|

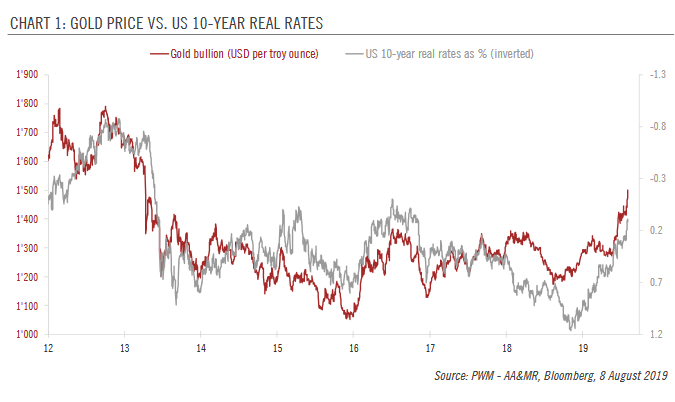

Increased trade tensions have boosted the gold price to above USD 1,500. The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce. The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets. Coupled with strong demand from central banks, the medium-term outlook of the yellow metal has improved. However, in the short term, we see a high probability of a mild correction because the recent sharp rise in gold may suffer from less supportive news flows than of recent days. In the medium term, rising trade tensions are likely to weigh further on global growth and elicit more accommodative monetary policy from central banks. Coupled with strong official demand, elevated global uncertainties and a mature US business cycle, we favour more upside for gold on a 12-month time horizon from current levels (USD 1,500 on 8 August). In a nutshell, as the number of positive-yielding bonds falls, the rationale for holding a liquid safe haven asset such as gold rises. In light of the recent developments, we have decided to increase our projections for the gold price. We favour a gold price of USD 1,440 on a three-month time horizon (versus USD 1,320 previously), USD 1,500 on a six-month time horizon (versus USD 1,380 previously) and USD 1,600 on a 12-month time horizon (versus USD 1,480 previously). |

Gold Price vs US 10-year Real Rates, 2012-2019 Source: perspectives.pictet.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: gold forecast,Gold prices,Macroview,newsletter