| A synchronized global slowdown, with no end in sight, has spooked some of the wealthiest investors around the world, according to a new survey from UBS Wealth Management, seen by Bloomberg. UBS polled wealthy investors, who are preparing for a significant stock market correction by the end of next year. |

S&P 500 Index, 2013-2021 |

In the survey of more than 3,400 high net wealth respondents, 25% said they’ve sold risk assets, such as equities, commodities, and high-yield bonds, and have transitioned into cash. The synchronized global slowdown, coupled with a US-China trade war, were some of the greatest concerns of respondents.

|

Trade Price, 2016-2021 |

| About 80% of the respondents expect volatility to increase through 2020, and 55% believe a market plunge could occur before Q4 2020.

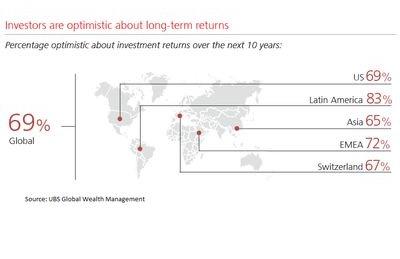

Worse, 60% of respondents expected to raise cash levels in the coming quarters (i.e., sell stocks). Most respondents said the added caution is due to a possible blowoff top in global equity markets. About 70% of respondents are optimistic through 2030. |

Investors are optimistic about long term returns |

“The challenge is that they seem to want to respond” to short-term uncertainty “by really shortening their time horizons and shifting to assets like cash that are safe,” said Michael Crook, a managing director on the investment strategy team. Though with many of these people investing on a time horizon across decades and for future generations, that “seems like a mismatch.”

And while most respondents said they’re preparing for market turbulence in the short term, many should rethink their US outlook for the next decade. Teddy Vallee, CIO of Pervalle Global, shows that the “US is dead money for the next 10 yrs.”

US is dead money for next 10 yrs. $SPX pic.twitter.com/m3WszBeg8c

— Teddy Vallee (@TeddyVallee) October 28, 2019

Vallee suggests that today’s parabolic up moves in stocks could actually be blowoff tops, similar to what was seen in Nikkei 225 in late 1989/90.

Full story here Are you the author? Previous post See more for Next post

Tags: newsletter