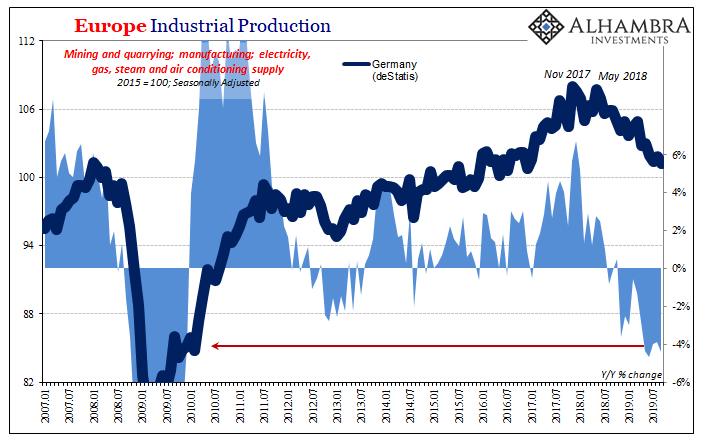

| Germany’s vast industrial sector continued in the tank in September. According to new estimates from deStatis, that country’s government agency responsible for maintaining economic data, Industrial Production dropped by another 4% year-over-year during the month of September 2019. It was the fifth consecutive monthly decline at around that alarming rate.

Four percent doesn’t sound like much, but in the context of German IP it is well within recession territory. During the 2012 recession which ravaged all of Europe, the biggest decline in IP during it was all of 2.9% (Nov ’12). Ten years earlier, during Germany’s (and the world’s) version of the dot-com recession, the worst month was -4.9%. And there was only a single four-month period at the end of 2001 and the beginning of 2002 when IP declined consecutively by around 4% or so. These are not times that Germans remember fondly. |

Europe Industrial Production, 2007-2019 |

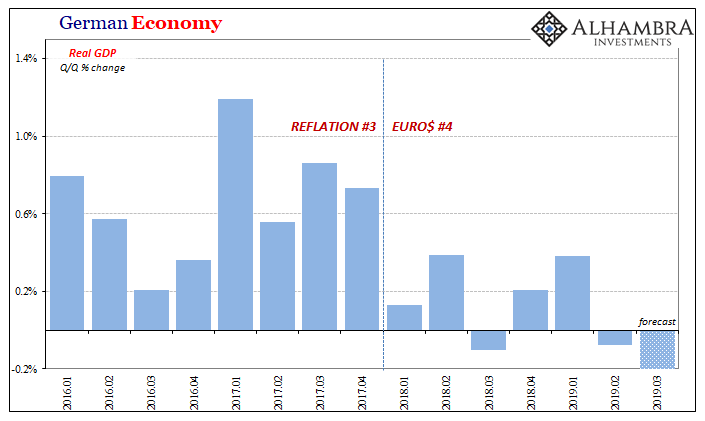

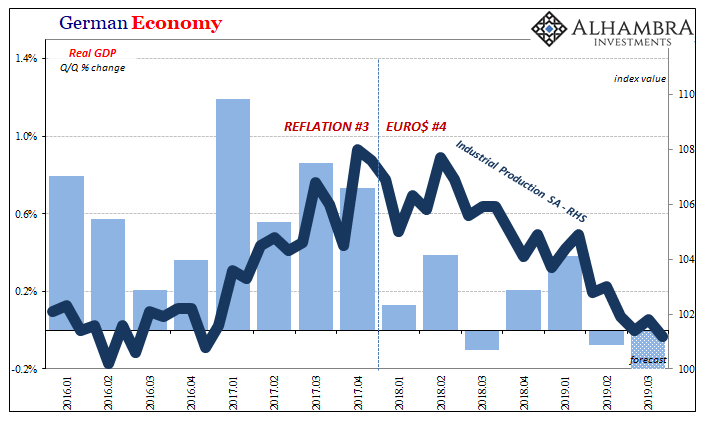

| We will find out next week if this means the German economy has finally met the terms of the so-called technical definition for recession – two consecutive quarters of negative GDP. Q2 2019 was negative and all signs point to an even greater minus during Q3. As it stands, Germany’s output has been on and off flirting with minuses ever since the first quarter of 2018.

Pretty much the moment the calendar flipped from 2017, even though it was the height of inflation/boom hysteria, it has been steadily if not spectacularly downhill ever since. Not trade wars; dollar. The euro as other currencies slammed into the eurodollar wall in January 2018. What that meant has been classic eurodollar squeeze. In IP, you can see it clearly. And you can also see it in GDP, though it doesn’t fit with conventional ideas about the business cycle. |

Germany Economy 2016-2019 |

| We are taught that an economy either booms or busts, no in-between. That’s just not true; there’s much more nuance to every situation. In terms of these eurodollar squeezes, what results especially in GDP is a clear change in the overall situation. Not flipping directly from growth to recession, rather an end to growth and the beginning of volatility and instability.

That’s the squeezing. It can go on for a very long time, as it has already. Germany is closing in on two years of grinding downward a little bit at a time and not in a straight line. That’s remarkable in many ways, not least of which is how it defies the conventional expectations (and explanations) for boom/bust cycles. And, of course, at each and every gyration during that time toward the positive, a plus month of IP or especially a positive quarter in GDP (see: Q1 2019), is overhyped as the definitive signal of the end to the downturn and the guaranteed beginning of the rebound. Even though it never happens, Economists and central bankers always try to extrapolate in straight lines because they don’t understand and therefore cannot appreciate the nature of the instability and what it does to the economy. It happens in both directions, as we are seeing right now especially in the US narrative; if the economy turns weak but doesn’t immediately fall into an obvious recession, Economists take that as a sign of strength and resilience. The economy didn’t go straight down, therefore there must be underlying strength no one can actually see in the data. On the other hand, when some positive does show up it is immediately seized upon as the first step of several future steps accelerating into the happy Hollywood ending. In German GDP, such as Q1 2018 accelerating into Q2; and again from the first minus in Q3 2018 followed by two straight quarters of advancing “growth” in Q4 and then Q1 2019. Neither of those suggested what everyone said they did. The instability of the ongoing squeeze, not the straight lines of orthodox binary extrapolations. |

Germany Economy 2016-2019 |

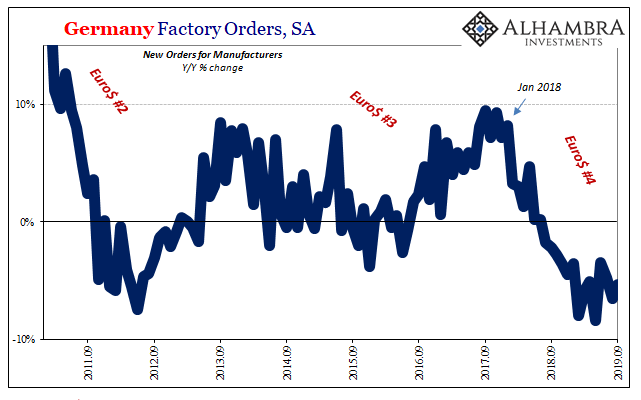

| Why does anyone outside of Germany care about that country’s convention-defying slow burn into an outright recessionary condition? To begin with, German industry is a pretty good proxy for global growth. If it stumbles, it’s a good bet that’s because something’s wrong outside of Germany. Substantial negatives you shouldn’t (and ultimately can’t) just ignore.

More importantly, it is a prime example of the squeeze effects. Again, these defy traditional notions of the business cycle beginning with the element of time. The longer it goes on the more people are told it must be trivial. The opposite is true; the longer the squeeze keeps squeezing, the more intractable the instability, the more likely it leads to someplace even worse than volatility. The downside risks rise with time. Even Jay Powell seems to understand that danger. |

Germany Factory Orders, SA 2011-2019 |

| Back in September at his press conference announcing the Fed’s second (out of three so far) rate cut, he stated all the usual optimistic pabulum. How the economy is in a really good place, strong labor market, models foreseeing no real trouble ahead, etc.

But then he admitted:

They don’t expect “particularly to weak global growth” but that’s because they don’t understand the instability of the squeeze as it never makes an appearance in their econometric models (GIGO: garbage in, garbage out). At this point, though, even Powell has to recognize how nothing has gone the way the models have forecast, and the reason is “particularly to weak global growth.” Therefore, even if he has no idea why “particularly to weak global growth” he at least understands if that gets worse it will put even more downward pressure on the US economy and further cause the FOMC to undertake more than just the three rate cuts. |

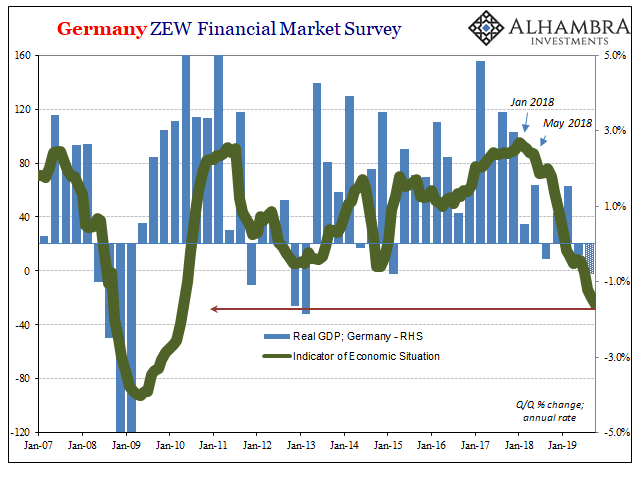

Germany ZEW Financial Market Survey 2007-2019 |

Thus, Germany. What we see there is already pretty bad, but more importantly there isn’t any sign of a turnaround. Even after almost two years, forward-looking indications are looking forward to more downside. The squeeze is still squeezing Germany, so we should expect the slow grind lower to show up around the rest of the world, too.

The post A Perfect Example of the Euro$ Squeeze appeared first on Alhambra Investments.

Full story here Are you the author? Previous post See more for Next post

Tags: economy,EuroDollar,eurodollar squeeze,factory orders,Federal Reserve/Monetary Policy,Germany,global growth,industrial production,newsletter,real GDP,ZEW