Despite broad-based dollar weakness, EM currencies have not fully participated in the risk on environment that’s now in place. The good news is that fundamentals matter again. The bad news is that there are a lot of EM countries with bad fundamentals, and the secular decline in carry no longer gives these weaklings any cover. Here, we posit that fundamentals will be the main driver for currencies in this new normal of near zero interest rates everywhere.

RECENT DEVELOPMENTS

The pandemic has led to an unprecedented environment of aggressive fiscal and monetary stimulus. Record low policy rates across EM are simply the final nail in the coffin for the carry trade, continuing a trend seen since the financial crisis.

Whilst some nations were able to attempt to normalize monetary policy after that crisis, most policy rates never recovered to pre-2008 levels. With the onset of the pandemic, many EM policy rates quickly fell to the zero bound. Those that aren’t are at record lows.

With the S&P 500 making new record highs, one would think that EM would also be rallying. EM stocks have, with MSCI EM retracing nearly all of this year’s sell-off and trading just shy of the February high near 1113. However, EM FX is lagging, with MSCI EM FX retracing only half of this year’s sell-off.

In a typical risk-on trading environment, we would almost always see EM currencies gain en masse. That is, there was very little differentiation between strong and weak credits. But things have clearly changed. The lagging performance of MSCI EM FX reflects some big losers in that basket. Year-to-date, the biggest EM FX losers are BRL (-27% vs. USD), ZAR (-19%), ARS (-18.5%), TRY (-18.5%), and RUB (-16%). By way of comparison, the biggest EM FX winners YTD are PHP (+4% vs. USD), CZK (+3.5%), PLN (+3%), TWD (+2%), and CNY (+1%).

Those high beta currencies at the bottom of the league table used to rally strongly during risk-on periods. Clearly, they are not doing so now. What’s changed? We think it is due largely to the fact that these high beta currencies no longer offer any significant carry. In the past, the high carry would draw in investors searching for yield during risk-on periods. That carry used to help offset weak fundamentals, but not anymore. As the charts below show, that carry has evaporated and we think it is unlikely to return anytime soon. Carry is represented by the interest return to currencies as calculated by Bloomberg.

| ASIA

In greater China, CNY was one of the few EM currencies that saw their carry increase significantly after the financial crisis. KRW too, but to a lesser extent. HKD, SGD, and TWD pretty much flatlined after the financial crisis. All have fallen during the pandemic. |

Greater China EM Carry, 2000-2020 |

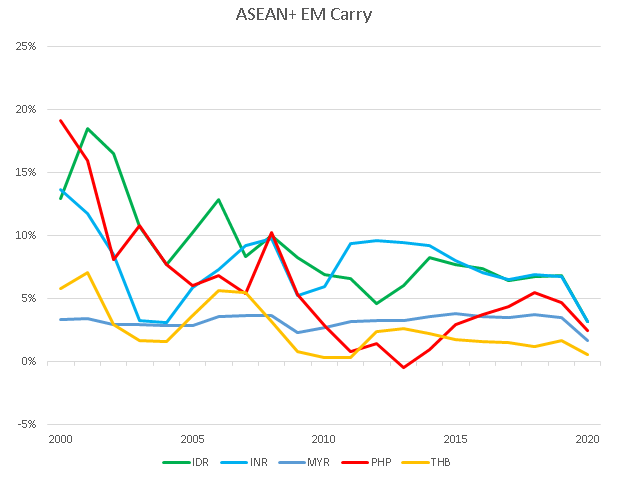

| In ASEAN plus India, INR was the only currency to see its carry recover after the financial crisis. The others pretty much flatlined and have now taken another leg lower. |

ASEAN+ EM Carry, 2000-2020 |

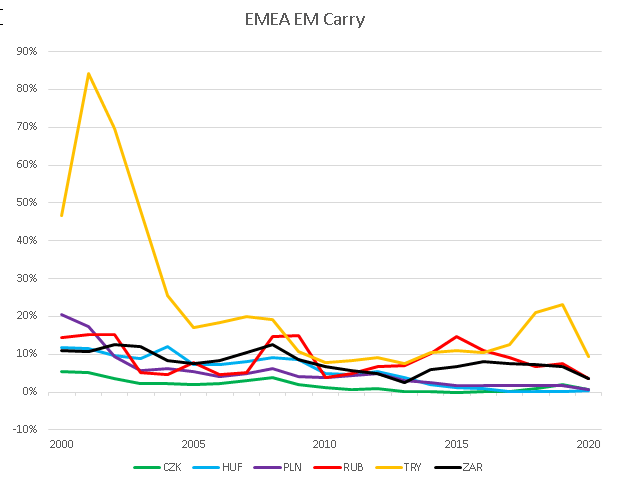

| EMEA

In EMEA, TRY was the only currency to see its carry recover after the financial crisis. That was seen largely in 2018 and 2019, when Turkey faced a currency crisis and was forced to hike rates aggressively. It has since cut and is now on the cusp of another crisis, so carry is likely to rise again. The others pretty much flatlined and have now taken another leg lower. |

EMEA EM Carry, 2000-2020 |

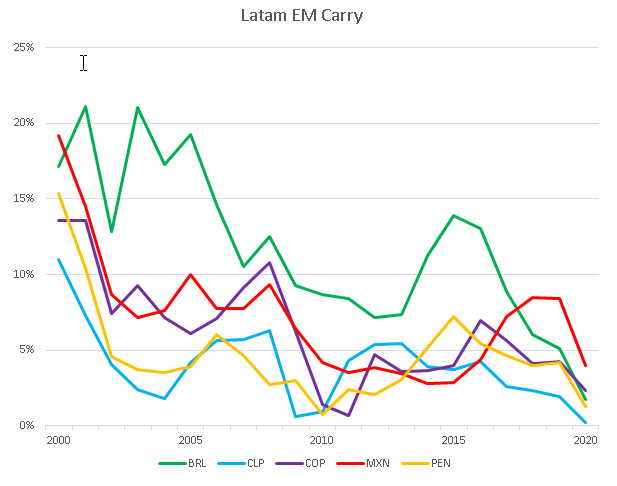

| LATIN AMERICA

Latin America appears to have been an exception in the post-crisis world. Virtually all the currencies in this region saw their carry rise back close to pre-crisis levels. MXN lagged but eventually played catchup when pressure on the peso forced Banco de Mexico to hike aggressively over the course of 2016-2019. All have fallen close to the zero bound now as the pandemic spread. |

Latam EM Carry, 2000-2020 |

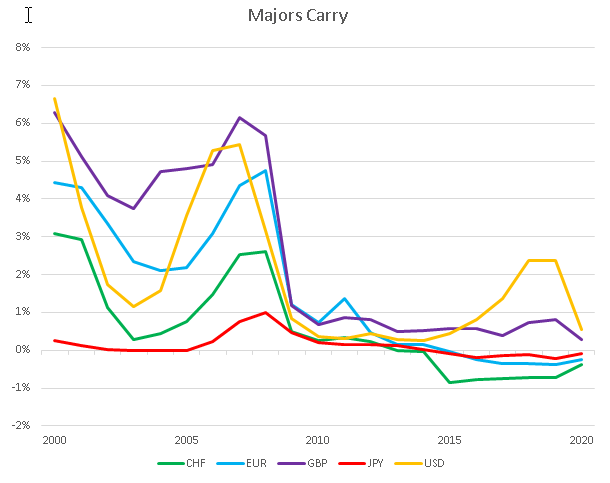

| MAJORS

It’s worth pointing out that this is not just an EM phenomena. As the graph below shows, carry in the majors evaporated during the financial crisis and never even came back. Indeed, some moved into negative territory and remain there to this day. The dollar and sterling stand out as being the “high yielder” in the majors but even their carry is approaching the zero bound. |

Majors Carry, 2000-2020 |

INVESTMENT OUTLOOK

We continue to look for dollar weakness ahead. Our faithful readers now that this call is based on aggressive Fed stimulus coupled with a failure to contain the virus in the US. The US economy is losing momentum in Q3 and that should keep the dollar under pressure. While that likely means that EM currencies should broadly rally, we are likely to see continued divergences ahead as markets grapple with the same backdrop of low carry and idiosyncratic risks across EM.

Forward guidance from virtually every central bank (both DM and EM) suggests interest rates are not going up anytime soon. As such, investors will have to get used to this new normal of extremely low carry across most currencies. And when carry is pretty much the same everywhere, we think investors will have to go back to the fundamental stories for each currency. Which countries are growing relatively faster? Which ones have transparent policymaking and predictable investment environments? We believe these sorts of factors will drive currencies for the time being, not relative interest rates.

That is where our EM Equity and FX models will come in handy. Our EM Equity Allocation Model suggests that Korea, Hungary, and China should outperform in Q3 while South Africa, Mexico, and India should underperform. Similarly, our EM FX Model suggests TWD, THB, KRW, CNY, and MYR should outperform while PKR, TRY, and ARS should underperform. Both of these models are fundamentally-based and should help investors navigate the tricky waters ahead.

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,developed markets,Emerging Markets,Featured,newsletter