- “We’re experiencing a slowdown,” says Blackrock fund manager

- Global Allocation Fund adding to gold exposure through ETFs

- Gold “has had a very consistent record of helping mitigate equity risk when volatility is rising”

- Gold bullion has been a “store of value for a very long time”

| Gold may extend gains as global growth slows, equity market volatility remains elevated and the Federal Reserve is expected to ease back on the pace of policy tightening this year, according to a BlackRock Inc. money manager, who says the precious metal offers an effective hedge.

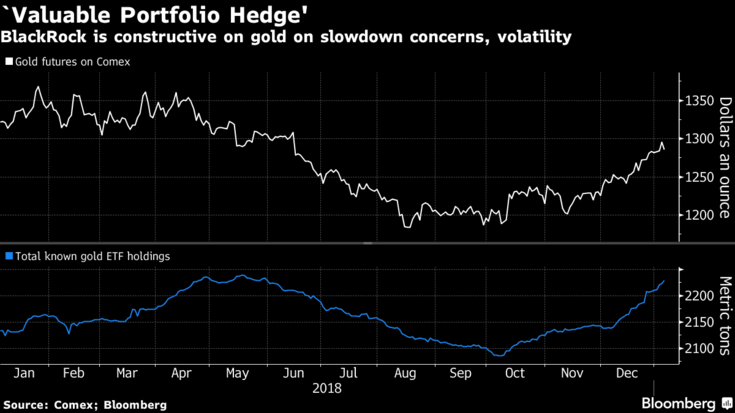

“Recession fears are probably overblown, but I do think we’re experiencing a slowdown,” Russ Koesterich, portfolio manager at the $60 billion BlackRock Global Allocation Fund, said in an interview, citing decelerations in the U.S., China and Europe. While BlackRock doesn’t have a price target, it’s been raising bullion holdings since the third quarter through exchange-traded funds. Bullion surged in December as global stocks capped their worst annual performance since the financial crisis. Investors took fright at signs of economic weakness in the world’s largest economies, with China grappling against the U.S. trade war. Other political uncertainties, such as Brexit and the partial U.S. government shutdown, have also buttressed demand for havens. “We’re constructive on gold,” Koesterich said in the phone interview on Friday. “We think it’s going to be a valuable portfolio hedge. We’re multi-asset investors: we think about its effect on the entire portfolio, and what we see value in right now is gold’s value as a diversifier.” Gold futures advanced 7.1 percent on the Comex in the final quarter of 2018 as worldwide ETF holdings expanded, and prices carried on rallying in the opening days of the new year to top $1,300 an ounce on Friday, before a standout U.S. jobs report spurred a small drop. The metal was last at about $1,293. The Fed raised rates four times in 2018 and investors have been trying to assess how many hikes, if any, policy makers will deliver this year. On Friday, Chairman Jerome Powell signaled that rises could be paused if the U.S. economy weakened. A more data-dependent Fed, combined with net softer U.S. data, could hurt the dollar, according to Goldman Sachs Group Inc. |

Gold Futures and ETF Holdings, Jan 2017 - 2019 |

| With the dollar and interest rates expected to be range bound, this could be bullish for gold, according to Koesterich.

“There were two things that worked against gold for most of last year — one was rising real interest rates, and the second was a strong dollar — and those were a function of the Fed consistently raising U.S. rates,” said Koesterich. “If there’s a pause in that trend, that will remove or mitigate two of the headwinds that hurt gold during the first nine months of the year.” Investors are paying close attention to the partial government shutdown, which is now into its third week as President Donald Trump and Republicans remain at an impasse with Democrats over border security funding. While the deadlock isn’t overly significant for the economy or financial markets, it has the potential to undermine confidence if it drags on, Koesterich said. The “shutdown is occurring in the context of a lot of political uncertainty, trade frictions,” said Koesterich. “The relationship between uncertainty, volatility and gold’s relative performance, it’s something that’s worth watching. It has been a store of value for a very long time, and again, it has had a very consistent record of helping mitigate equity risk when volatility is rising.” Editors note: Gold bullion, not gold ETFs, has been a store of value for thousands of years. Gold ETFs have yet to be tested in a major geopolitical or financial crisis. They are excellent vehicles for getting exposure to the gold and silver price, long or short, but should not be confused with store of value and safe haven gold and silver coins and bars. |

ETF Monthly Flows, Oct 2017 - Dec 2018 |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below |  |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newsletter