|

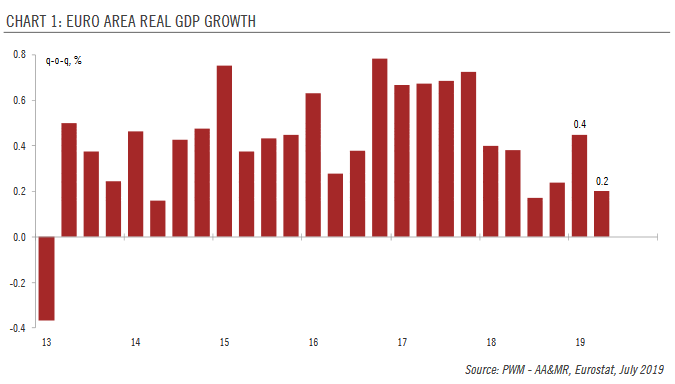

Slowing economic momentum in the euro area means that we are lowering our GDP forecasts for this year. The euro area economy grew by 0.2% q-o-q in Q2, down from 0.4% in Q1. While 0.2% is still a decent pace of growth, concerns about the economy in the second half of the year have increased. Recent data have shown that the industrial slump has started to leave some marks on the domestic economy. Tentative signs of weakening domestic demand, the possibility of a hard Brexit, potential US tariffs on EU cars, the ongoing trade frictions between the US and China as well as the slow rotation of the Chinese economy are all factors that make us cautious about economic prospects in H2. As a result, we have revised down our 2019 GDP growth forecasts for the euro area to 1.1% from 1.4%. |

Euro Area Real GDP Growth, 2013-2019 |

The ECB did not deliver policy action last week but it did prepare the ground for a rate cut in September and left open the possibility of additional monetary easing measures going forward. Recent data add to the case for an easing package in September. We believe this will take the form of a 10bp deposit rate cut (along with tiering) as well as the launch of a new asset purchase programme.

Full story here Are you the author? Previous post See more for Next postTags: ECB,Macroview,newsletter,Pictet