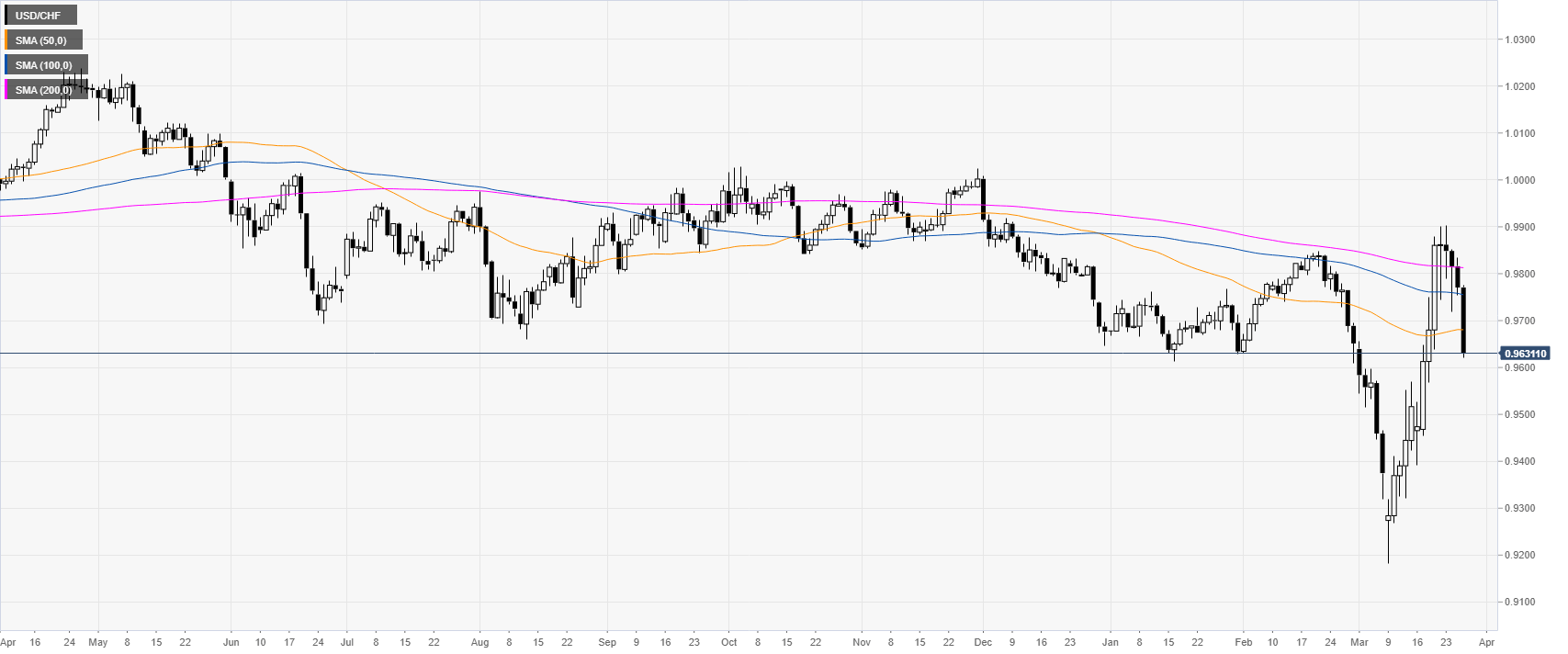

USD/CHF daily chartUSD/CHF is easing from the monthly highs as the spot drops below the main SMAs on the daily chart. The US dollar is down against most currencies this Thursday. |

USD/CHF daily chart |

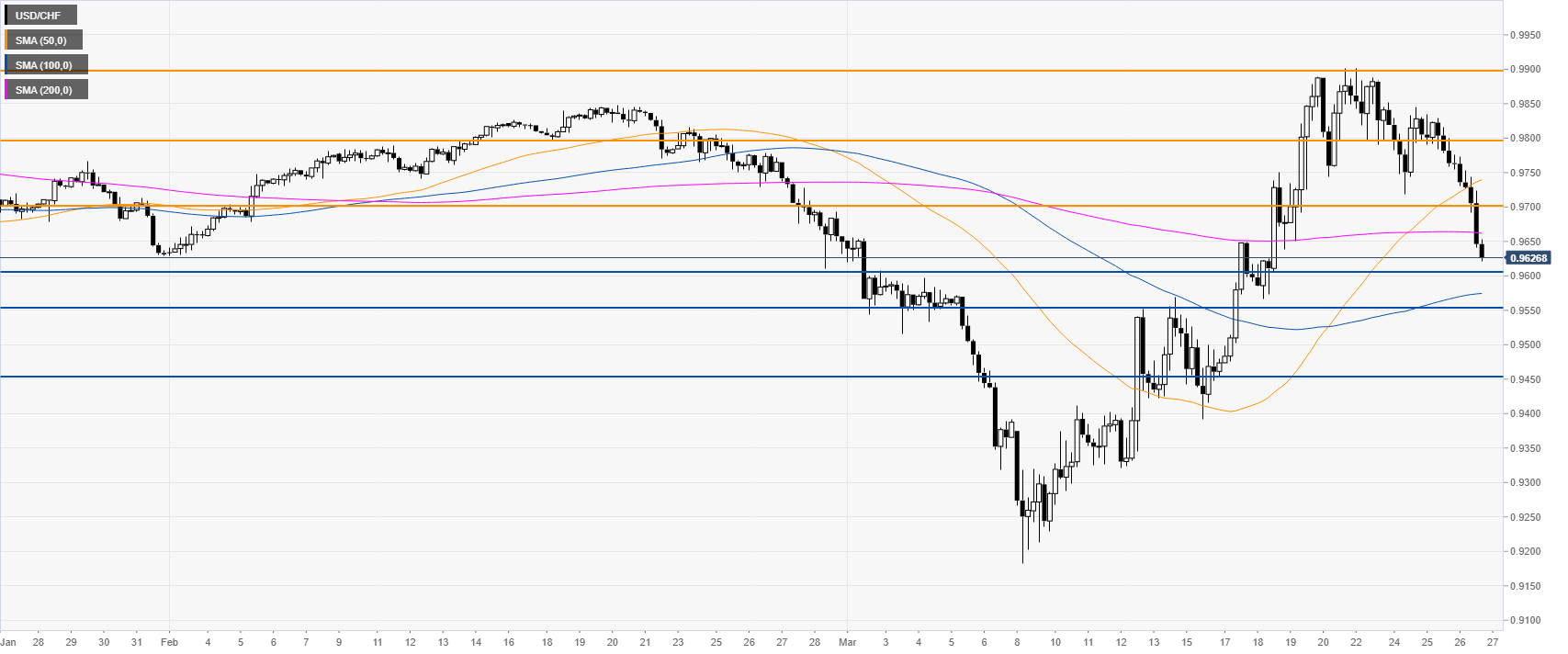

USD/CHF four-hour chartThe spot is pulling back down while nearing the 0.9600 figure below the 200 SMA on the four-hour chart. Bears could continue to extend the decline towards the 0.9550 and 0.9540 levels while the 0.9700 and 0.9800 figures could become resistance on bullish attempts. |

USD/CHF four-hour chart |

Full story here Are you the author? Previous post See more for Next post

Tags: newsletter

1 comment

Ralph

2020-03-27 at 14:32 (UTC 2) Link to this comment

test