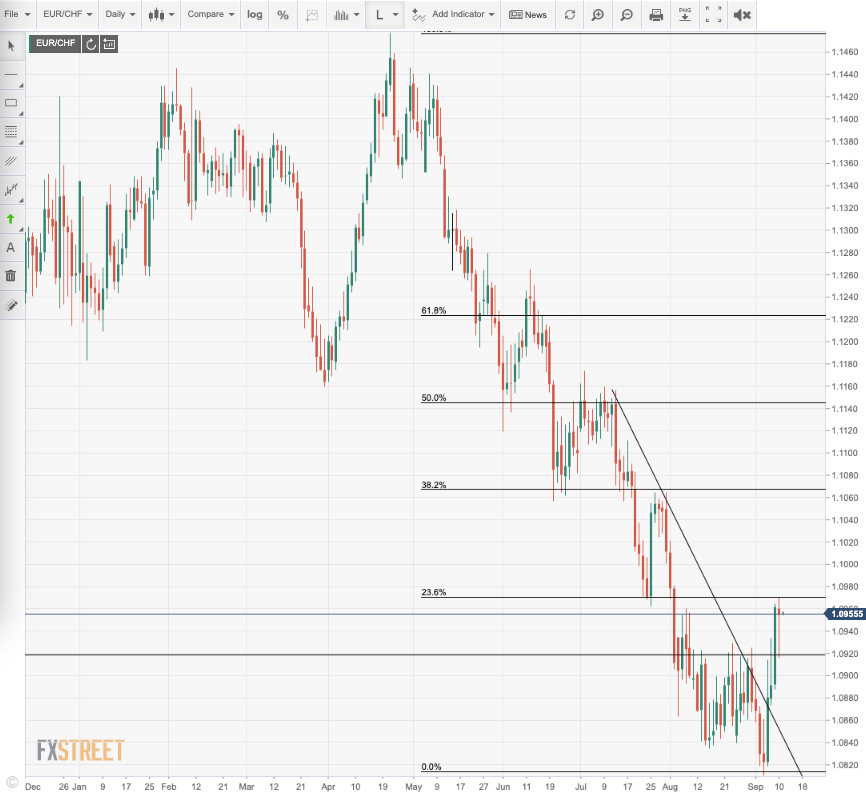

- The cross needs to hold above the 1.0970s and beyond the 25th July swing lows.

- To the downside, a break back below the prior descending resistance will spell bad news for the bulls.

| EUR/CHF has been running higher of late, despite the onset of the European Central Bank – a possible buy the rumour sell the fact scenario as the less committed euro shorts are squeezed.

Nevertheless, the price action is all the counts from a technical analysis perspective. EUR/CHF has made for a compelling long, and if it was not for the ECB and risk of SNB intervention, would be a high probability set up considering the breakout fro trend line resistance has pulled back around a 50% mean reversion and printed a decent-sized bullish pin bar and has subsequently closed overnight at the highs. However, the cross needs to break and hold above the 1.0970s and beyond the 25th July swing lows to attract a commitment from the bulls. 1.1070, a cent higher, would be the first target as a combination of the late July resistance and late June support – This area has a confluence of the 38.2% Fibonacci retracement of the April swing highs to Sep swing lows. The following target would come as the 50% retracement of the same range up in the 1.1140s. To the downside, a break back below the prior descending resistance will spell bad news for the bulls as a test of the 1.08 handle will then be back in play. |

Daily EUR/CHF, September 11(see more posts on EUR/CHF, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: EUR/CHF,newsletter