The story of the 21st century is debt is soaring while earned income is stagnating for the bottom 95%.

Best wishes to all my readers and correspondents for a safe, healthy and productive 2019. Thank you, longstanding supporters, for renewing your financial support at the new year without any pathetic begging on my part. (The pathetic begging will commence shortly.)

While I don’t have any predictions for 2019 (why look any dumber than I have to?), I do have a couple of thoughts on the economy, markets, globalization, etc. Here are a few of the key issues confronting humanity:

1. The war being waged by Corporate Power (Globalization / Open Borders) to eradicate democracy and the power of nation-states to control their own destiny. Democracy ceases to exist in a corporate-controlled globalized system of governance; the sole structure that enables a citizen to have political and economic agency is the nation-state.

Try voting for a U.N. resolution or E.U. regulation. Sorry, pal, there are no elections or representation of the rabble in globalized governance. Globalization destroys democracy and the agency of the citizenry. That’s its goal.

Global corporations seek to destroy any and all barriers to their power and profits, and globalization / tax havens / Open Borders are the means to co-opt, marginalize and neuter nation-states and the political and economic agency of the citizenry. The net result of Corporate Power controlling the machinery of governance is neofeudalism.

2. Energy and capital flows. The status quo holds that energy flows don’t matter very much because energy represents a shrinking percentage of economic activity. In other words, capital is what matters, not energy, because capital can always buy whatever it wants.

Try pushing your car or truck uphill for a mile. How many humans would you need to push your 3,000 pound “compact” vehicle up a slight incline for a mile or two? How about 20 miles, or 100 miles?

Take away liquid fuels and the global economy grinds to a halt, and capital loses its scarcity and value. So-called renewable energy is around 3% of total global energy consumption.

3. Volatility, liquidity and price discovery. Central banks have labored diligently for the past decade to eradicate volatility and price discovery while providing almost unlimited liquidity.

For a variety of reasons (including the political blowback of the 90% who have been stripmined by central bank policies, corporate cartels, taxation and globalization), central banks are now attempting to “normalize” by reducing or withdrawing their distorting, perverse-incentives policies.

As a result, what they’ve suppressed–price discovery and volatility–have erupted. What they’ve pimped–liquidity–is sagging.

As I explained last month, capital gets skittish when certainty evaporates. When big blocks of assets hit the market, liquidity dries up due to the mismatch between sellers trying to unload hundreds of billions of dollars of assets and the few buyers willing to nibble on a couple of billion dollars of these assets.

Central banks can fill the mismatch by becoming buyers of last resort, but the political leeway to engage in this sort of manipulation is evaporating along with liquidity.

4. 2018-19 is not a repeat of 2008-09. While many have observed the similarity of the stock market meltdown in 2008 and 2018, the fundamentals are not as close a match. There is no analog to subprime mortgages this time around. That doesn’t mean there won’t be turmoil and asymmetries, but it does suggest we shouldn’t put too much weight on expectations that 2019 will follow the template of 2009. I’ll have more to say on this soon.

5. The predictably outsized returns on capital have ended. There’s more on this in The Crisis of Capital.

| 6. Debt and stagnant income. Rising debt is supposed to be matched by rising income to service the debt, but the story of the 21st century is debt is soaring while earned income is stagnating for the bottom 95%. That asymmetry eventually matters, for example, when zombie corporations finally default and marginal household borrowers default. The losses can’t be socialized this time around; the stripmined masses have finally awakened to the skims and scams of central states and banks. |

Americans paychecks are bigger than 40 Years ago, but their purchasing power has hardly budget 1964-2018 |

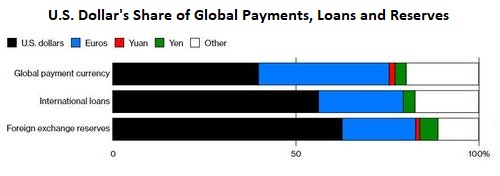

| 7. The much-desired de-dollarization of the global economy has yet to materialize. Personally, I believe a profusion of competing currencies in a transparent, open market is the ideal arrangement, but here’s the current arrangement: the USD and euro are dominant. |

USD other currencies |

8. Global harvests of grain and other essential food commodities have been good. Our luck may run out in the years ahead.

9. Cultural Revolutions are becoming more extreme and divisive. I’ll have more to say on this soon.

10. The topics covered here in December are key issues in 2019: in case you missed these:

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the book's website.

Full story here

Are you the author?

Previous post

See more for

Next post

Tags: newsletter