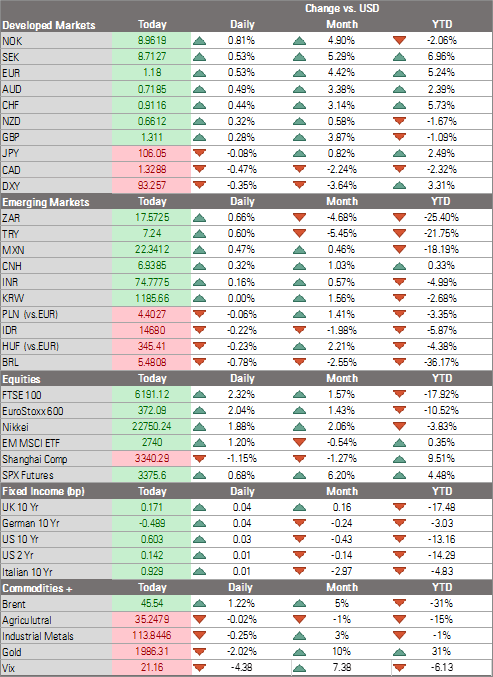

- Markets seem to be increasingly desensitized to the usual negative drivers; the dollar is under pressure again

- Stimulus talks remain stalled; reports suggest Trump is mulling a capital gains tax cut of some sort

- US data highlight today will be July PPI; US Treasury begins its record $112 bln quarterly refunding

- UK’s unemployment figures were mixed; Deputy Governor Marsden said the BOE stands ready to ramp up QE if the economy slows; German ZEW survey was also mixed, but favorable on balance

- Turkey continues to tighten policy though its various tools; mixed July NAB business survey was released in Australia

| Markets seem to be increasingly desensitized to the usual negative drivers.

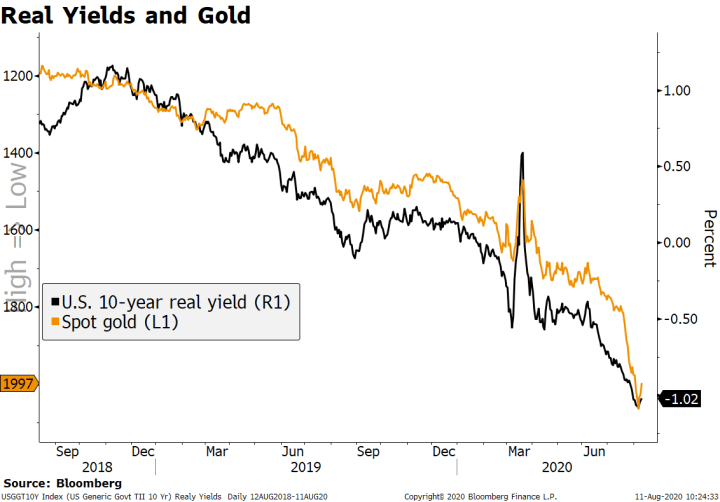

These include (but are not limited to) headlines about US-China tensions, delays to US stimulus, and fluctuations in the virus numbers. On the virus front, cases reached 20 million worldwide with numbers in India and Brazil still concerning. Cases have picked up in some European countries, but hospitalizations and mortality in some of the most affected US states is improving. We suspect that this is how the gradual path towards the end of the pandemic will look like. As long as infections don’t escalate to the point in which countries start considering national-level measures, markets should be fine. Lastly, President Putin said Russia has registered the first coronavirus vaccine. The vaccine will be produced at two plants though trials will continue. He added that his daughter has already been vaccinated. Meanwhile, the gold-real yields narrative continues to play out with a simultaneous reversal of both. The US 10-year real yield is off its -1.12% low to around -1.0% now. Gold is down 1.5% on the day, the largest 1-day move since early May. We are on the side of gold here; if real yields stabilize or even reverse a bit, we think there are plenty of other arguments in favor of higher gold ranging from currency debasement to hedging. |

Real Yields and Gold, 2018-2020 |

| The dollar is under pressure again. DXY is down today after two straight up days and has given up nearly half of its recent bounce. Break below 93 is needed to set up a test of last week’s low near 92.52. The euro found support just above the $1.17 area and is moving higher. Here, a break of $1.1840 is needed to set up a test of last week’s high near $1.1915. Sterling found support just above $1.30 and a break of $1.3120 would set up a test of last week’s high near $1.3185. Lastly, USD/JPY continues to flirt with a clean break above the 106 level.

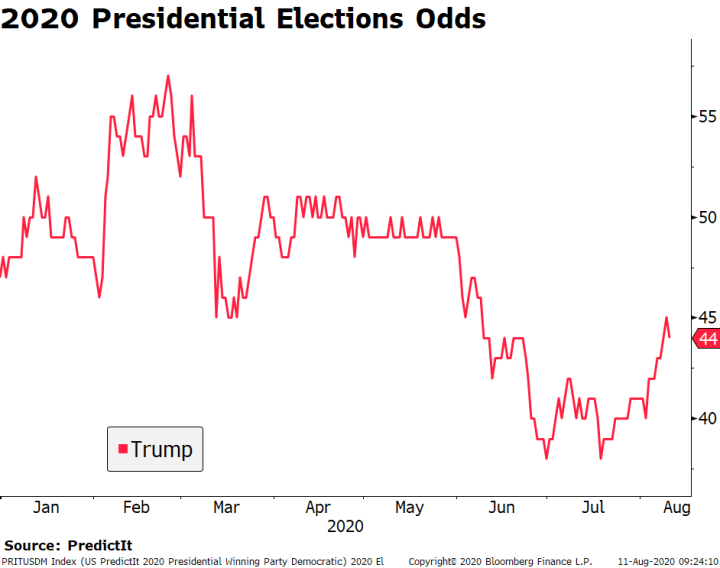

AMERICAS Stimulus talks remain stalled. If President Trump hoped that his executive orders would force Democrats back to the table, then he will be disappointed so far. His claims that Democratic leaders Pelosi and Schumer asked to meet with him were denied. It’s worth noting that Trump’s polling numbers have been picking up recently after an extended period of decline. Odds from betting markets give him about a 45% chance of winning, up from around 38% a few weeks ago. |

2020 Presidential Elections Odds |

| Reports suggest President Trump is mulling a capital gains tax cut of some sort. While he can’t cut the 20% long-term rate without Congress, Trump has been advised that he can issue an executive order to index capital gains to inflation, which would lower the effective tax rate. Legal challenges would be expected here too. Like the payroll tax cut, a capital gains tax cut would do nothing to help the millions of unemployed. Trump did say that he is considering a middle class tax cut, which is also something that he can’t do without Congress.

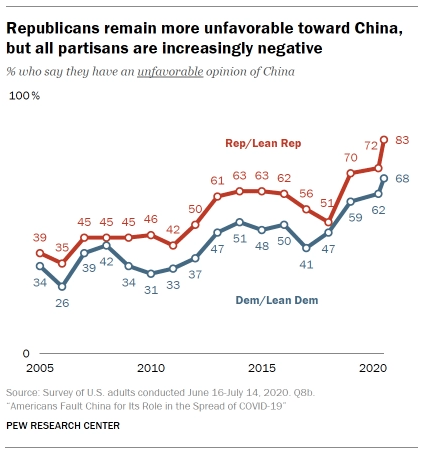

Several areas of disagreement remain. One is aid to state and local governments, where the Democratic plan passed in May provides around $1 trln. The package proposed by the Republican Senate provides nothing. It’s worth noting that the National Governors Association called on Congress to provide $500 bln in unrestricted aid to the states. This was a bipartisan request. Another area is enhanced unemployment benefits. Here, the Democrats want an extension at the full $600 per week amount. President Trump’s executive order puts the number at $400, though $100 would be provided by the states. It’s worth noting that a spokesperson for Ohio Governor DeWine (R) said that the state has no plans to provide it even as Trump has suggested that the matching payment could be waived for some states but has provided no details. The matter of liability protection is shaping up to be the major sticking point. While the other areas will likely be bridged by compromises on the amount of money, liability protections are pretty much all or nothing. Senate Leader McConnell has insisted that such protections for businesses, schools, and colleges be included in any relief bill. The House package seeks to provide enforceable federal standards of worker protection through the Occupational Safety and Health Administration. US-China tensions will probably rise further as we approach the elections, but we believe they will stay largely in the level of rhetoric. Both Democrats and Republicans have a vested electoral interest in sounding tough on China. As previously noted here, unfavorable views of China continue to worsen among US citizens of both parties, as seen by the latest Pew Research Centre. On the positive side, reports claim that China is substituting Brazilian soy imports with soy from the US. If confirmed, this could be an important gesture of good will ahead of the August 15 meeting between the two sides to review the Phase One trade deal. |

|

| US data highlight today will be July PPI. Headline is expected to rise a tick to -0.7% y/y and core is expected to fall a tick to flat y/y. CPI comes out tomorrow with headline expected to rise a tick to 0.7% y/y and core expected to fall a tick to 1.1% y/y. The 5- and 10-year TIPS breakeven inflation rates have crept higher but remain slightly below what they were in February. In other words, runaway inflation is not being priced in yet. Barkin and Daly speak today. With the US economy losing some momentum in Q3, we suspect Fed officials will maintain the very dovish tone established at the July 29 meeting.

The US Treasury begins its record $112 bln quarterly refunding. $48 bln of 3-year notes will be sold today, followed by $38 bln of 10-year notes tomorrow and $26 bln of 30-year bonds Thursday. The balance of its borrowing needs will be met through weekly bill auctions, cash management bills, TIPS, and floating rate notes. Brazil COPOM minutes will be released. Last week, it cut rates 25 bp to 2.0%, as expected, and left the door open to further easing. IPCA inflation picked up to 2.31% y/y in July, the highest since April but still below the 2.5-5.5% target range. At this point, markets aren’t pricing in any further rate cuts but the economic outlook remains fluid and so we cannot rule it out entirely. EUROPE/MIDDLE EAST/AFRICA UK’s unemployment figures were mixed. Headline unemployment remained steady at 3.9% over the last 3-month period ending in June, better than the 4.2% expected, while employment fell -220k vs. -300k expected and -125k previously. However, jobless claims rose 94.4k in July after falling a revised -68.5k (was -28.1k) in May. Of course, we won’t really know the true state of the UK’s labor market until the government’s generous furlough scheme runs out. Indeed, the number of people seeking work has declined, suggesting they have little hope of re-employment. |

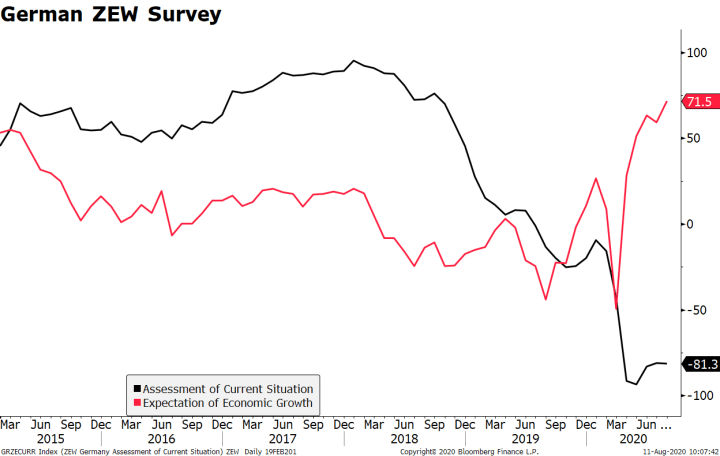

German ZEW Survey, 2015-2020 |

| Deputy Governor Marsden said yesterday that the Bank of England stands ready to ramp up QE if the economy slows. The bank delivered a less dovish than expected hold last week and was criticized by many for being too upbeat in the face of resurgent virus numbers. The labor market data this week in particular should serve as a wake-up call, especially with the government’s job furlough program set to expire this fall. Many, including us, look for the BOE to eventually add to its QE before year-end despite its stated plan to end purchase by then.

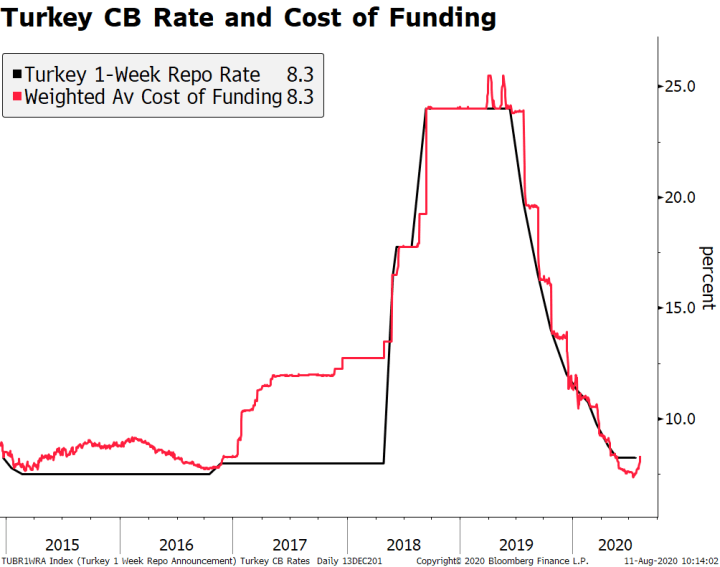

The German ZEW survey was also mixed, but favorable on balance. Although the current situations component worsened to -81.3 vs. -69.5 expected and -80.9 in July, the forward-looking expectations component shot up to 71.5 vs. 55.8 expected and 59.3 in July. For the eurozone as a whole, expectations rose to 64.0 from 59.6 in July. Turkey continues to tighten policy though its various tools. The last move was to restrict funding via its one-week repo rate (8.25%) since last Friday, forcing financial institutions to use its higher funding rates. As we have noted (see report on Turkey here), we expect officials to resist “formal” rate hikes as much as possible, but will eventually give in. Indeed, President Erdogan said this morning that “God willing, interest rates will go down further.” The lira is enjoying the broad risk on day, up 0.5% against the dollar, but it’s down 4% this month. |

Turkey CB Rate and Cost of Funding, 2015-2020 |

| ASIA

Mixed July NAB business survey was released in Australia. Business conditions improved to 0 from a revised -8 (was -7) in June, while business confidence fell to -14 from a revised 0 (was 1) in June. This will be followed by August Westpac consumer confidence tomorrow. The RBA just left policy steady last week, noting that it stands ready to change if needed as it awaits more information on the potential impact of the widening lockdown in Victoria. Next policy meeting is September 1 and no change is expected then. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter