Monthly Archive: August 2020

FX Daily, August 31: Month-End Gyrations and the Fed’s Ad Hocery

Markets are searching for direction at month-end. Asia Pacific shares outside of Japan lower. Berkshire Hathaway confirmed taking a $6 bln stake in Japanese trading companies over the past year, and the pullback in the yen helped lift shares. The MSCI Asia Pacific Index rose 2% last week.

Read More »

Read More »

Drivers for the Week Ahead

The dollar is likely to remain under pressure after Powell’s dovish message at Jackson Hole. August jobs data Friday will be the data highlight of the week. The Fed releases its Beige Book report Wednesday; Powell will face many questions about the Framework Review that he unveiled at Jackson Hole.

Read More »

Read More »

Swiss economist says Covid-19 ‘winners’ should pay more tax

Companies that netted their best-ever earnings during the coronavirus crisis should be subject to extra tax, finds one of Switzerland’s top economists.

Read More »

Read More »

Nihilism Embodied: Our Lawless Financial System

Not only have the billionaire class made money, they have tightened their monopolistic grip on the levers of money supply and distribution, turning a global rigged casino into a global company town.

Read More »

Read More »

America’s Riots Are Just the Latest Version of Marxist “Syndicalism”

The year 2020 is one of the most disrupted times in at least the last half century, maybe longer. Global protests and riots, the covid-19 virus, lockdowns, and police killings of unarmed citizens. Add to that widespread rioting, looting, arson, homelessness, and destruction of property, including the tearing down of statues.

Read More »

Read More »

Coronavirus: UK puts Switzerland back on Quarantine List

Travellers from Switzerland, Jamaica and Czech Republic who enter the UK from 4 am on Saturday 29 August 2020, must self-isolate for two weeks, the UK government announced this evening. The UK considers imposing quarantine when a country’s rate of infection exceeds 20 cases per 100,000 people over 7 days.

Read More »

Read More »

Why Americans Are Looking for a Safe Haven from the Dollar

As the Federal Reserve’s quantitative easing practices generate the biggest debt bubble in history, gold futures are trading at record highs, a phenomenon some have called "a bit of a mystery." However, this "mystery" was solved long ago by the laws of economics.

Read More »

Read More »

Mises on Syndicalism

As political tactics Syndicalism presents a particular method of attack by organized labour for the attainment of their political ends. This end may also be the establishment of the true Socialism, that is to say, the socialization of the means of production. But the term Syndicalism is also used in a second sense, in which it means a sociopolitical aim of a special kind.

Read More »

Read More »

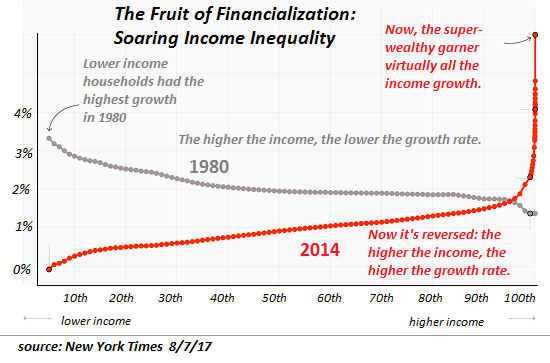

America’s Metastasizing Class Wars

Class wars are the inevitable result of an economic system in which 'anything goes if you're rich enough and winners take most'. The traditional class war has been waged between wage-earners (who sell their labor) and their employers (owners of capital and the means of production).

Read More »

Read More »

Swiss Private Banks Brace for Coronavirus Impact

The Swiss private banking sector saw a resurgence in fortunes last year but faces an uncertain future as the Covid-19 pandemic continues to play havoc with financial markets. Favourable market conditions in 2019 allowed the 84 banks surveyed by KPMG to grow client assets by 14%, according to a recently published report by the audit firm.

Read More »

Read More »

FX Daily, August 28: Powell and Abe Drive Markets

After a confused and volatile reaction to the Federal Reserve's formal adoption of an average inflation target, it took Asian and European traders to embrace the signal and take the dollar lower. It is falling against nearly all the currencies and has slumped to new lows for the year against sterling and the Australian dollar.

Read More »

Read More »

Rise of 380 000 jobs in tertiary sector between 2011 and 2018

28.08.2020 - In 2018, almost 70 000 additional jobs were counted in Switzerland, bringing the total to more than 5.2 million. As in the previous years, the tertiary sector, which accounted for some 4 million jobs in 2018, contributed greatly to this increase with a +1.5% rise in employment.

Read More »

Read More »

This Has To Be A Joke, Because If It’s Not…

After thinking about it all day, I’m still not quite sure this isn’t a joke; a high-brow commitment of utterly brilliant performance art, the kind of Four-D masterpiece of hilarious deception that Andy Kaufman would’ve gone nuts over. I mean, it has to be, right?I’m talking, of course, about Jackson Hole and Jay Powell’s reportedly genius masterstroke.

Read More »

Read More »

New Swiss Rail Timetable Speeds up Cross-Border Trips

Next year the train connections from Switzerland to Germany and Italy will be faster. On Wednesday the Swiss Federal Railways unveiled the timetable for 2021. In addition to various inland tweaks, the new schedule brings swifter links from Zurich to Milan (3:17) and Munich (ca. 4hrs). From Zurich there will be ten direct trains to Milan; from Basel, five.

Read More »

Read More »

How the CARES Act Is Still Kicking the Can

During Real Vision’s Daily Briefing of August 13, Ed Harrison asked rhetorically, “How is it possible for you to have a bull market, a new leg up in the business cycle when bank stocks, the traditional value cyclical trade are 30% off their highs? That's not a signal of bull, it's a signal of secular stagnation.”

Read More »

Read More »

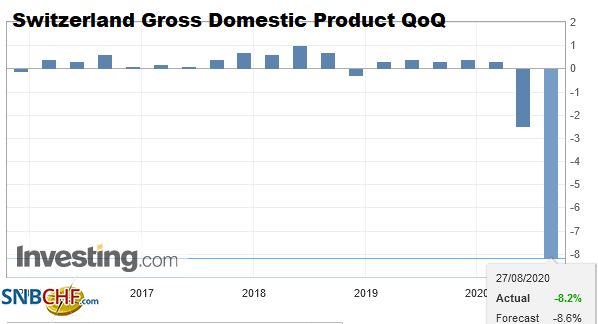

Switzerland GDP Q2 2020: -8.2 percent QoQ, -9.3 percent YoY

Switzerland’s GDP fell by –8.2 % in the 2nd quarter of 2020, after decreasing by –2.5 % (revised) in the previous quarter.* Domestic economic activity was severely restricted in the wake of the pandemic and the measures are taken to contain it. The global economy also plunged into a sharp recession. However, Switzerland’s GDP decline remained limited in an international comparison.

Read More »

Read More »

FX Daily, August 27: After much Build-Up, Could Powell be Anti-Climactic?

The strong rally in US equities yesterday, with the fifth consecutive gain in the S&P 500 and a big outside up day in gold, failed to spur follow-through buying today. Asia Pacific equities were mixed. China, Australia, and India rose while most of the rest of the regional markets fell.

Read More »

Read More »

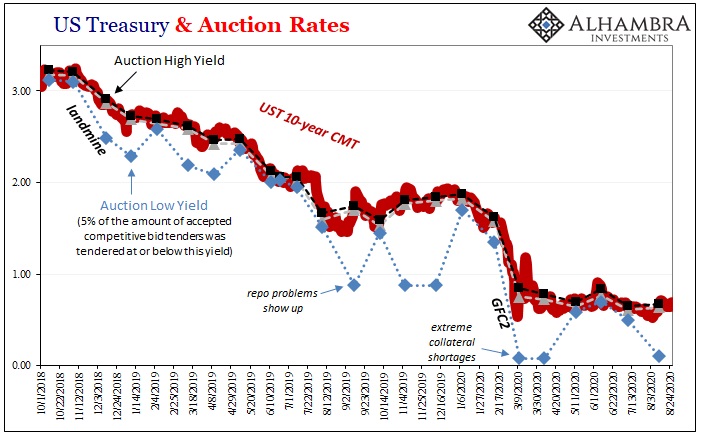

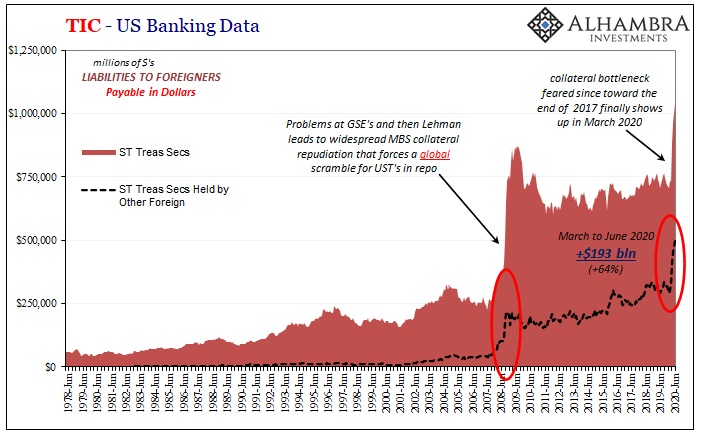

Not This Again: Too Many Treasuries?

Tomorrow, the Treasury Department is going to announce the results of its latest bond auction. A truly massive one, $47 billion are being offered of CAH4’s notes dated August 31, 2020, maturing out in August 31, 2027. In other words, the belly of the belly, the 7s.We’ve already seen them drop for two note auctions this week, both equally sizable.

Read More »

Read More »

Belgium Investigates Credit Suisse over hidden Bank Accounts

The investigation by federal prosecutors is at the information-gathering stage, looking for evidence of money laundering and whether the Swiss bank acted as an illegal financial intermediary, a spokesman for the prosecutors said on Monday. However, no formal charges have been brought.

Read More »

Read More »

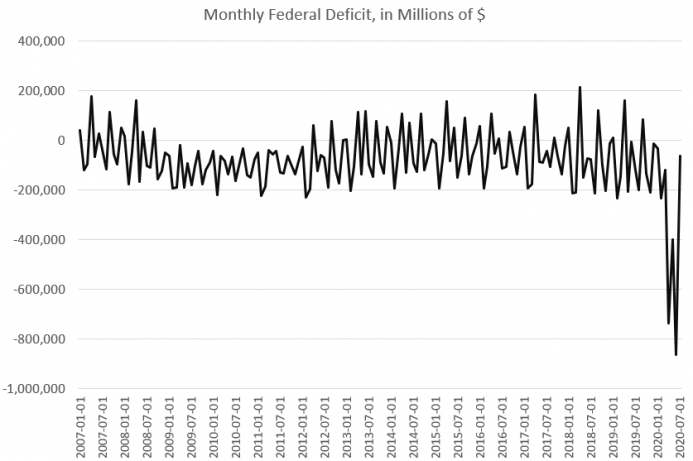

2020 Will Be a Record-Breaking Year for Debt. How Long Can This Last?

The deficit narrowed during July after months of record shortfalls in federal tax revenues. During April, May, and June of this year deficits surges to unprecedented highs as economic activity dried up, workers were furloughed and laid off, and tax payments were deferred.

Read More »

Read More »