- The virus news stream is negative today; the dollar is trying to build on its recent gains

- Weekly jobless claims are expected at 4.5 mln vs. 5.245 mln last week; regional Fed manufacturing surveys for April continue to roll out

- ECB confirmed reports that it will accept sub-investment grade debt as collateral; EU leaders will hold a video conference today

- Preliminary April eurozone PMI readings were awful; UK readings were even worse

- Japan reported weak preliminary April Japan PMI readings

The dollar is mixed against the majors as global economic data continue to weaken. Nokkie and Kiwi are outperforming, while Swissie and euro are underperforming. EM currencies are also mixed. RUB and INR are outperforming, while HUF and RON are underperforming. MSCI Asia Pacific was up 0.8% on the day, with the Nikkei rising 1.5%. MSCI EM is up 0.4% so far today, with the Shanghai Composite falling 0.2%. Euro Stoxx 600 is up 0.2% near midday, while US futures are pointing to a lower open. 10-year UST yields flat at 0.62%, while the 3-month to 10-year spread is flat to stand at +53 bp. Commodity prices are mostly higher, with Brent oil up 7%, WTI oil up 11%, copper up 0.2%, and gold up 0.7%.

The virus news stream is negative today. Spain’s government extended the state of emergency to May 9. Singapore remain in focus as the case count rises further (over 1,000 yesterday). But perhaps the greatest surprise came from Trump’s comments reprimanding Georgia Governor Kemp’s decision to soften social-distancing. Earlier this week, Trump’s tweets were calling on many governors to “liberate” their states.

The dollar is trying to build on its recent gains. DXY is edging higher after a toehold above 100. It is trading at the highest level since April 7 and the next target is the April 6 high near 100.931. The euro is trading at the lowest level since March 25 and is on track to test the March 23 low near $1.0635. Elsewhere, sterling is holding up relatively better near the $1.2350 area and so the EUR/GBP cross is coming under renewed pressure. Lastly, USD/JPY remains stuck in narrow ranges just below the 108 area. We remain constructive on the dollar.

| AMERICAS

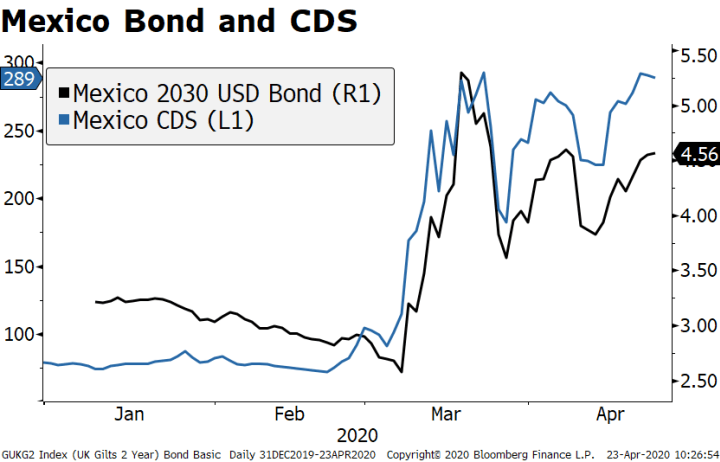

Weekly jobless claims are expected at 4.5 mln vs. 5.245 mln last week. If so, this would mean that nearly 27 mln have become jobless over the last five weeks, which is close to 18% of the labor force. Unemployment was 3.5% in February, just before the crisis. If we add these together, the US is likely already over 20% unemployment after barely over a month. May is unlikely to bring any relief. Note that this week’s claims data is for the BLS survey week that includes the 12th of each month. Keep an eye on the state-by-state readings, with data likely to continue showing that some of the key swing states are getting hit very hard. The regional Fed manufacturing surveys for April continue to roll out. Kansas City Fed survey will be reported and is expected at -37 vs. -17 in March. Last week, the Empire survey came in at -78.2 vs. -35.0 expected and -21.5 in March, while the Philly Fed survey came in at -56.6 vs. -32.0 expected and -12.7 in March. Markit also reports preliminary April US PMI readings. Manufacturing PMI is expected at 35.0 vs. 48.5 in March, while services PMI is expected at 30.0 vs. 39.8 in March. March new home sales (-15.8% m/m expected) will also be reported today. Mexico placed $6 bln in debt at relatively strong demand, especially given the recent downgrades. The 5-year issuance was priced to yield 4.125%, the 12-year at 5.0% and the 31-year at 5.5%. The sale was 4.75 times oversubscribed, but rates came in higher than previous sales, as has been the case with other EM borrowers. It’s no surprise that EM borrowers, especially oil producers, are facing challenges in the funding markets, but it’s important to remember that there is a lot of help available between the Fed swap lines and IMF/World Bank programs. This can help both with liquidity issues and as a bridge over the difficult economic times ahead. |

Mexico Bond and CDS, 2020 |

| EUROPE/MIDDLE EAST/AFRICA

The ECB confirmed reports that it will accept sub-investment grade debt as collateral in its operations. To be eligible, however, the issuer had to be rated at least the lowest investment grade on April 7. The decision comes ahead of S&P’s scheduled review of Italy tomorrow, where the agency may decide on a sovereign downgrade. If this happens, corporate and financial sector bonds will also be downgraded along with the sovereign. Note that in the most recent update for Q2, our own sovereign ratings model shows Italy’s implied rating slipping into BB+ territory. There was no official statement about whether the ECB will buy these bonds through its asset purchase program, but we are confident they will if necessary. EU leaders will hold a video conference today to discuss its coronavirus response. The discussion now moves towards the rumored €2.2 trln economic stimulus plan. The plan would be funded by combination of budget spending and a new financing mechanism. However, joint debt issuance (coronabonds) still seems to be off the table. Separately, Germany is coming out with a new €10 bln stimulus package. It will include a temporary cut on VAT for certain businesses and wage support. The government expects the budget to widen by more than 7% this year, with growth falling by at least 5%. Preliminary April eurozone PMI readings were awful. Headline manufacturing PMI came in at 33.6 vs 38.0 expected and 44.5 in March, services PMI came in at 11.7 vs. 22.8 expected and 26.4 in March, and the composite came in at 13.5 vs. 25.0 expected and 29.7 in March. Looking at the country breakdown, Germany and France saw their composite readings dropping to 17.1 and 11.2 vs. 28.5 and 24.5 expected, respectively, with most of the damage seen in the services sector. Preliminary April UK PMI readings were even worse. Manufacturing PMI came in at 32.9 vs. 42.0 expected and 47.8 in March, services PMI came in at 12.3 vs. 27.8 expected and 34.5 in March, and the composite came in at 12.9 vs. 29.5 expected and 36.0 in March. CBI industrial trends for April were also reported, with all readings plunging further from March. |

Europe Composite PMIs, 2017-2020 |

ASIA

Japan reported weak preliminary April Japan PMI readings. Manufacturing PMI came in at 43.7 vs. 44.8 in March, services PMI came in at 22.8 vs. 33.8 in March, and the composite came in at 27.8 vs. 36.2 in March. Not surprisingly, the Cabinet Office said the economy was in an “extremely severe situation” and “getting worse rapidly” as it cuts its economic outlook for the second straight month. It added that the severe conditions were expected to continue as the impact of the pandemic spreads. Elsewhere, preliminary April Australia PMI readings were also reported. Manufacturing PMI came in at 45.6 vs. 49.7 in March, services PMI came in at 19.6 vs. 38.5 in March, and the composite came in at 22.4 vs. 39.4 in March.

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,newsletter