| If you want to make money from investing, it’s simple: find a bull market and go long. And in 2020 gold and silver are in a bull market.

by Dominic Frisby via the UK’s best-selling financial magazine Money Week I ran into Jim Mellon at a party at the weekend, and we soon got talking about markets. One of his comments – stated with surety and simplicity – has stuck in my mind. “Investing in 2020 is going to be easy,” he said. “All you need to do is own gold and silver.” He said it like it was a no-brainer. And in many ways it is a no-brainer. Investing can be as simple or as complicated as you want to make it. But the bottom line is this: find a bull market and go long. That really is all you need to do. |

|

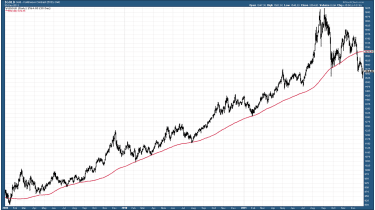

All the signs are that precious metals are in a bull marketYou need some kind of device by which you can define a bull market – and that’s where the arguments start – but if you have a device you are satisfied with, that’s all you need. The rest is noise. I like moving averages, as you may know. I like them to be sloping up and I like the price to be above. But other people have different methods – and good for them. And, like it or not, gold and silver are in a bull market. There might be better bull markets out there – there almost certainly are – but a bull market is a bull market is a bull market. If you want to get academic, you could argue that the bull market started in late 2015 when gold hit $1,050 an ounce. Or you could say it only really got going after the 2016 lows at $1,125. Or the 2018 lows at $1,170. Whatever. Each high was lower than the last, and since the autumn of 2018, the trend has been clearly rising. I’m going to let you into a little secret here. The 144-day simple moving average (144DMA). During the last bull market of the 2000s, it worked like a dream. Lord knows why, but you could set your clock by it. All gold’s corrections in that ongoing bull market seemed to stop at the 144DMA, especially during that period from 2009 to 2011. There were times when gold would start to correct and I could confidently write on these pages the price at which the correction would end, and often I would nail it to the nearest dollar. People would come up to me at conferences, thanking me for the money they had made, believing I had some kind of guru-like power. Time and time again it worked. Here’s gold over that period with the 144DMA underneath in red. You can see that every single correction ended at the 144DMA. Then at the end of 2011 the indicator stopped working, and that, it seemed, was the end of it. |

|

The mysterious 144-day moving average appears to be working againHere’s gold over the last 18 months, with that 144DMA drawn on once again in red. If nothing else, it’s an indicator of trend. It’s rising, and the price is above, so medium and long-term investors want to be long as long as things stay that way. But the good news, it seems to be working once again as a bottom-fisher too. The 2018 consolidation/correction ended thereabouts, and so did the one of autumn of last year. Lord knows why it works. The extraordinary power of Fibonacci numbers maybe. But it’s an extremely useful tool in a gold bull market it seems. And, like Jim Mellon, it’s saying “be long”. Nor is this a US dollar thing. Gold is rising against all currencies, and is close to all-time highs against most of them. Ross Norman, meanwhile, has proved the LBMA’s (London Bullion Market Association) number one forecaster over the last 22 years, proving even more reliable than the 144DMA. He pinged me an email with his forecasts for the gold and silver price in 2020. “2019 was the year we learned that central banks are locked into QE-forever,” he said. He has a point. The Fed’s recent actions coming to the rescue of the ‘repo’ market, which had ground to a halt back in September, and lending money directly, was QE (quantitative easing) by a different name. Ross continued: “With global debt-to-GDP ratios hitting a record 322% and with equities massively overvalued… it just depends upon when and not if the proverbial hits the fan. Financial markets are trapped and we expect gold to respond by hitting an all time high in the second half of 2020.” Ross forecasts an average price of $1,755, a high of $2,080 and lows at $1,520. The LBMA’s number one gold forecaster being as bullish as that will be music to the ears of gold bugs. Silver, meanwhile, was up 15% last year. Ross sees something similar in 2020 with an average price of $19.25, a high of $23.00 and lows around $17.50. Plenty to ponder then. Currently gold sits at $1,560, while silver is at $18. I don’t think I’m quite as bullish as Ross or Jim. But I like the cut of their jib. I’m long gold, I’m long silver, and the trend is up. Enjoy 2020! |

|

In this special podcast to celebrate GoldCore’s appointment as an Approved Distributor of The Royal Mint, the GoldCore team discuss the ‘3 Key Things to Protect Your Finances in the 2020s’ |

|

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newsletter