We have been locked down for weeks. Classes have been canceled. Only essential activities are allowed. Although there is much to cover and analyze, I want to focus on the economics of the situation.

To understate it, the situation today is simply not good. The COVID-19 crisis has caused the world to lock down the population, which essentially ceased most commerce. While all businesses are affected in some way, a report by the US Chamber of Commerce shows that 24 percent of businesses are completely unable to conduct business in the emergency state, and further notes that 43 percent of all small businesses are less than six months away (and 10 percent less than one month away) from permanently closing their doors.

From their highs in February, the DJIA is down approximately 20 percent and the NASDAQ is down about 15 percent. Initial claims for unemployment insurance since the US Department of Labor’s March 19 report exceed 22 million. A rough calculation places the current US unemployment rate above 17 percent. Yes, the situation is not good.

How Did We Get Here?

The obvious answer is that a virus has swept across the globe and caused all of our woes. Although this is the proximate cause of the current recession, it is not the only cause. In other words, our economic weakness didn’t start in February or March; it has been building for years.

The most recent recession was over a decade ago. Here is a quick history beginning with the 2007–08 recession. In the period that is now called “the housing bubble,” banks bought assets that were backed by mortgages. These mortgages were driven by politics and an expansionary monetary policy. People were loaned mortgages that were simply beyond their means. Eventually reality hit, and borrowers started to default on the loans. As the defaults piled up, the mortgage-backed assets lost value, resulting in the banks’ balance sheets showing that they were in the red. (The value of their assets fell but their liabilities didn’t, which caused their net equity to plummet and in some cases even turn negative.) This crisis generated a political response in the form of the Troubled Asset Relief Package (TARP), and the Federal Reserve’s secretive bank bailout was conducted through its facility accounts.

The lesson learned by the banking system was that even though profits are private, losses (if you are too big to fail) could be socialized (i.e., covered by the taxpayer). The consequence of this lesson was that banks continued to engage in riskier investments on larger margins, and to make themselves so large in the process that if anything happened they would be deemed essential and bailed out.

| A banking bubble is precisely what has happened since the end of the last recession. In the years after 2009, the larger banks grew and acquired smaller banks. Meanwhile the economy grew at an anemic annual rate of 1.6 percent between 2009 and 2016.

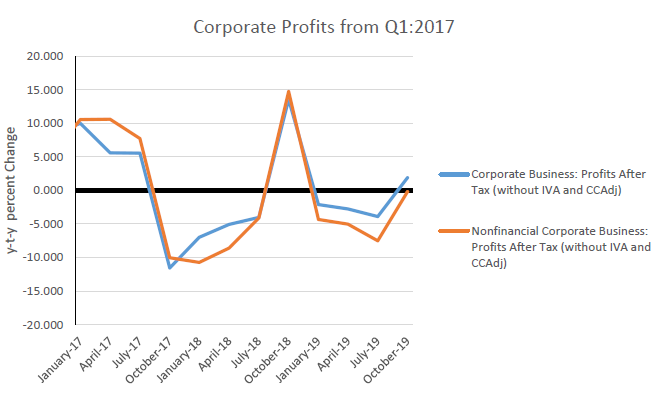

It was against this backdrop that the political winds shifted in 2016. After Trump was elected, Congress pushed through a cut in the corporate tax rate (from 35 to 21 percent). Although this repatriated some overseas profits and stimulated economic growth (averaging 2.5 percent annual real GDP growth since January 2017), it was not enough to overcome the underlying fragility built up by the previous malinvestments. Over the summer and fall of 2017, corporate profits began to soften and lose steam. In nine of the ten quarters since QIII:17, nonfinancial corporate business profit returns fell. As a result, the value of the banks’ assets softened as well. |

Corporate Profits from Q1:2017 |

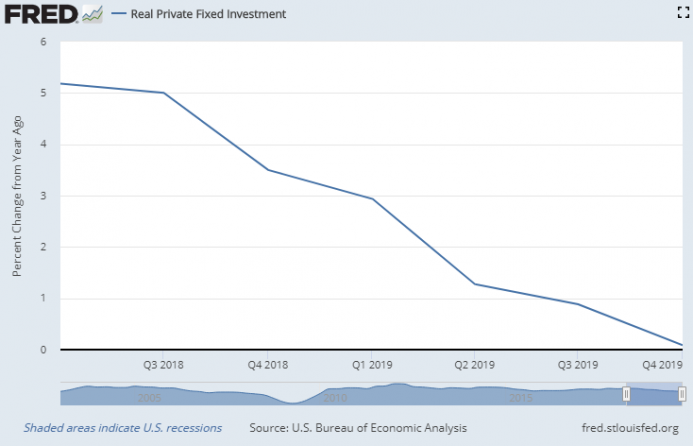

| At this point, the profits weren’t negative in absolute terms, but they were shrinking from what they were just a year prior. In other words, the economy was still growing, but it was slowing down. As profits lessened, we saw year-to-year real private fixed investment fall from 5.2 percent in QII:18 to 0.1 percent in QIV:19. |

Real Private Fixed Investment, 2018-2019 |

| Making profits, retaining earnings, and reinvesting these funds into companies is a form of saving. This fund of savings supports the investments made in the structure of production. Without these savings, the economy falters. An alternative way to temporarily prop up investment and consumption (without a firm foundation of savings) is through credit expansion. However, the problem is that credit expansion creates the malinvestments which we have been building since the end of the previous recession. At some point, the expansion has to give way to a crunch. The economy was on the path towards this crunch long before COVID-19 became a reality.

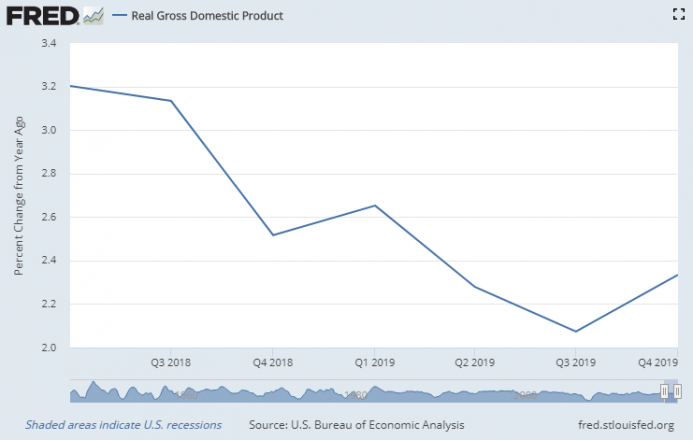

Furthermore, a general slowing of the economy also occurred as real GDP y-t-y growth fell from 3.2 percent in QII:18 to 2.3 percent in QIV:19. |

Real Gross Domestic Product, 2018-2019 |

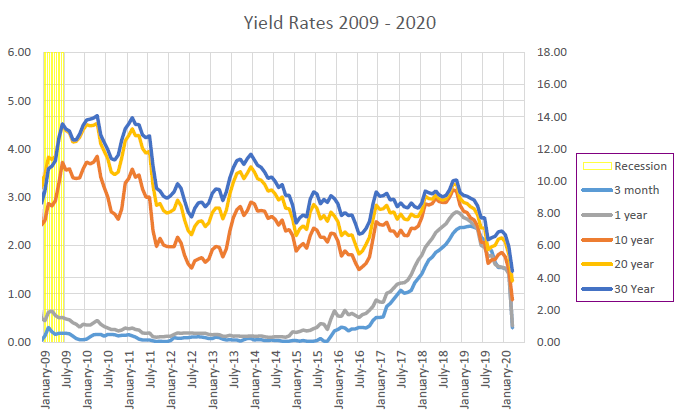

| With declining profits, a slowdown in investment for future growth, and a slowing economy, the banks’ asset values continued to decline, assets which were highly leveraged. By law, a large bank must maintain 10 percent as required reserves. As the value of the assets depreciated, the banks had to make up that difference to maintain the balance on their balance sheets, resulting in borrowing from other banks. As we see in the figure below, the short-term rates started to climb in 2015 and 2016 but accelerated their climb in 2017 and 2018. Part of this climb was due to Federal Reserve monetary tightening, but a large part of it was coming from the banks looking to shore up their crumbling accounts by borrowing funds. |

Yield Rates, 2009-2020 |

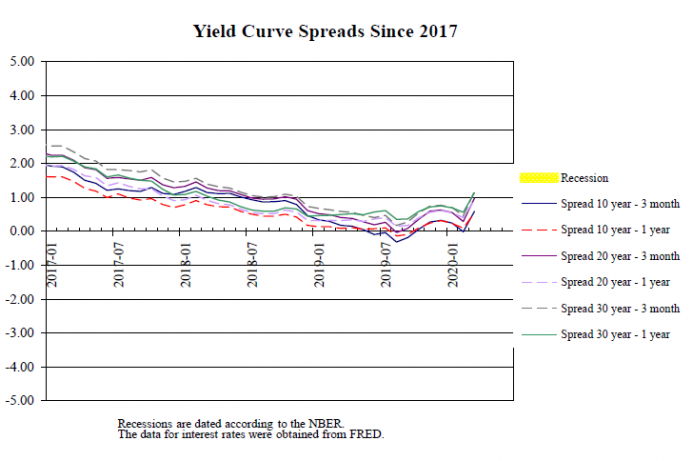

| The result of this scramble for funds results was a brief semi-inverted yield curve in the summer (June–September) of 2019. |

Yield Curve Spreads Since 2017 |

| Today, an inverted yield curve is a financial sign of a forthcoming recession. As I have shown in my September 5 article “Inverted Yield Curves, Recessions and You,” a recession was projected to take place between October 2020 and April 2021.

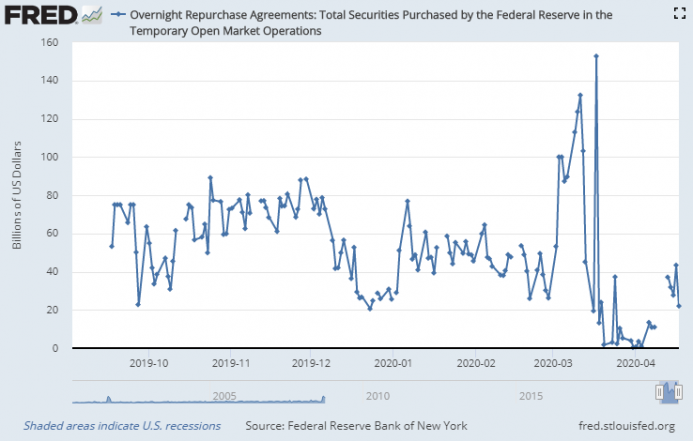

To counteract and stop the yield curve from fully inverting, the Fed took an unusual step and did something it had not done since October 8, 2008. In September 2019, it injected massive amounts of liquidity into the repo market. These injections continue today. Furthermore, on March 26 the Fed declared that banks no longer needed to maintain a 10 percent reserve ratio. The reserve ratio was waived entirely and set to zero. The intention of this combination was to make the banks financially sound. Instead these actions signal an underlying fragility in the fractional reserve system based upon a fiat money. The bottom line is that in this crisis the banks are being bailed out yet again. What is wrong with the current policy is that banks have not learned the correct lesson—that investment contains risk—because they continue to be bailed out. If the risks are transferred to the taxpayer, the banks will simply continue to build up malinvestments as they get new cash infusions. |

Overnight Repurchase Agreements, 2019-2020 |

The Current Path Is Wrong

Austrian business cycle theory explains that for the economy to establish a sound foundation, it must get rid of the malinvestments which have built up in the market. If there are a lot of malinvestments to be liquidated, then collectively that process is known as a recession. In an economic downturn, companies go out of business. This step is unfortunate, painful, and sadly necessary. A person with a cavity needs to have the bad parts of the tooth drilled away before the tooth can be filled and made strong again. No one likes to have their teeth drilled into, but if they don’t go through the short-term pain, the long-term problems fester and grow.

The road from recession to recovery is the liquidation process. Imagine a store that is unable to sustain itself. What happens? It closes, of course, but the story doesn’t end there. What happens next is the liquidation process, best illustrated through an example.

Imagine a boutique cupcake shop that has a weekly shortfall of $1,000. (I am just using $1,000 as an example; the real number would be much larger.) If the company has a gross margin of 25 percent, the store would have to make an additional $4,000 in total sales to make up the shortfall. If the government wanted to stimulate demand by giving money to consumers, it would have to give these customers $4,000 per week to prevent the store from closing. As we can see, demand-side stimulus is expensive. If instead the government cut the store’s taxes by $1,000 per week, it could achieve the same result. Thus, tax cuts are better policy than demand-side stimulus.

However, let us suppose that this cupcake company still fails. The next step for the bank (and other creditors) to foreclose on the shop. The company has a liquidation sale. The ovens, tables, chairs, and even the curtains are sold to whomever might purchase them. The money is allocated to the claimants (creditors and equity holders) in accordance with Chapter 7 of the Federal Bankruptcy Reform Act of 1978. The claimants are paid according to the absolute priority rule, where the common stockholders are the last in line. (It should come as no surprise that the lawyers always get paid first.)

Notice that the equipment—the ovens, tables, and the chairs—don’t simply disappear. They are sold to other users. In these liquidation sales, the buyers are not paying top prices. In fact, during the economic downturn, prices tend to fall (deflation). When these new buyers purchase this liquidated capital equipment, they are converting malinvestments into proper investments. The more flexible the capital is, the faster it can be added to other parts of the economy, and the quicker the economy can recover. If, however, the capital equipment is very specialized, then those tools might simply be thrown away and their total value lost. To simplify our cupcake store example, suppose that a single buyer purchases the whole store. Since this buyer has purchased this store for a fraction of the original price, the new owner can make the very same products, sell them at the previously listed prices, but instead of losing $1,000 per week could very well make a profit, because its cost structure is much lower.

In this liquidation process, the banks lose a part of the value of their loans. Through these liquidation sales, they will only recover a fraction of the value loaned out. These losses should be painful to the banks due to their miscalculations. However, the Federal Reserve’s recent actions have protected the banks from these painful lessons.

A New Path

The takeaway points are these: the bubble was caused by massive credit expansion. The recession was inevitable, and the proximate cause was the forced closures due to COVID-19. As the economy falls into recession, a continual inflating of the money supply bubble will not create a foundation for future economic growth. Expanding the money supply will only delay the inevitable and ultimately make the situation even worse. Furthermore, demand-side stimulus will not produce the “V-shaped” recovery. Economic growth is generated by saving, investment, and capital formation.

A three-pronged recipe emerges to quicken a solid and sustainable recovery. The first ingredient is to build up savings relative to spending. Savings are the cushion for a falling economy. It is savings that bidders use to buy the liquidating businesses. Without buyers for the liquidating capital, the recession cannot be converted into a recovery. Thus, policies that can quicken a recovery are those that stimulate saving (not spending).

It is troubling how little Americans save. In February 2020, the personal savings rate in the US was 8.2 percent of disposable personal income. One of the most prominent features of the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 was the personal cash injections directly into people’s accounts. The argument was that people needed that money to pay for rent, food, and other basic necessities. In contrast, the 2000–01 tax rebate, as President Bush argued, was for consumer spending. In fact, the Bush stimulus was considered a failure, because so few people spent the money on consumption. Unfortunately, neither the 2000–01 nor the 2020 policies help build up our savings fund. The better approach is for the government to reverse its spend-and-inflate policies. Cutting taxes on activities that defer consumption will ultimately lead us out of the recession more quickly.

The second ingredient is deflation. Economists have correctly associated deflation with recessions, but they have wrongly concluded that if we avoid deflation we will avoid recessions. If deflation is artificially created by a government, then yes, a recession will be the result. However, deflation is the natural way in which an economy repairs itself. It works from two fronts. The first is the liquidation process. In our example, the store had an oven. Suppose that it was originally purchased for $5,000. If the new buyer acquires it for $3,000, he is left with $2,000 that he can allocate to other factors of production. Thus, as capital equipment prices fall, it becomes easier for new entrepreneurs to get started in the recovery process. Deflation also aids recovery from the consumer end. As prices fall, consumers’ purchasing power grows. This increase in purchasing power is especially important for those who are newly unemployed. For example, if the weekly grocery budget was $300 per week, deflation means that the same amount of food can be purchased for less.

The third ingredient is anything that can expedite the liquidation process. Laws should be reformed to make the bankruptcy process easier, as well as mergers and acquisitions.

It is unfortunate that many people are using this crisis as an opportunity to advocate for socialism, nationalization, and the adoption of modern monetary policy. Every time socialism has been tried it has failed to produce enough wealth for its people. The nationalization of industries has failed because bureaucracies simply cannot engage in economic calculation. And although modern monetary theory may seem new and novel, it is nothing more than a repackaging of the ideas of the “monetary cranks” of the nineteenth century. It is now more critical than ever to return to what we know works—free markets. History has shown us time and time again that free markets generate sustained economic growth. Adam Smith found the formula as early as 1755.

Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism, but peace, easy taxes, and a tolerable administration of justice; all the rest being brought about by the natural course of things. All governments which thwart this natural course, which force things into another channel, or which endeavour to arrest the progress of society at a particular point, are unnatural, and to support themselves are obliged to be oppressive and tyrannical.

It is not a coincidence that when nations liberalized trade and opened markets there was an explosion of wealth for all—the rich, the poor, and everyone in between. This simple insight spurred a surge of growth that has had a greater impact on humanity than any virus, natural disaster, or war. It is time to simply let individuals be free.

Full story here Are you the author? Previous post See more for Next post

Tags: newsletter