|

The fictitious valuation of the stock market will eventually re-connect with reality in a violent decline. No, buy the tumor, sell the news ™ is not a typo: the stock market is a lethal tumor in our economy and society. Buy the rumor, sell the news encapsulates the old traders’ wisdom that markets rise on the sizzle of hope, promises, projections, Federal Reserve pimping (see below), tax cuts, etc. etc. etc., not on the actual steak of sales and profits. Buy the tumor, sell the news ™ encapsulates the fatal sickness of the past 20 years of “buy the dip because the Fed has our back”, the toxic certainty that the Fed will never let the stock market decline to fair value because that would reduce the wealth of the Fed’s cronies: the banks, the parasitic corporate cartels, the wealthiest families that own much of the stock market, and all those profiteering from various rackets, skims and scams. |

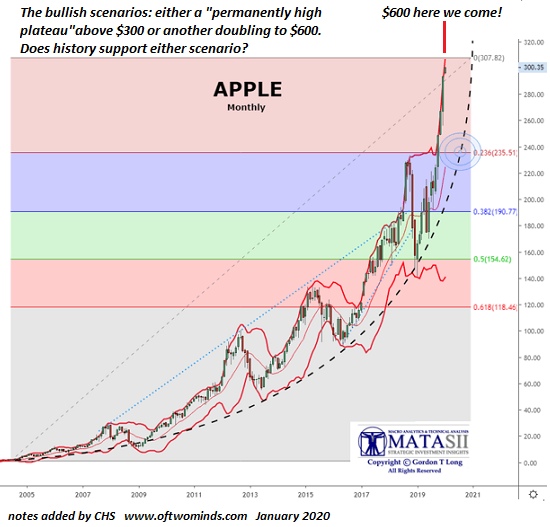

Apple Monthly, 2005-2021 |

| The system’s total dependence on asset bubbles in stocks and housing to generate the “wealth effect” that drives consumption defines Fed policy, along with the need to keep stock-dependent pension funds and liquidity-dependent zombie corporations solvent.

That the Fed’s pimping of asset bubbles and liquidity has created the greatest wealth inequality in a century is ignored by the self-serving, tone-deaf political/financial “leadership” because the wealth asymmetry has greatly enriched the “leaders,” their cronies and the army of technocrat flunkies who do all the real work to keep the rackets functioning. All this wealth wasn’t earned via the creation of value; it was skimmed / embezzled from the bottom 95% via high costs, junk fees, penalties, interest rates and taxes, all set by monopolies and cartels unburdened by competition, accountability or transparency. “It appears many investors have come to believe a truckload of cash will replace lost revenue until things return to ‘normal.’ I don’t think investors have a clear understanding about the difference between private revenue and public revenue. It’s like the difference between junk food and real food. One is high in calories and the other high in nutrition. Once your economic metabolism gets adjusted to junk food, there is a loss of dynamism and vitality akin to those poor souls who are are greater risk to COVID-19 due to real metabolic disorders. There is the issue that government wastes and squanders most of the funds it touches. For example, the dulled senses and immersive delusions perpetuated by a set of perfectly-coiffed GM executives who trafficked in the lamest pop-corporate dead-end cliches like ‘strategic planning’ and ‘R&D’ for decades while the company’s market share fell from 52% in the 1960s to 22% in 2008, the year it filed for bankruptcy. In fact, the company had lost $100 billion in the five years leading up to its bankruptcy. The same executives then axle-greased their way into a politically engineered $50 billion government bailout hidden behind the moral smokescreen of ‘jobs’ and ‘Made in America’ and (most comical of all) ‘electric vehicles.’ In the five years following its bankruptcy GM made $22.6 billion for shareholders. One fact that makes the irony so explicit: taxpayers still lost $11.2 billion on the bailout that saved the company. |

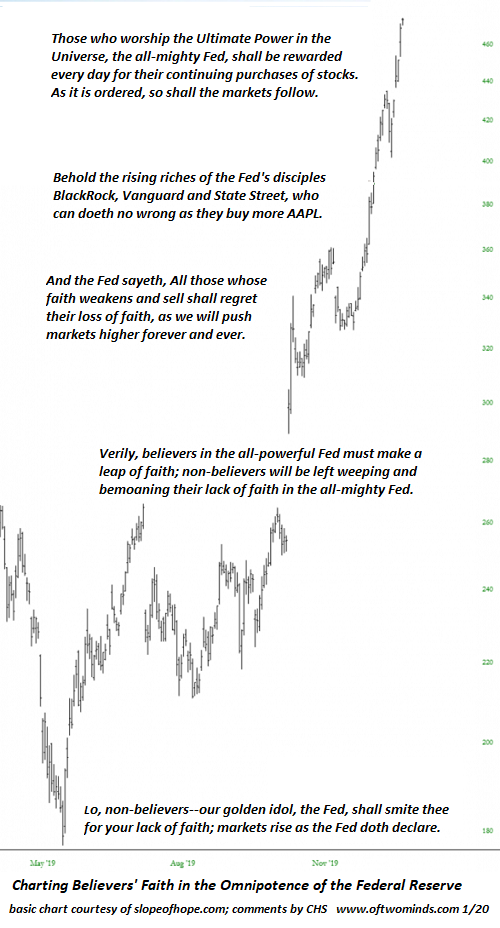

Charting Believers' Faith in the Omnipotence of the Federal Reserve |

| My point is that there is a cost to all this ‘free money.’ Societies cannot thrive when 60% of the economy is derived from the government. Survive yes, not not thrive.”

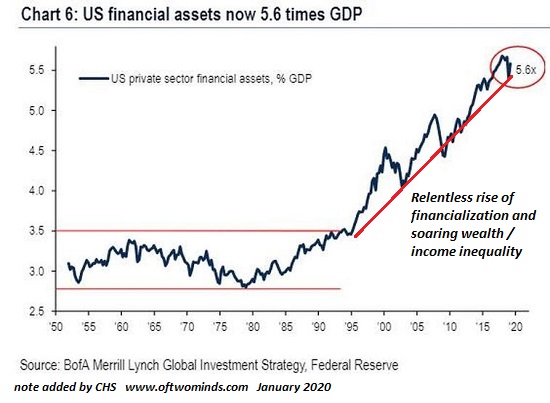

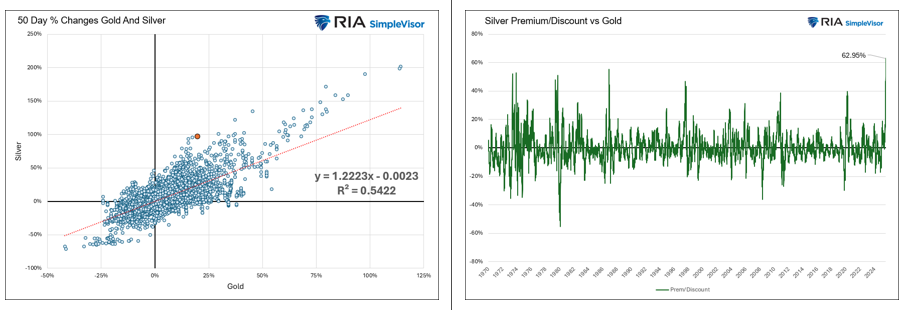

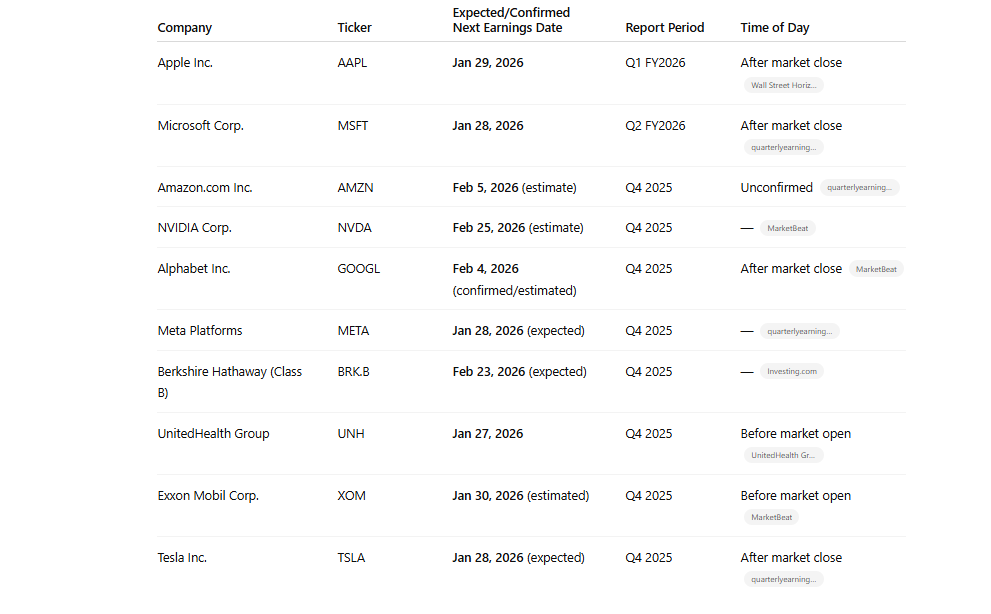

So management can run the company into the ground with stock buybacks funded by junk bonds, and the Fed and Uncle Sam will bail them out, no questions asked. This is moral hazard writ large: fraud, embezzlement, profiteering and cartel rackets have no consequences, so what’s the message? Go ahead and game the system to maximize your private gain, the Fed and Treasury will bail you out by transferring the losses to taxpayers and the bottomless pit of the Fed balance sheet. Meanwhile, Fed-pimped stocks have completely disconnected from the real world of goods, services, revenues and real profits, as the three charts below illustrate. The first is Apple’s stock, which doubled on flat operating earnings due to Fed pimping. The second chart is of Tesla’s stock, with my commentary on the quasi-religious belief of the financial punditry in the omnipotence of the Fed. The third chart depicts the extreme overvaluation of stocks and the lethal dependence of the entire financial system and economy on bubble valuations. The fictitious valuation of the stock market will eventually re-connect with reality in a violent decline. The fiction that the Fed is all-powerful is the Emperor’s new clothes; no one dares mention the emperor is buck-naked and the Fed cannot keep stocks separated from reality forever. The day of reckoning approaches, and the true costs of moral hazard, Fed pimping and a systemic dependence on the lethal tumor of a stock “market” that is no longer a market will be exacted from the financial system and the economy. Oh the wonder of Fed omnipotence: buy the tumor, sell the news ™. |

US Financial Assets now 5.6 times GDP |

Full story here Are you the author? Previous post See more for Next post

Tags: newsletter