bill today that would extend current levels of spending for government agencies through December 11. However, it does not include $30 bln in farm aid that the White House and Republican lawmakers had sought. As a result, the mood on Capitol Hill has worsened, if that’s possible. Nerves were already on edge due to the failure to pass a stimulus bill as well as the efforts by Senate Republicans to push through a Supreme Court nominee before the election. Failure to pass a stopgap bill would lead to a government shutdown at the end of this month.

Fed manufacturing surveys for September will continue to roll out. Richmond Fed reports today and is expected at 12 vs. 18 in August. Kansas City Fed reports Thursday and is expected to remain steady at 14. Last week, the Empire survey came in at 17.0 vs. 6.9 expected and 3.7 in August, while the Philly Fed came in as expected at 15.0 vs. 17.2 in August. These are the first snapshots for September and will help set the tone for other manufacturing data. Markit flash PMI readings for September will be reported Wednesday. Manufacturing is expected at 53.3 vs. 53.1 in August, while services is expected at 54.5 vs. 55.0 in August. August existing home sales will also be reported today and are expected to rise 246% m/m vs. 24.7% in July.

Brazil COPOM minutes will be released. The bank just left rates steady at 2.0% last week and introduced dovish forward guidance, saying it “does not intend to reduce the monetary stimulus unless inflation expectations, as well as its baseline scenario inflation projections, are sufficiently close to the inflation target.” It also sees the current rise in inflation as temporary. Mid-September IPCA inflation will be reported Wednesday and is expected to rise 2.59% y/y vs. 2.28% in mid-August. If so, it would be the highest since March and back within the 2.5-5.5% target range. The central bank releases its quarterly inflation report Thursday and should give some more insight into the new forward guidance.

| EUROPE/MIDDLE EAST/AFRICA

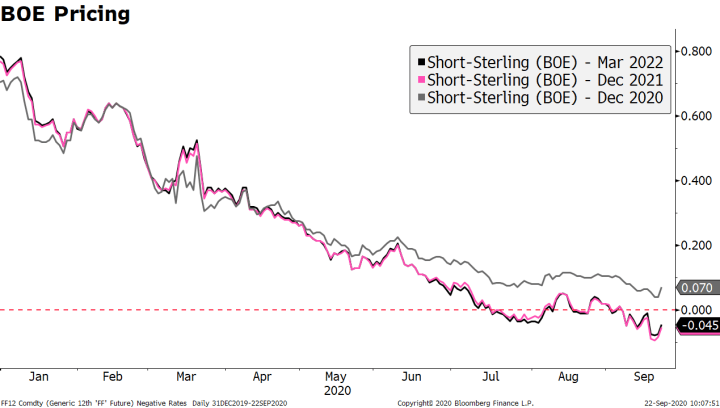

UK CBI September industrial trends survey came in weak. Total orders came in at -48 vs. -40 expected and -44 in August, while selling prices came in at -1 vs. -4 expected and -5 in August. This will followed by its distributive trades survey Thursday. While recent data have been solid, signs of weakness are appearing and it’s clear that the UK economy is facing headwinds as we move into Q4. BOE Governor Bailey reiterated the discussion on negative rates but confirmed that implementation is nowhere in sight. He reminded us that “negative rates should be in the toolbox,” but provided no stronger signal that it’s imminent. In fact, he said the evidence in favor of negative rates is mixed and technical work to implement it will take time, implying no urgency. We are firmly in the camp that we will not see negative policy rates in the UK barring a tremendous downside surprise. Yields on the UK’s interest rate futures curve are up about 3 bp on the day, while yields on the short end of the gilt curve have popped back into positive territory, albeit barely. |

BOE Pricing, 2020 |

| New restrictive measures are trickling out in the UK. The government said people should return to their working from home arrangements, but there are no firm rules to enforce this. It will also impose a 10 PM curfew on pubs and restaurants. The measures are a reaction to new forecasts of daily infections rising to 50k by mid-October. And while they fall well short of a nationwide lockdown, the restrictions will nevertheless be another headwind on the UK economy in Q4.

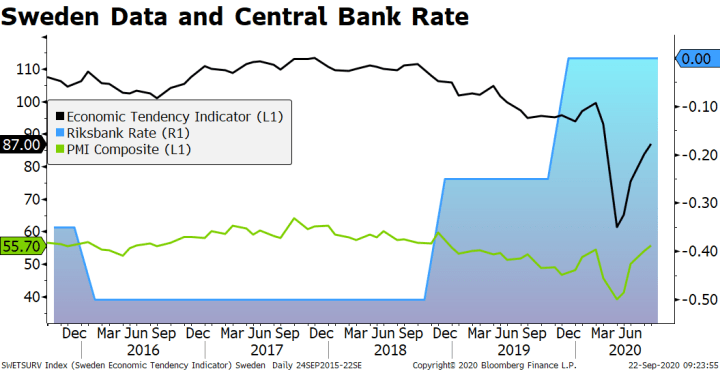

The Riksbank left rates unchanged at zero, as expected. However, it was a slightly dovish hold as the bank left the door open for further easing. The bank said the repo rate could be cut again but stressed that “QE remains the prime policy tool if things would turn out worse.” Now that the Riksbank got rates out of negative territory, we believe it has no appetite to go negative again. Inflation forecasts for the next couple of years were cut slightly and are still seen remaining below the 2% target until after Q3 2023. The 2020 GDP forecast was raised to -3.6% vs. -4.5% previously, while the 2021 forecast improved a tick to 3.7%. The bank’s flat rate path was extended out to at least Q3 2023. National Bank of Hungary is expected to keep rates steady at 0.60%. After cutting rates 15 bp each in June and July, the bank stayed on hold in August and saw no room for lowering the policy rate. However, it announced increased bond purchases then to help fund the budget deficit, buying up to HUF40 bln per week and injecting liquidity into the system via HUF30 bln of repo operations per week. The forint has reacted as one would expect to ultra-loose policy, with EUR/HUF moving closer to the all-time high near 370 from April. |

Sweden Data and Central Bank Rate, 2016-2020 |

| ASIA

Reserve Bank of Australia Deputy Governor Debelle said the bank is still weighing options to further support the economy. He said these measures include expanded bond buying and currency intervention. In our reading, this seems for a statement of the options than a demonstration of intent to pull the trigger in any one of them. Indeed, Debelle stressed that fiscal stimulus remains the best tool to support growth. Of note, Debelle said the evidence on negative rates is “mixed,” which we (and BOE Governor Bailey, see above) agree with. Debelle also noted about intervention that “it is not clear this would be effective in the current circumstances.” He said one policy option being discussed is to expand bond-buying to include bonds that are further out the curve than the current 3-year bond yield target. Debelle noted that a flatter yield curve might contribute to a weaker currency. |

YTD Performance, 2020 |

| The next policy meeting is October 6 and more stimulus then seems too soon. However, the next quarterly Statement of Monetary Policy will be released right after the following meeting November 3. This may provide a better opportunity to ease, and also gives the RBA more time to better gauge the trajectory of the economy. Lastly, Treasurer Frydenberg will present the government’s budget for 2020/2021 October 6 and so the RBA may not want to steal his thunder by easing that same day. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter