- The dollar is stabilizing today but further losses are likely

- Senate Republicans have proposed a sharp cut to weekly unemployment benefits; Senator Collins will oppose Judy Shelton’s nomination to the Fed

- Regional Fed manufacturing surveys for July will continue to roll out; early July reads for the US economy support our view that Q3 is off to a rocky start

- ECB extended its ban on dividend payouts and share buybacks through year-end; LSE report suggests Brexit will deliver a different shock to the UK economy than the pandemic

- IMF approved South Africa’s $4.3 bln emergency support loan; Japan’s biggest private life insurer said it plans to buy more US corporate debt

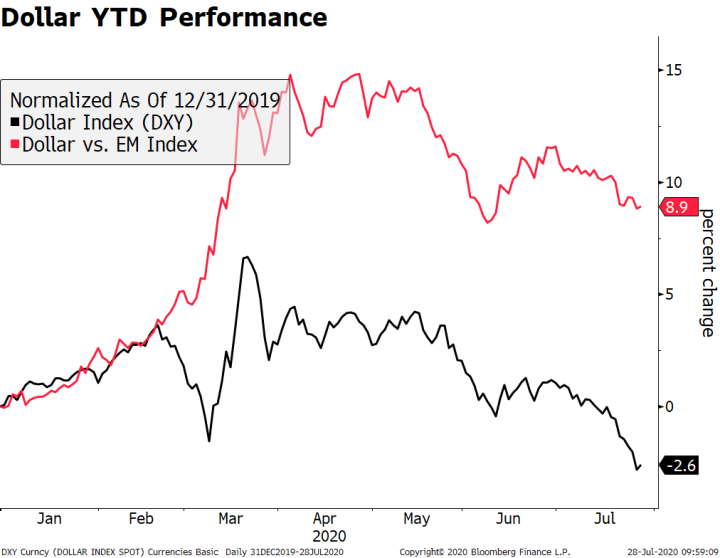

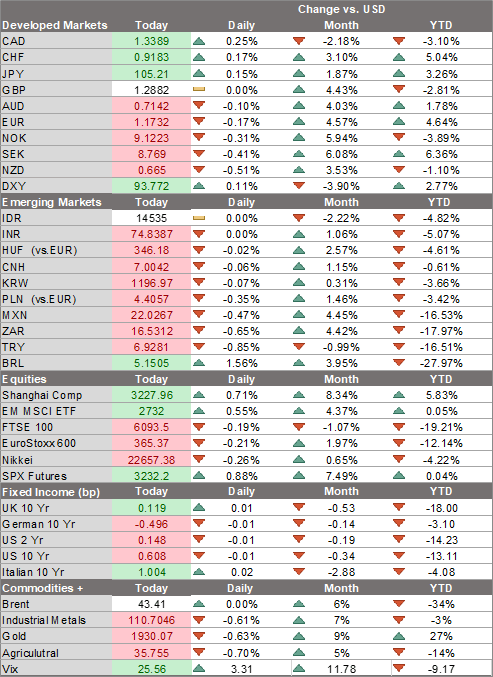

| The dollar is stabilizing today but further losses are likely. DXY is up modestly after registering seven consecutive sessions of declines. Year to date, DXY is down 2.6% after being up nearly 7% in March. The September 2018 low near 93.814 is the next target, followed by the June 2018 low near 93.193 and then the May 2018 low near 92.243. Against the broad EM index, the dollar is still up 9% YTD, but this compares to gains of around 15% earlier in the year. Also of note, precious metals are taking a breather after their meteoric rise this year with gold and silver down 0.7% and 3.5%, respectively, by mid-morning in London. |

Dollar YTD Performance, 2020 |

| AMERICAS

Senate Republicans have proposed a sharp cut to weekly unemployment benefits. The latest reports suggest the package would cut the weekly supplemental benefit from $600 to $200 for a two-month transition period until the states are able to create and implement a system designed to provide 70% of a worker’s lost wages. An additional two-month waiver may be requested if the states are unable to implement the new plan. While we understand that this is meant to be the starting point for negotiations with the House Democrats, the proposal underscores the wide divide that exists between the two parties and signals difficult talks ahead. Senator Susan Collins said she would oppose Judy Shelton’s nomination to the Fed’s Board of Governors. She is the second Republican to oppose Shelton, joining Senator Mitt Romney. With a 53-47 majority in the Senate, two more Republicans voting no would derail her nomination. Christopher Waller, director of research at the St. Louis Fed, is pretty much a shoo-in. The regional Fed manufacturing surveys for July will continue to roll out. Richmond Fed reports today and is expected at 5 vs. 0 in June. Yesterday, the Dallas Fed came in at -3.0 vs. -4.9 expected and -6.1 in June. Last week, Kansas City came in at 3 vs. 5 expected and 1 in June. The week before that, the Empire survey came in at 17.2 vs. 10.0 expected and -0.2 in June, while the Philly Fed survey came in at 24.1 vs. 20.0 expected and 27.5 in June while. July Conference Board consumer confidence will be reported today and is expected at 95.0 vs. 98.1 in June. Early July reads for the US economy support our view that Q3 is off to a rocky start. Jobless claims are rising again, while the regional Fed surveys are stalling out a bit. Next hard data is the July jobs report next Friday. Consensus is now 2 mln vs. 4.8 mln in June but think risks are to the downside. We’ll have a better idea after another round of jobless claims data this Thursday but for now, we continue to believe that the US economy will underperform in H2. In turn, this should drive further dollar underperformance, at least until the US can get its virus numbers under control. |

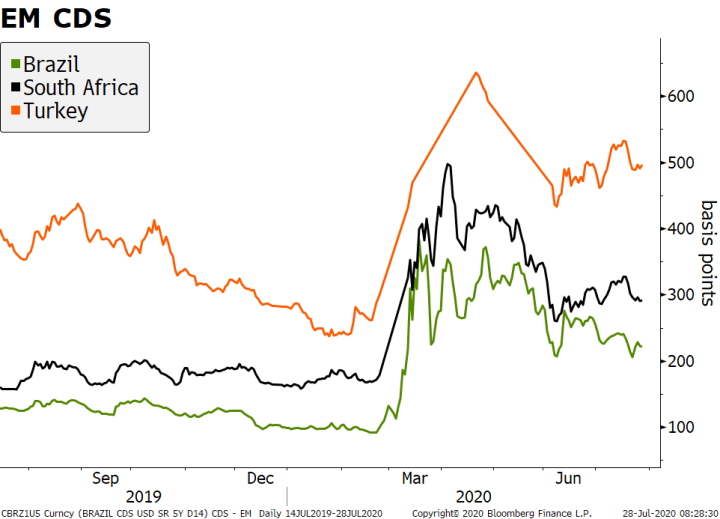

Emerging Markets CDS, 2019-2020 |

| EUROPE/MIDDLE EAST/AFRICA

The European Central Bank extended its ban on dividend payouts and share buybacks through year-end. It also urged eurozone banks to show some restraint on paying bonuses. The ECB said it will review its stance in Q4. Despite the improvement in the eurozone outlook, it’s clear that the ECB remains concerned and is requiring the banks to be more prudent as well. Recall that the major US banks sharply increased their loan loss provisions. All of these developments are a sign that policymakers and banks foresee a difficult period ahead despite the economy recovery under way. London School of Economics report suggests Brexit will deliver a different shock to the UK economy than the pandemic. Co-author Swati Dhingra noted that “Our analysis shows that the sectors that will be affected by Brexit and those that are suffering from the Covid-19 pandemic and lockdown are generally different from each other.” In other words, firms and industries that have not suffered as much from the pandemic will be impacted more by Brexit, further hobbling an already weakened economy. The report also notes that fiscal stimulus will roll off this fall, further weakening the economy. The report (Covid-19 and Brexit: Real-Time Updates on Business Performance in the United Kingdom) is by the LSE’s Centre for Economic Performance information and is based on a monthly survey of Confederation of British Industry (CBI) members. The IMF approved South Africa’s $4.3 bln emergency support loan. The funds will come in the form of the Rapid Financing Instrument program designed to support the government in addressing the pandemic fallout. The official statement describes it as an effort to “help fill the urgent BOP needs originating from the fiscal pressures posed by the pandemic, limit regional spillovers, and catalyze additional financing from other international financial institutions.” South Africa also secured a combined $1.3 bln from the New Development Bank (created by the BRICs countries) and the African Development Bank and is working towards a $2 bln loan from the World Bank. South African assets didn’t stand out that much during the pandemic, despite behaving in their usual high-beta fashion. Its CDS is trading around 300 bp, well below the around 500 bp peak in March, while the JSE index is down 13.5% on the year. The rand is down 15% YTD against the dollar, roughly what we have seen for the Mexican and Turkish currencies. ASIA Japan’s biggest private life insurer said it plans to buy more US corporate debt. Nippon Life official noted that “Cheap hedging costs are still making US debt attractive, so we plan to continue investing in U.S. corporate bonds while being selective.” The cost to hedge for Japanese investors to hedge USD investments has fallen to around 45 bp, the lowest since early 2015. The firm yen is also likely playing a part, as US assets are now cheaper. USD/JPY is currently sitting right at the key 105.20 level. Break below that retracement objective would set up a test of the March low near 101.20. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter