|

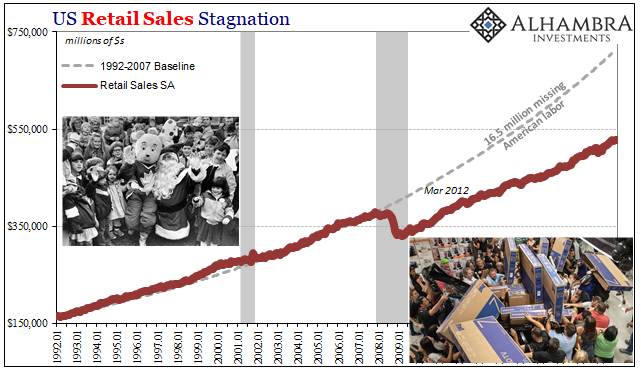

Gone are the days when Black Friday dominated the retail calendar. While it used to be a somewhat fun way to kick off the holiday shopping season, it had morphed into something else entirely in later years. Scenes of angry shoppers smashing each other over the few big deals stores would truly offer, internet clips of crying children watching in horror as their parents transformed their local Walmart into Thunderdome. Two shoppers enter, one shopper leaves…with the goodies. Economists if they weren’t too busy trying to figure out why central bank bond buying doesn’t affect bond prices all that much might call this an increasing price sensitivity among American consumers. It’s as if something big happened over the last decade or so to turn what used to be Christmas celebration into an all-out bargain war. I’m exaggerating, of course, certainly as to the extent of the few who would become transformed into the overzealous – but not about price sensitivity. Because Economists and central bankers won’t do it, there’s no accounting for how the booms never boom except in these other ways. This one will do it graphically: |

US Retail Sales Stagnation, 1992-2012 |

| In search of better bargains, lower average prices overall, and perhaps a less Ultimate Fighting retail experience, Americans and much of the rest of the world have been taking their business to the internet. Black Friday has been surpassed by Cyber Monday. Even the shopping on Black Friday itself has been transformed into another big e-commerce day.

How much retailers pull in from their websites now makes or breaks their year. It all comes down to this. Or not. Recall what happened last year. The November part of the holiday season was disappointing, a bit less than the unemployment rate and Jay Powell had prepared everyone for. |

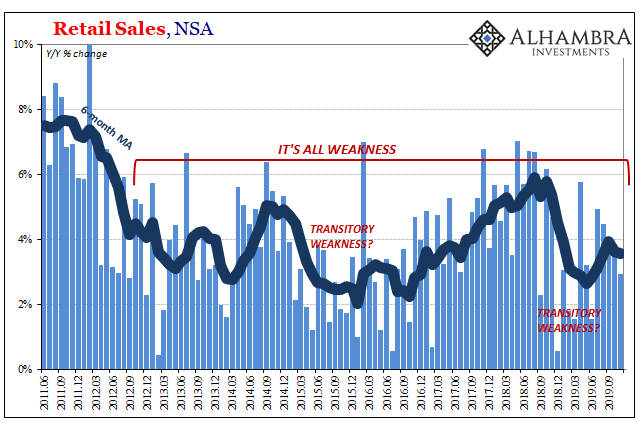

US Retail Sales, NSA 2011-2019 |

| December, however, was a total disaster. It was so bad officials were running around the media circuit trying to claim it had to have been a statistical anomaly.

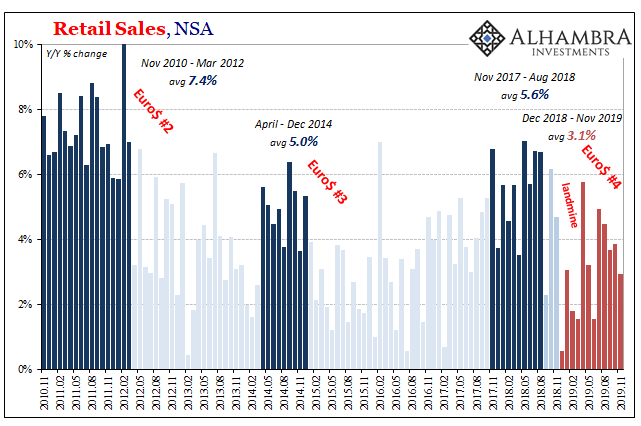

Sadly, no, December 2018 was the start of something. That something has continued throughout 2019, even unfolding according to the pattern established before during these same types of periodic downturns. The Census Bureau announced today that retail sales in November 2019 were pretty dismal. To kick off this year’s Christmas Season, American shoppers spent more than they did last year but not much more. Total retail sales, unadjusted, were up just 2.94% from last November. That’s (still) recession-ish territory. |

US Retail Sales, NSA 2010-2019 - Click to enlarge |

| For non-store retail sales, those gathered online from days like Cyber Monday, the receipts were up just 7.2%. That sounds like a lot but over the past several months non-store retail sales had been growing by an average of 14%.

But this year’s Cyber Monday fell in December. That means we have to depend upon Census’ seasonal adjustments and calendar filters to give us a sense of how things went on a more apples-to-apples basis. Seasonally-adjusted, non-store retail sales were up just 11%; still significantly less than recent months. It was a dip at the worst possible time, even if we don’t quite yet know how big of one. |

US Retail Sales Non-store, NSA 1993-2019 |

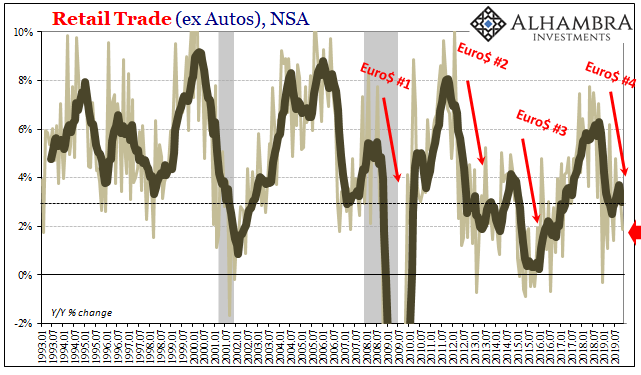

| Adjusted or unadjusted, the sales estimates are all pretty bad. Excluding auto sales, which continue to mildly rebound, the unadjusted year-over-year increase was an alarmingly low 2.47%. Taking out sales of both autos and food, the gain was a downright pitiful 1.86%. |

US Retail Trade, NSA 1993-2019 |

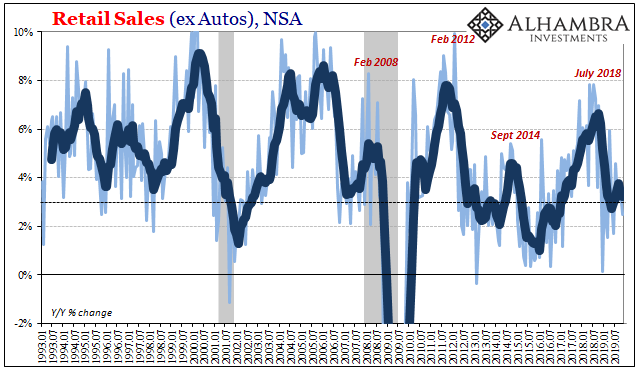

US Retail Trade, NSA 1993-2019 |

|

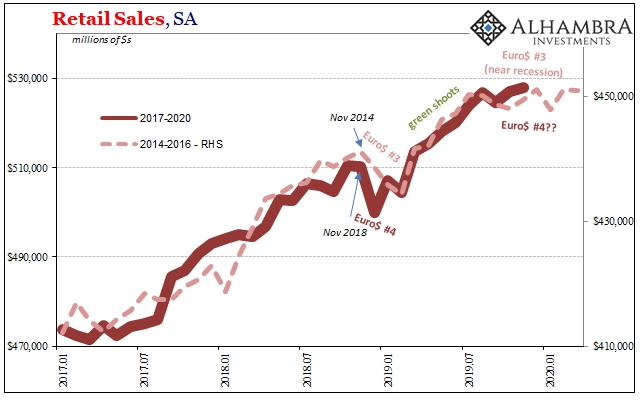

| All of this follows a few months over the summer where it seemed like the American consumer might have turned a corner. If last Christmas was the beginning of a downturn, these headwinds current policymakers refuse to call anything but “cross currents”, they were expected to be “transitory” and disappear in plenty of time for the holidays.

In July and August, that seemed at least plausible. There was some stabilizing in terms of retail sales and then a modest pick up during summer. Unfortunately, this tends to happen especially during the downturn cycles. Therefore, it wasn’t possible to distinguish the one (transitory) from the other (not-transitory) with just those few months. |

US Retail Trade, SA 2017-2019 |

Instead, September’s estimates began to illustrate our answer. Retail sales on a seasonally-adjusted basis fell month-over-month, suggesting how the economy was still consistent and tracking with the latter, the downturn. With October and now November figures, it makes three months following this well-worn pattern.

November’s questionable Christmas kickoff becomes just more evidence for something rotten in the state of the economy.

For weeks leading up to Black Friday week, retailers had been fretting what they fear is a too-shortened holiday season. With Thanksgiving falling late in November, pushing Cyber Monday into December, the industry worries Americans won’t have enough time to shop all that they might want.

As if parents are going to buy fewer gifts for their children if the big online and brick and mortar deals hadn’t been pushed forward by retailer angst to the week before Thanksgiving.

Many still hope that with Cyber Monday kicking off December this month will end up making up for what some will think was missing from last month. The Census Bureau’s seasonal adjustments, however, say don’t count on it.

Seasonally-adjusted, taking into account which holiday went where on the calendar, total retail sales were up just 3.48% year-over-year in November. Not materially better than the unadjusted result. Retailers should be more worried about how very real economic constraints are actually constraining consumers rather than imaginary calendar ones which don’t.

Full story here Are you the author? Previous post See more for Next post

Tags: consumer spending,currencies,economy,Federal Reserve/Monetary Policy,Markets,newsletter,Retail sales