The new IGWT report for 2019 will be published at the end of May…

…and for the first time a Mandarin version will be released as well.

In the meantime, our friends at Incrementum have decided to release a comprehensive chart book in advance of the report. The chart book contains updates of the most important charts from the 2018 IGWT report, as well as a preview of charts that will appear in the 2019 report.

A brief summary of the contents:

- A Turn of the Tide in Monetary Policy: Events in Q4 clearly showed that a “monetary U-turn” is currently on its way, which means that further large-scale experiments like MMT, GDP targeting and negative interest rates might be expected in the course of the next severe downturn.

- A Turn of the Tide in the Global Monetary Architecture: Renunciation of the US-centric monetary order (“de-dollarization”) is now making headlines.

- Gold‘s Status Quo: 2019 ytd, gold is up in almost every major currency. In many currencies (AUD, CAD) gold trades at or close to new all-time highs! Despite the rally that started in August of last year, sentiment is still bearish.

- Gold Stocks: Mining stocks are in the beginning of a new bull market. Creative destruction has taken place, and leverage on a rising gold price is higher than ever. The mega-merger between Barrick and Randgold may have marked the bottom.

|

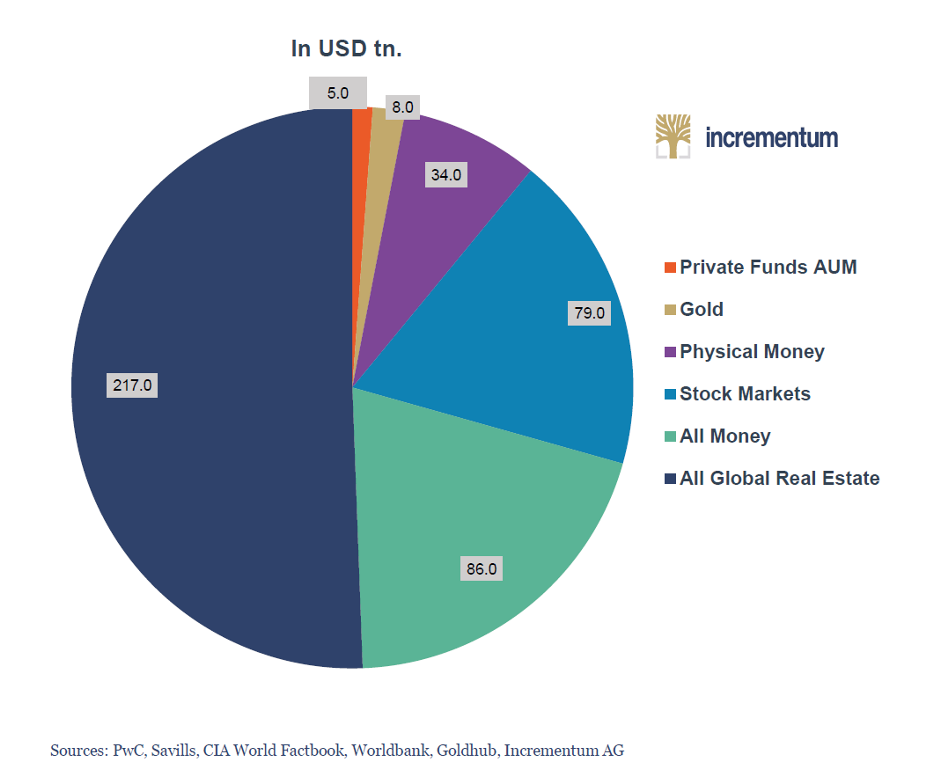

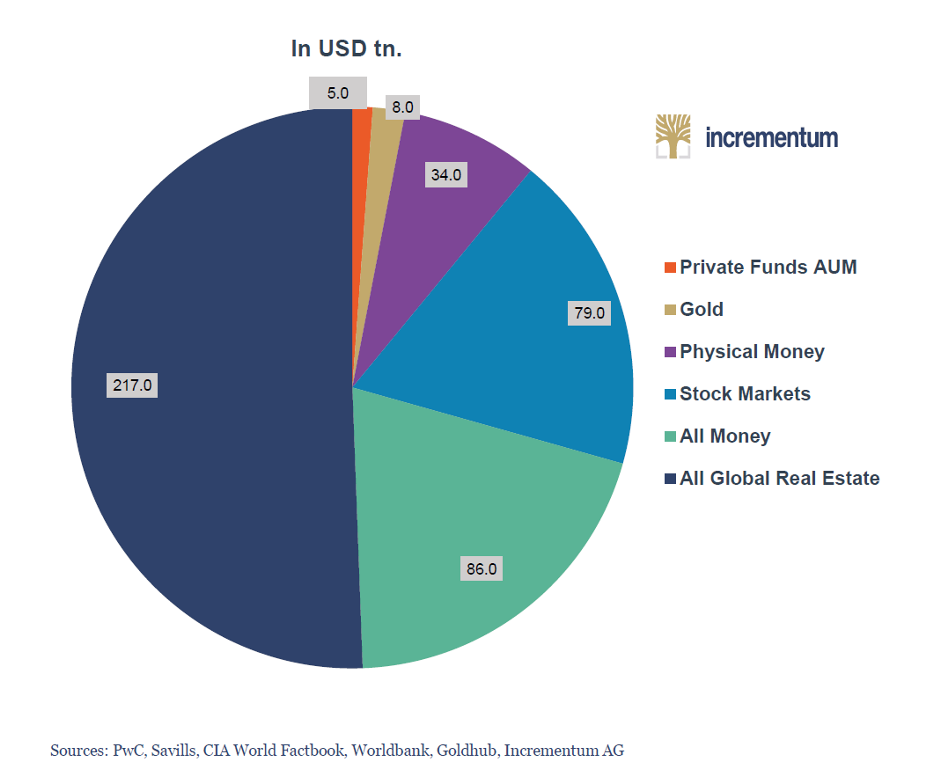

Gold and other financial assets  Gold compared to other financial assets – from the IGWT chart book - Click to enlarge |

The file can be downloaded here:

Preview-Chartbook of the “In Gold we Trust”-Report 2019 [PDF]

Enjoy!

PS: Pater briefly out of order again…

As regular readers may have guessed already, we were once again inconvenienced health-wise over the past week or so, but we are now at our desk again.

Full story here

Are you the author?

Pater Tenebrarum is an independent analyst and economist/social theorist. He has been involved with financial markets in various capacities for 39 years and currently writes economic and market analyses for independent research organizations and a European hedge fund consultancy as well as being the main author of the acting-man blog.

Previous post

See more for 6b.) Acting Man

Next post

Tags:

Chart Update,

newsletter,

Precious Metals