The SNB’s monetary policy is geared to counteracting upward pressure on the Swiss franc against the Euro. (© Keystone / Ti-press / Alessandro Crinari)

The Swiss National Bank’s negative interest rates, introduced five years ago, are having an increasingly significant economic and social impact. But despite criticism, the SNB does not want to remove them. It considers the measure necessary to stop the Swiss franc appreciating too much.

Why were negative interest rates introduced?

Following the financial crisis of 2008, many central banks took an unprecedented series of measures to keep the banking sector afloat and to avert a possible economic depression. These included historic interest rate cuts. In the United States and the eurozone, interest rates fell to almost zero a few years ago.

Because the Swiss franc is regularly used as a safe haven currency in times of crisis, the SNB was forced to go below zero. Five years ago, the SNB lowered its key interest rate to -0.75% in order to avoid a further appreciation of the Swiss franc.

What is the purpose of negative interest rates?

The primary purpose of low or negative interest rates is to encourage banks and other investors to invest their available capital in the economy rather than parking it with central banks. At the same time, because the cost of money is low, companies can borrow from banks to finance new projects more easily.

In the case of the SNB, the main purpose of negative interest rates is to make the franc less attractive. The SNB has also used its currency reserves, which total CHF800 billion ($815 billion), to intervene in the foreign exchange market with the same objective.

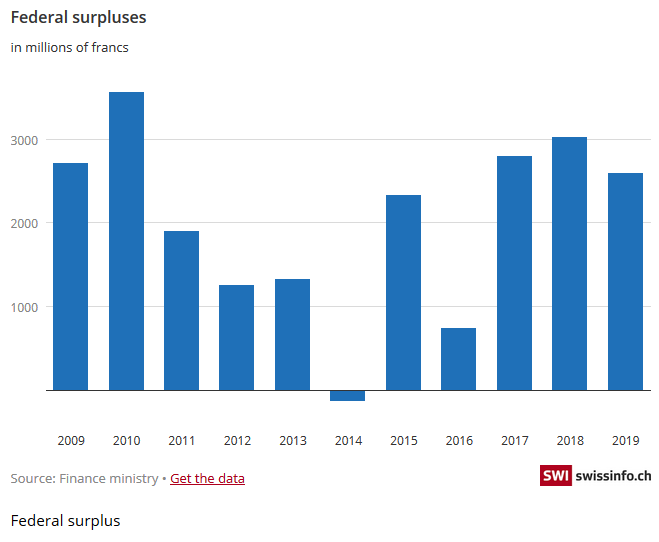

Who benefits?Businesses: Because negative interest rates keep the value of the Swiss franc within limits, they benefit primarily the export industry and the tourism sector. Companies active in the domestic market also benefit from low interest rates as they can get cheap loans. The State: With a total debt of almost CHF200 billion, the government, cantons and municipalities have largely benefited from the low cost of money. Low interest rates have helped the government generate billions in surpluses over the past decade, which can be used to reduce debt. Healthy public finances have also benefited taxpayers to some extent. Property owners: Because mortgage interest rates have been at unprecedentedly low levels for several years, property owners also benefit from negative interest rates. At the same time, the prices of houses and apartments in many regions of Switzerland have practically doubled within a decade. |

Federal Surpluses, 2009-2019 |

Who loses?

Banks: Financial institutions had to spend around CHF2 billion in 2019 to pay the negative interest on the money they deposit with the SNB. Seeing their margins reduced, some banks also began to charge negative interest on their own customers’ accounts. So far, however, this practice has applied only to assets over CHF100,000. Banks have also compensated for the losses by charging clients more account management fees.

Savers: For some years now, savings have been earning interest at rates just above zero. At the beginning of the 1990s, people who had CHF10,000 in a bank account still received up to CHF500 in interest per year. Today, at best, one has to be content with a few dozen francs, which are often used up again by the costs of keeping the account.

Pension funds: Until about ten years ago, pension funds were able to pay substantial interest to their policyholders, thereby making a significant contribution to the growth of their old-age assets. This is no longer the case. Obliged to deposit at least part of their funds in secure investments such as bonds, pension funds now earn much lower incomes, which are only partially offset by investments in shares and real estate. Banks have also started to apply negative rates on funds deposited by pension funds. The state pension scheme also faces similar problems, although to a lesser extent.

How long will negative interest rates last?

The SNB still sees no alternative. It is obliged to adapt to the monetary policy pursued by other central banks, starting with the European Central Bank. The situation in the eurozone remains rather fragile and uncertain. Last autumn, a number of major central banks eased their monetary policy, signalling that they were likely to leave their reference rates at a low level for a prolonged period.

In recent years, the SNB has faced severe criticism with regard to negative interest rates. The unions are urging the bank to use part of its profits for the state pension scheme and pension funds, which have been penalised by the negative interest rate strategy. SNB President Thomas Jordan says the task of the central bank is not to pursue a social policy but to pursue the general interest of the country. In recent years, the Swiss economy has grown slightly compared with many other European countries, while unemployment had fallen to 2.3% at the end of 2019.

Full story here Are you the author? Previous post See more for Next postTags: Business,newsletter