| via Bloomberg

Gold climbed for a fourth day as investors weighed the unfolding coronavirus crisis, including a stark warning from the head of the World Health Organization about the potential for more cases beyond China and signs the disease is spreading in the key Asian trading hub of Singapore. Prices rose as the death toll from the outbreak topped 900 and WHO Director-General Tedros Adhanom Ghebreyesus voiced concern over the spread from people with no travel history to China, saying “we may only be seeing the tip of the iceberg.” In Singapore, there are two confirmed cases in the central business district, according to a building manager and separate company. Bullion’s trading near the highest since 2013 as investors assess the impact of the disease on global growth and appetite for risk, although concerns over weaker physical demand for gold in China is capping gains. |

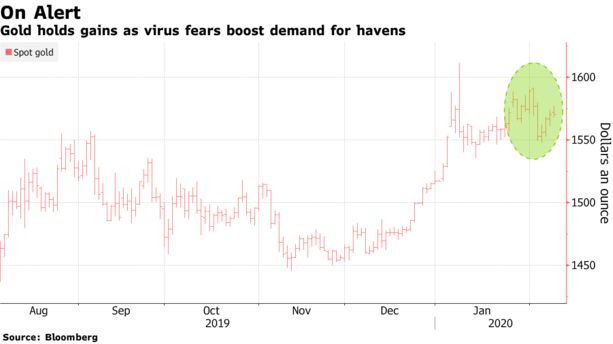

Gold Holds Gains as Virus fears boost demand for havens, 2019-2020 |

| The effects of the virus have presented a “new risk” to the outlook, according to the Federal Reserve, and the issue will probably be front and center when Chairman Jerome Powell kicks off two days of Congressional testimony on Tuesday.

“All the way through, gold has received good support, and the fact that we’re once again seeing it bubble upward does suggest those concerns are increasing,” said Michael McCarthy, chief market strategist at CMC Markets. Spot gold rose as much as 0.4% to $1,576.71 an ounce and traded at $1,573.24 at 8:24 a.m. in London. Prices gained 1.1% in the last three days. The unfolding health emergency has seen holdings in global exchange-traded funds backed by bullion expand to a record. The haven is in focus as the disease spreads around the globe and equities stumble. In Singapore, there are 43 confirmed cases of the virus — the largest number of infections outside China, excluding a quarantined ship in Japan. Those infected include a taxi driver, overseas worker, baby, and a teacher. Among other main precious metals, silver added 0.3%, platinum climbed 0.5% and palladium advanced 1.3%. |

10 Year Gold Price in USD/oz |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newsletter