- Major European stocks post modest losses on Wednesday.

- US Dollar Index clings to gains above 97.30.

- Coming up: Swiss National Bank’s (SNB) Quarterly Bulletin.

The USD/CHF pair dropped to its lowest level since late August at 0.9798 on Wednesday but staged a technical recovery in the last hour. As of writing, the pair was up 0.05% on the day at 0.9808.

After major Asian equity indexes closed the day in the negative territory on Wednesday, European stocks struggled to gain traction to reveal a sour market mood, which benefits the safe-haven CHF. Additionally, the 10-year US Treasury bond yield is down 0.6% on the day to confirm the risk-off atmosphere. The lack of fresh developments surrounding the US-China trade deal seems to be forcing investors to book their profits following the risk rally.

Attention shifts to SNB publicationLater in the day, the Swiss National Bank (SNB) will release its Quarterly Bulletin that includes the monetary policy report. The bank is likely to reiterate its willingness to interfere in the FX markets with an aim to curb CHF’s strength. In an interview with Blick on Wednesday, SNB Chairman Jordan explained that although there was no need tor an additional rate cut at the moment, the bank wouldn’t hesitate to act to further deepen negative rates if CHF were to appreciate strongly. On the other hand, the US Dollar Index is adding 0.2% on the day at 97.38 ahead of the American session to help the pair limit its losses. There won’t be any significant macroeconomic data releases from the US in the second half of the day and the market sentiment is likely to continue to drive the pair’s action. |

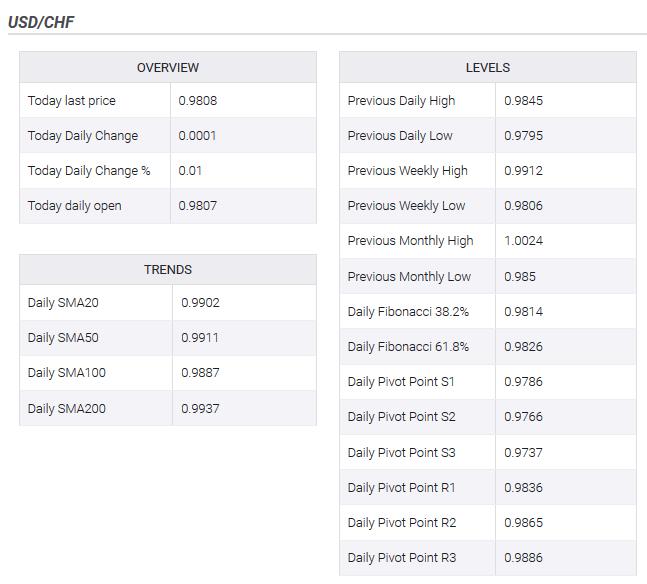

Technical levels to watch for USD/CHF(see more posts on USD/CHF, ) |

Tags: newsletter,USD/CHF