- The outlook for risk assets remains uncertain; the dollar continues to make new lows; the uncertain outlook continues to propel gold and silver higher

- The next round of stimulus in the US is proving to be difficult; regional Fed manufacturing surveys for July will continue to roll out

- German July IFO survey came in better than expected; eurozone June M3 rose 9.2% y/y vs. 8.9% in May

- Industrial profits in China rose 11.5% y/y in June vs. 5.5% in May; Hong Kong reported weak June trade data

| The outlook for risk assets remains uncertain. Risk is staging a modest recovery today, but this can quickly change. Global equities are rebounding despite continued growth concerns, rising virus numbers, and increased tension between the US and China.

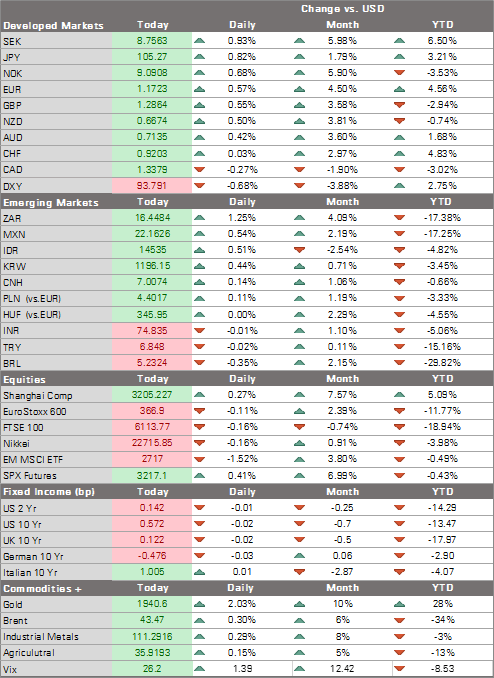

On the growth front, we think economic strength in Europe and China should outweigh weakness in the US. On the virus front, the UK has imposed a quarantine on travelers from Spain amid rising infection numbers in the countries. China, Hong Kong, and India were also on the spotlight due to rising infection numbers – the growth rate in India reached 20% last week, or 1.4 mln. The dollar continues to make new lows. DXY is trading at new lows for this move below 94 after breaking below the March low near 94.65 last week. The September 2018 low near 93.814 is the next target, followed by the June 2018 low near 93.193 and then the May 2018 low near 92.243. The euro is also making new highs and is on track to test the September 2018 high near $1.1815, followed by the May 2018 high near $1.20. USD/JPY finally broke out of its 106-108 trading range to trade at the lowest level since March 16 near 105.25. Break below the 105.20 area would set up a test of the March low near 101.20. The uncertain outlook continues to propel gold and silver higher. Gold futures are up 1.7% today after rising 5% last week. Silver is up 6% today after rising nearly 18% last week. Even bitcoin seemed to get an extra boost with USD/BTC crossing back over the 10,000 mark again. Although nominal treasury yields have been little changed, breakeven inflation rates have been quickly normalizing. AMERICASThe next round of stimulus in the US is proving to be difficult. Reflecting ongoing disagreement, Republican Senators are planning to reveal their $1 trln proposal in a series of bills today. Reports suggest they will propose a formula to determine extended weekly jobless benefits, a new round of $1200 one-shot stimulus checks, and provide funding for schools and for testing. There are also reports that the White House wants the eviction ban extended. |

US Inflation Expectations, 2019-2020 |

| This is just the beginning of what promises to be protracted negotiations between the two parties. Senate Majority Leader McConnell said the piecemeal approach might take weeks to complete but he appears to be trying to frontload the more important provisions into the small (and shrinking) window to strike a deal with House Democrats ahead of the August recess.

The situation remains fluid and the only sure thing at this point is that the payroll tax cut that President Trump wanted is out. The regional Fed manufacturing surveys for July will continue to roll out. Dallas Fed reports today and is expected at -4.9 vs. -6.1 in June. Richmond Fed reports Tuesday and is expected at 5 vs. 0 in June. Last week, Kansas City came in at 3 vs. 5 expected and 1 in June. Before that, the Empire survey came in at 17.2 vs. 10.0 expected and -0.2 in June, while the Philly Fed survey came in at 24.1 vs. 20.0 expected and 27.5 in June while. July Chicago PMI will be reported Friday and is expected at 44.0 vs. 36.6 in June. Note preliminary Markit PMIs were reported last week. Manufacturing came in at 51.3 vs. 52.0 expected and 49.8 in June, while services came in at 49.6 vs. 51.0 expected and 47.9 in June. June durable goods orders will be also reported today and are expected to rise 7.0% m/m vs. 15.7% in May. Mexico reports June trade. A surplus of $1.55 bln is expected. Q2 GDP will be reported Thursday, which is expected to contract -19.6% y/y vs. -1.4% in Q1. The economy remains weak and so further easing is expected despite the uptick in inflation to 3.59% y/y in mid-July. Next policy meeting is August 13 and another 50 bp cut to 4.5% is expected. The relatively firm peso should give the bank confidence to maintain its pace of easing. EUROPE/MIDDLE EAST/AFRICAGerman July IFO survey came in better than expected. The headline number came in at 90.5 vs. 89.3 and a revised 86.3 (was 86.2) in June. The expectations component in particular shot up to 97.0 vs. 93.4 expected, the highest level for the year so far, while the current assessment was a bit below consensus at 84.5. Due to its reliance in exports, Germany is lagging much of the major eurozone economies. However, the data suggest the worst is likely past. Eurozone June M3 rose 9.2% y/y vs. 8.9% in May. This was the fastest rate since July 2008 and reflects the ECB’s balance sheet expansion this year. That has also translated into faster loan growth and so the seeds have been planted for the recovery in H2 as long as the virus numbers can be kept low. Markets appear to be coming to grips with the likelihood that Europe will outperform the US in Q3 and perhaps Q4. This is due purely to the inability of the US to suppress its virus numbers, something we warned about back in our piece “Virus Numbers Pose Headwinds to US Economy” from June 30. Extending this train of thought, the economic underperformance of the US is likely to feed into continued underperformance of the dollar. Informal Brexit talks continue this week between the UK and the EU. The previous round of formal high level talks between Frost and Barnier wrapped up last week with no progress seen in the contentious areas of fisheries, level playing field guarantees, governance of the deal, and the role of the European Court of Justice. The two are ready to meet again in August if there is any progress. Press reports that UK officials are now working on the central assumption that it will trade with the EU under WTO rules after the transition period ends December 31. However, they feel that a basic deal remains possible if the EU makes more concessions in the fall. The EU reportedly believes that the true deadline for a deal is the end of October, which would allow time for ratification before year-end. ASIAIndustrial profits in China rose 11.5% y/y in June vs. 5.5% in May. The recovery continues to deepen. Given still weak external demand, the figure bodes well for improving prospects of domestic forces. Much of the industry is being buoyed by government expenditure, but the country’s relatively good handling of the pandemic and the early onset means consumer behavior will normalize sooner than the rest of the world. Hong Kong reported weak June trade data. Exports fell -1.3% vs. an expected 3.8% gain, while imports contracted -7.1% y/y vs. -6.0% expected. The recovery in the mainland economy has not yet translated into one in Hong Kong. Q2 GDP will be reported Wednesday, which is expected to contract -7.7% y/y vs. -8.9% in Q1. June retail sales will be reported Thursday. While some modest improvement in sales is likely, the rising virus numbers in Hong Kong have led to some limited roll-backs of the reopening efforts. If this picks up, the recovery will likely become more uneven. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter