Key developments in 2019

The current account surplus for 2019 was CHF 86 billion, CHF 29 billion more than the previous year. This increase was principally due to growth in primary income (labour and investment income). In the year under review, receipts exceeded expenses by CHF 14 billion, whereas in the two previous years, expenses had significantly exceeded receipts. The main contributors to this development had been finance and holding companies, which had reported exceptionally high expenses for direct investment earnings in the two previous years. These expenses were significantly lower in the year under review. The receipts surplus in goods trade increased by CHF 7 billion to CHF 66 billion, chiefly due to higher goods exports according to the foreign trade statistics. The receipts surplus from trade in services, on the other hand, decreased by CHF 3 billion to CHF 18 billion. In secondary income (current transfers), the expenses surplus increased by CHF 2 billion to CHF 11 billion.

On the assets side of the financial account, reported transactions showed an overall net acquisition of CHF 32 billion in 2019 (2018: net reduction of CHF 66 billion). This development was mainly attributable to reserve assets and direct investment. As a result of the SNB’s foreign currency purchases, reserve assets recorded a net acquisition of CHF 16 billion. Direct investment registered a net acquisition of financial assets of CHF 14 billion. Resident parent companies reinvested earnings and also increased their equity capital in their non-resident subsidiaries. Portfolio investment recorded a net reduction of CHF 2 billion, mainly because resident investors sold shares and units in collective investment schemes issued by non-residents. Other investment saw a net acquisition of financial assets of CHF 4 billion.

The liabilities side of the financial account registered an overall net reduction of CHF 4 billion (2018: net reduction of CHF 134 billion). Transactions under direct investment and other investment were the main drivers here. Direct investment recorded a net reduction in liabilities of CHF 18 billion. This was primarily due to non-resident parent companies withdrawing equit y capital from their resident subsidiaries. Offsetting this, non-resident parent companies reinvested earnings generated by their resident subsidiaries back into Switzerland. Other investment saw a net incurrence of liabilities of CHF 17 billion. Although the SNB reduced its liabilities towards non-residents, resident commercial banks increased their net liabilities towards non-residents. Portfolio investment registered a net reduction in liabilities of CHF 3 billion due to non-resident investors selling shares and long-term debt securities issued by residents.

The financial account balance stood at CHF 36 billion (2018: positive balance of CHF 71 billion).

The international investment position recorded an increase in stocks of both assets and liabilities in 2019. On both sides, this increase was largely a result of valuation gains due to higher stock market prices in Switzerland and abroad, although high ‘other changes in volume’ also contributed. The weaker euro and US dollar exchange rates against the Swiss franc had a dampening effect on the increase.

The other changes in volume were mainly attributable to the fact that certain capital stocks were statistically recorded for the first time. The effect of this was visible in direct investment, other investment, and portfolio invest ment.

Overall, assets were up CHF 260 billion to CHF 5,265 billion year-on-year and liabilities were CHF 324 billion higher, at CHF 4,453 billion. Since liabilities increased more strongly than assets, the net international investment position decreased by CHF 64 billion to CHF 812 billion.

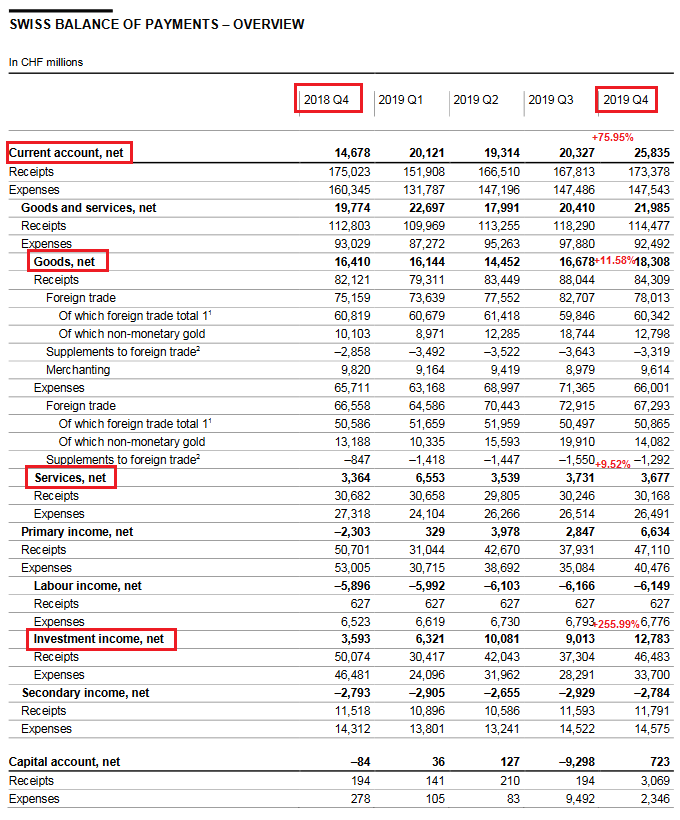

Q4 2019

Overview

In the fourth quarter of 2019, the current account surplus was CHF 26 billion, CHF 11 billionmore than in Q4 2018. The increase was primarily attributable to the higher receipts surplus in investment income and goods trade.

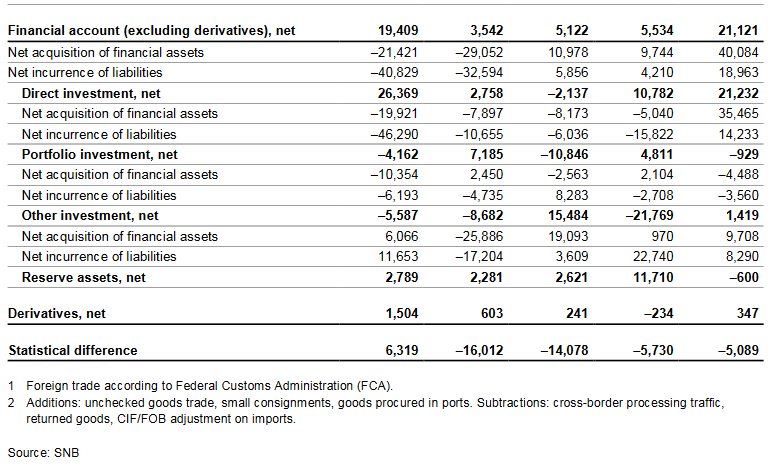

The transactions reported in the financial account showed a net acquisition of financial assets (CHF 40 billion) and a net incurrence of liabilities (CHF 19 billion) in Q4 2019. Direct investment was the main driver on both sides. Overall, the financial account reported a positive balance of CHF 21 billion.

In the fourth quarter of 2019, stocks in the international investment position increased compared to the previous quarter, on both the assets and the liabilities side. In both cases, the rise was due to multiple factors, notably the increase in connection with financial account transactions and valuation gains as a result of higher stock market prices in Switzerland and abroad. Countering this was the impact of exchange rate-related valuation losses caused by the weaker US dollar; these effects were mainly felt on the assets side, but they also influenced liabilities. Overall, assets increased by CHF 15 billion to CHF 5,265 billion. Liabilities were up by CHF 42 billion to CHF 4,453 billion. Since stocks of liabilities increased more strongly than stocks of assets, the net international investment position contracted by CHF 27 billion to CHF 812 billion.

Current accountReceiptsAt CHF 84 billion, receipts in the fourth quarter of 2019 from total goods trade exceeded the figure for Q4 2018 by CHF 2 billion. The increase was attributable to higher receipts from goods exports according to the foreign trade statistics; these rose owing to higher exports of non-mo netary go ld. Receipts from foreign trade in services amounted to CHF 30 billion, down CHF 1 billion on Q4 2018. In particular, lower receipts were recorded in telecommunications, computer and information services, and business services. At CHF 47 billion, receipts under primary income (labour and investment income) were CHF 4 billion lower than in Q4 2018. This was mainly due to lower earnings from direct investment abroad. As in Q4 2018, receipts under secondary income amounted to CHF 12 billion. ExpensesExpenses for total goods trade were unchanged compared to Q4 2018, at CHF 66 billion. Expenses for services imports amounted to CHF 26 billion, CHF 1 billion lower than in Q4 2018. The decrease was principally driven by licence fees. Expenses under primary income (labour and investment income) fell by CHF 13 billion to CHF 40 billion, mainly due to lower earnings from direct investment in Switzerland. Earnings fro m finance and holding companies had been exceptionally high in Q4 2018. On the expenses side, too, secondary income remained unchanged, at CHF 15 billion. NetThe current account surplus amounted to CHF 26 billion, a CHF 11 billion increase compared to Q4 2018. It is calculated as the sum of all receipts (CHF 173 billion) minus the sum of all expenses (CHF 147 billion). |

Current Account Switzerland Q4 2019(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) |

Financial accountThe following is from the official press release and gives more details on the other parts of the financial account.

|

Swiss Financial account, Q4 2019 |

Switzerland’s International investment positionAssetsStocks of assets rose by a total of CHF 15 billion to CHF 5,265 billion compared to Q3 2019.This rise was due to the increase in connection with financial account transactions and also, in particular, to higher stock market prices on foreign exchanges. The weaker US dollar, on the other hand, dampened the rise. Direct investment increased by CHF 19 billion to CHF 1,928 billion, mainly due to the transactions. Portfolio investment stocks rose by CHF 24 billion to CHF 1,425 billion, largely as a result of the higher stock market prices. Other investment assets fell by CHF 8 billion to CHF 997 billion, and derivatives assets by CHF 14 billion to CHF 89 billion. Reserve assets decreased by CHF 6 billion to CHF 826 billion. LiabilitiesStocks of liabilities rose by CHF 42 billion overall to CHF 4,453 billion. This was mainly due to significant valuation gains as a result of price rises on the Swiss stock exchange. These valuation gains were reflected in the portfolio investment figures where stocks of liabilities were up CHF 61 billion to CHF 1,294 billion. Direct investment liabilities increased by CHF 2 billion to CHF 1,758 billion. Other investment liabilities decreased by CHF 5 billion to CHF 1,213 billion. Derivatives declined by CHF 16 billion to CHF 88 billion. Net international investment positionGiven that stocks of liabilities (up CHF 42 billion) increased more strongly than stocks of assets (up CHF 15 billion), the net international investment position fell by CHF 27 billion to CHF 812 billion. |

Switzerland International Investment Position, Q4 2019(see more posts on Switzerland International Investment Position, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: newsletter,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account,Switzerland International Investment Position